A $590 billion stock rally in India since late March is at risk of faltering as earnings face headwinds and retail investors pull back amid stretched valuations.

Key gauges in India hit records in July on bets that Asia’s third-biggest economy will stage a strong recovery even with elevated policy rates. The rapid gains, which follow a 4% advance for the benchmark last year, have led Goldman Sachs Group Inc. and CLSA Ltd. to warn that the equities are looking expensive. Global funds may find better bargains in other emerging markets after pouring $13 billion into local stocks this year as domestic retail traders turn net sellers.

“We do think that markets are not as attractive from a valuation standpoint as they were a quarter back,” said Rupal Agarwal, quantitative strategist at Sanford C. Bernstein.

The MSCI India Index’s 12-month forward-earnings multiple has risen to near 21 times from 18.5 times just over three months ago, according to data compiled by Bloomberg. That’s above its 10-year average and more than 50% higher than the valuation for the broader Asian gauge.

Here are three charts on the investment case for Indian stocks:

CLSA said June 27 that valuations are “exceedingly rich” and analysts’ earnings expectations are too optimistic. The stocks were overbought by some 14%, by its modeling. Goldman’s analysts argued that valuations are expensive, and that there will be a consolidation in the third quarter. The BSE 500 Index, which covers 93% of India’s total market capitalization, traded slightly lower as of 2:45 pm in Mumbai.

The valuation premium for stocks in the South Asian nation has risen sharply against that of emerging market, Asian and global peers. “In the short-term, the market has got stretched, so a 3-5% correction is on the cards,” said Atul Suri, a fund manager at Marathon Trends Advisory Pvt Ltd.

Surging food prices due to adverse weather for crops would also delay any potential pivot by the central bank to cut rates. India’s retail inflation quickened more than estimated in June after four months of declines. Earnings growth for the MSCI India index saw its first downgrade last week after seven consecutive weeks of increases, according to data compiled by Bloomberg Intelligence.

“We think earnings estimates could be at risk with both consumption and exports slowing down and commodities being in deflation,” said Prateek Parekh, analyst at Nuvama Wealth Management Ltd.

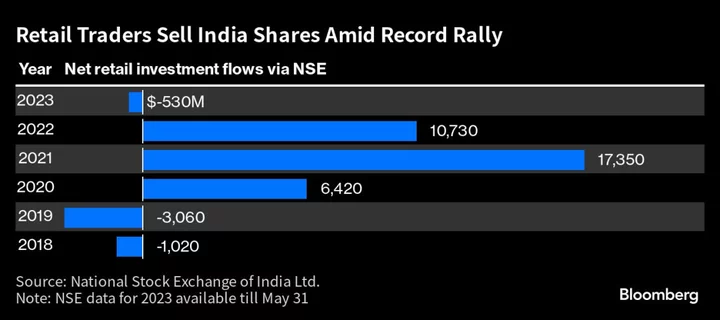

Retail investors appear to be calling the top on the stock rally, net selling $1.4 billion of equities in May, according to data from the National Stock Exchange of India Ltd. They have withdrawn net $530 million worth of shares this year through May 31, putting them on course for the first annual outflow since 2019 when they sold $3.1 billion of stocks, NSE data showed.

While the near-term rally in India may be at risk, strategists see continued appeal in India’s long-term growth story driven “by a stable macro, the pace of reforms, infrastructure upgrades and the prospect of manufacturing and export-led growth, which could lift the potential growth of the country,” said Amit Sachdeva, equity strategist at HSBC Securities and Capital Markets India Pvt Ltd.

--With assistance from Anirban Nag.

(Updates about broader market in fifth paragraph, inflation data in 7th paragraph.)