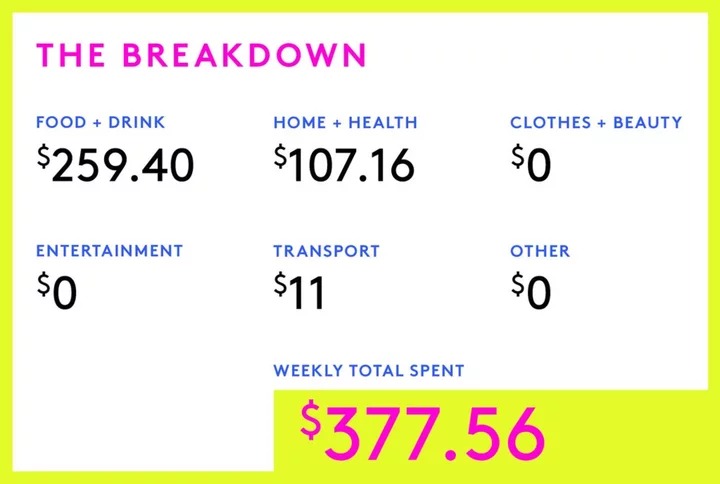

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a research associate working in academia who makes $63,000 per year and spends some of her money this week on Van Leeuwen ice cream.

Occupation: Research Associate

Industry: Academia

Age: 24

Location: Hoboken, NJ

Salary: $63,000

Net Worth: $46,000 ($1,000 in consumption smoothing savings, $20,000 in an emergency fund, $12,500 in investments, $5,800 in 403(b), ~$700 in checking and my car is worth ~$6,000).

Debt: $0

Paycheck Amount (1x/month): $3,989

Pronouns: She/her

Monthly Expenses

Rent: $1,650 (my boyfriend, Z., and I rent an apartment together. Our rent is $2,670 but we split bills proportional to our income).

Internet: $50 (split proportionately with Z.).

Electricity: $15 (this can go up to $75 if I run the A/C continuously in the summer).

Parking: $175

Car Insurance: $60 (which I pay to my parents because it’s cheaper).

Spotify: $2.85 (I split a family account with Z. and a bunch of friends).

iCloud Storage: $0.99

The New York Times Games: $2.65 (I get subscriptions for regular NYT, Wirecutter and NYT Cooking through my job).

Renter’s Insurance: $9

Phone: $0 (I technically pay $15 to Z.’s parents but Z. covers it).

Netflix, Hulu, Max & Disney+: $0 (all borrowed from friends and family).

Retirement Savings: $250 (my employer automatically puts 7% of my paycheck into a retirement fund).

HSFA: $20

Emergency Savings: $300

Consumption Smoothing Savings: $300 (used for vacations, medical expenses and large, unseen expenses like car repairs).

Annual Expenses

Credit Card Fee: $95

Amazon Prime: $140

Apple Fitness: $80

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, definitely. Both my parents joined the military to pay for college because they believe (as do I) that education is the key to socioeconomic mobility and financial security. I was always a smart kid and loved to learn so I was excited about college from an early age. I attended an Ivy League school using my dad’s GI Bill benefits. My school also had a large endowment so all my tuition was covered through the Yellow Ribbon program. My parents paid for my books and fees. They also paid for my meal plan during freshman year and I worked part-time for the rest of college, which covered everything. I’m starting a PhD program this fall, which is fully funded (tuition, fees, health insurance, plus a living stipend).

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Most of the conversations my parents had with me about money were simple: Save as much as you can and work to make extra cash whenever you can. They always talked about living well below their means and planning for the future so I try to do the same. Now that I have an income of my own, I’m trying to learn about personal finance beyond working all the time without spending anything — I learned that is a quick path to burnout. That’s why I like the idea of consumption smoothing, which is basically about striking the right balance of spending and saving to achieve the highest standard of living I can, instead of just burning myself out to save for the future.

What was your first job and why did you get it?

My first informal job was babysitting at age 12. I didn’t do it for any particular reason besides my mom always pushing me to work and earn as much as possible. My first job that I paid taxes on was the summer after my freshman year of high school. I worked two jobs that summer: camp counselor trainee and ice cream scooper. Once again, this was largely because my mom pushed me to work as much as possible but I was also starting to date and go out with friends so I needed pocket money to last me until the next summer.

Did you worry about money growing up?

No, never. My parents never had an issue paying for the basics (housing, food, health, education). We lived frugally. I have three younger siblings and most of our family vacations were to visit my grandparents or aunts and uncles. I was often told that we couldn’t afford things but I never really knew if that was because we actually couldn’t afford it or because my mom simply hated spending money. I had unlimited access to the library so I never felt like there were things I wanted that we couldn’t afford. My parents also framed a lot of conversations around saving money in order to go to a nice college so I always felt that any financial restrictions were in service of something more important later.

Do you worry about money now?

Yes, but more for big life moments than for survival. I have no trouble affording my lifestyle now but I know that I won’t have any income growth until I finish grad school at the end of my 20s. I would like to be able to pay for children and a house but I won’t be able to save too much money during grad school. I would also like to get married in the next few years and I’m hesitant to waste so much of my savings on a party or to ask my parents for help.

At what age did you become financially responsible for yourself and do you have a financial safety net?

When I started my first full-time job, a couple months after graduating college. My parents paid for my living expenses until then and I was responsible for fun money. My parents also paid for my car insurance for the first six months of my job and my dad still covers my E-ZPass to be nice. I follow the six-month-emergency-fund rule so I could support myself long enough to find another job. I also know my parents or Z.’s parents would take us in if needed but I would do everything I could to avoid putting that strain on them after all the help we’ve already gotten.

Do you or have you ever received passive or inherited income? If yes, please explain.

No. However, my parents made sure I graduated from college debt-free, which I consider to be a major financial boost.

Day One

8:55 a.m. — I wake up five minutes before my alarm. I turn off my sound machine and enjoy having the bed to myself. My boyfriend, Z., is out of town at a bachelor party so the bed is still neat this morning. I log into my work laptop and check my email and Slack. No messages. I’m starting grad school in the fall so I only have two weeks left in this job before I take off the summer to relax.

11 a.m. — I head down to my car to pick up my friend L. from the PATH. She lives on the west coast so I am excited to have the weekend with her! We listen to Olivia Rodrigo in the car — it’s fun summer music for me but it reminds her of her recent breakup. We switch to an angrier song. Back at my apartment, we work from the kitchen and snack on strawberries.

1:15 p.m. — L. finishes her last meeting. We walk to a deli to pick up sandwiches. I withdraw $80 from the ATM ($40 for gas later this month, $20 for laundry, $20 for whatever). My bank covers ATM withdrawal fees. I order a grilled chicken caprese sandwich. We bring the sandwiches back to my apartment and eat there with seltzers from my fridge. $10.68

5:30 p.m. — We decide to slack off work for the rest of the day and watch the last season of Never Have I Ever. We watched the first season virtually during the pandemic so it’s nice to end it together. I drop off L. at the PATH to meet coworkers for dinner, then come back to my apartment and eat the second half of my sandwich and chocolate-covered pretzels.

7:15 p.m. — I won lottery tickets to see Camelot ($44, paid yesterday) so I leave for the theater where I’ll be meeting L. again. Last week I purchased 10 bus tickets at a discount so I use one of those to take the NJ transit bus to the Port Authority. I take the subway the rest of the way to the theater.

11 p.m. — The show is amazing! L. and I have a great time with fantastic seats. She suggests getting ice cream so we walk to a Van Leeuwen and split three scoops. $6

11:40 p.m. — It’s nice out so we walk a little bit before heading to the subway. Due to poor timing, we run through the Port Authority and make it to our bus three minutes before departure. The bus fills up so we still don’t make it on. I am very sweaty.

12:25 a.m. — We finally board the next bus and are able to sit. I use two bus tickets for me and L.

1:10 a.m. — We get back to my apartment, shower and get things together for tomorrow. I’m exhausted and want to sleep but L. shows me a couple funny videos and we end up talking for over an hour before falling into bed. This is a long day for me!

Daily Total: $16.68

Day Two

10:45 a.m. — I wake up and check my phone. L. has already left and is in Manhattan by now. Nothing much going on today so I laze in bed.

12 p.m. — I get up and slowly start getting ready. I do a face mask and make tea after getting ready for the day, then watch Netflix and mindlessly browse on my laptop.

1:45 p.m. — I make a salad for lunch: arugula, clementines, avocado, walnuts, goat cheese and homemade balsamic vinaigrette.

2:30 p.m. — I spend the next couple of hours doing a lot of nothing: tidying the kitchen, browsing online and deciding not to buy anything, watching more TV, drinking too much tea. I also look up gluten-free restaurants for my friend who is coming tomorrow. I am excited to have time alone resting this weekend but I may be hitting my limit. I text Z. and feel bad distracting him.

5 p.m. — I leave to meet L. for dinner and decide to take the PATH, which smells particularly bad today. I add money to my MetroCard when I’m there. $5.50

6 p.m. — I meet L. at Xi’an Famous Foods in Chelsea. We both get lamb noodles and jasmine tea. L. pays and I venmo her my share minus the cost of the bus ticket last night. $14

6:45 p.m. — We take the PATH back to my place. L. doesn’t want to wait in line to refill her MetroCard so we squeeze through the turnstile together, using the $2.75 left on mine.

7:30 p.m. — We get back to my apartment and I make green tea. We watch the rest of Never Have I Ever.

9:30 p.m. — We both shower, then spend some time talking/crying about L.’s recent breakup. This eventually devolves into plotting out a romance novel about pickleball players in California (fake dating trope) and two in-universe spinoffs. We agree this is the best way to cap off our yearly visit.

1 a.m. — We reluctantly go to bed. It’s hard to say goodbye but I’m happy with the time we got to spend together.

Daily Total: $19.50

Day Three

7 a.m. — I wake up to my alarm. I did not get enough sleep.

7:15 a.m. — I drive L. to the bus stop and use one of my bus tickets to send her off. I probably won’t see her in person again until next summer, after my first year of grad school. Someone immediately says that I look sad about her leaving and then asks about my husband so I make a swift exit.

7:45 a.m. — Go back to bed.

11:45 a.m. — Okay, I’m up again. I give Z. a quick call because I haven’t heard from him much. I get out of bed to drink water and take an evening primrose supplement. My period just started and I’ve been trying to figure out how to better manage the PMS soreness. L. left the second half of her sandwich from yesterday (chicken parm) so I heat it up in the oven and finish it off.

3:30 p.m. — I take the bus to Midtown (using another previously purchased ticket) to meet up with R., another friend from college. I use the last two of my bus tickets for us to ride back to Hoboken so she can drop off her bag.

5 p.m. — R. is gluten-free and wants to go somewhere exclusively gluten-free while she’s in the city. I make a reservation at a restaurant in the West Village and we take the PATH there. I add $11 to my MetroCard and R. reimburses me half. $5.50

6:30 p.m. — We get to the restaurant and four different waiters ignore us. We are finally seated in a back corner — maybe to ignore us more easily? R. and I both get watermelon sangria and split a small order of mozzarella sticks. I order an avocado salad with chicken for $25, which I think is overpriced. R. wants to splurge on a gluten-free dessert. Instead of a menu, they bring out a plate with the night’s desserts to show us. I do not like this sales method; there are no prices when you do it this way! I order a flourless chocolate cake anyway, which is too rich. R. and I split the bill. Despite the mediocre service, I tip 20%. $73.67

8 p.m. — We take the PATH back to Hoboken using my MetroCard and walk along the waterfront. I take a picture of the Water’s Soul statue for Z.’s mom. She is a huge fan and says it makes her cry.

9 p.m. — Back at my apartment, I pop a bottle of riesling in the fridge for tomorrow. I bought it a few months ago for about $50.

12:30 a.m. — I take a melatonin and try to sleep. Staying up so late the last few nights has NOT prepared me to return to work tomorrow. After an hour of tossing and turning, I finally fall asleep.

Daily Total: $79.17

Day Four

8:50 a.m. — My alarm goes off. I snooze it and stay in bed for another 30 minutes. When I finally gain the motivation, I turn on my work laptop to make sure I don’t have any messages and do a little work.

10:45 a.m. — R. and I go for a coffee down the street. I get a coconut cold brew with oat milk. We hang out at a nearby park and chat while drinking our coffees. $6.50

12 p.m. — Back to my apartment to get some work done while R. explores. I’m hitting a wall with the data I need to find so I decide to work on my exit memo. The next person in my job can figure things out.

1:30 p.m. — R. gets back and we scrounge through my kitchen for food. I really need to get groceries and the gluten-free options are slim. I make rice for burrito bowls with leftover chipotle chicken taco filling and pickled onions I made last week, plus avocado and sour cream.

5 p.m. — I am so tired from my weekend. The rest of the workday is a slog and I log off and take a nap as soon as the clock hits 5.

7:30 p.m. — After (very slowly) getting up and putting my bra back on, R. and I head to a nearby Cuban restaurant for dinner. We split an order of yucca fries and I get a virgin piña colada and plantains with molé. This is one of my favorite local spots, partially thanks to the great prices. $25

9:30 p.m. — Back at my apartment, we split the bottle of riesling I chilled last night and catch up on people from college. Z. gets home from his bachelor party weekend and we talk about recent Broadway and regional shows (we are all former theater kids).

12 a.m. — After showering, Z. and I catch up for a while in bed. It’s nice to be back in the same place.

Daily Total: $31.50

Day Five

8 a.m. — I wake up and R. lets me know her flight has been canceled AGAIN. She was supposed to leave last night but her flight was rescheduled to this morning. Now she’s on an afternoon flight later today. I go back to bed.

9 a.m. — I begrudgingly wake up and spend the morning working from bed. It is not a pants day for me.

12 p.m. — I take R. to the airport for her new departure flight. Another sad goodbye but mostly I am relieved that I am done with hosting. It takes a lot out of me.

1 p.m. — I have a miserable headache by the time I get home so I take the rest of the day off. Turns out my boss has COVID so I feel better about not working. I make a tuna mayo rice bowl with soy sauce, sesame oil, scallions and furikake for lunch, then flip through streaming services to entertain myself.

3:30 p.m. — I walk to the farmers’ market a few blocks away. Cooking in the summer is so much easier with nice produce. I pick up broccoli, Yukon gold potatoes, sweet onions, zucchini, summer squash, cucumber and a few tomatoes. I also splurge on strawberries — $8 for a quart! $26.15

6 p.m. — I meet Z. at the grocery store to pick up everything else we need. We get a case of seltzer, popsicles, canned chipotles, black beans, bucatini, white vinegar, Cheetos, a whole chicken, frozen chicken patties, a caesar salad kit, shallots, lemons and limes, buttermilk, bacon, eggs and salmon. I pay. $79.01

8 p.m. — We belatedly start making dinner. Z. makes homemade teriyaki sauce to glaze our salmon, which we cook in our air fryer. I start the rice cooker and roast half of the farmers’ market broccoli in the oven.

9:30 p.m. — Z. and I watch Meet the Robinsons because we recently remembered it exists. I order three Insomnia Cookies through Grubhub for us to share. $18.39

11:30 p.m. — Fall asleep!

Daily Total: $123.55

Day Six

9 a.m. — I wake up feeling fully rested, which is unusual on a weekday. I get up and get ready right away, which is also unusual on a weekday! Then I work from my home office.

12:30 p.m. — I should probably eat something today so I pop my leftover plantains from the other night in the oven. I clean the kitchen while I’m there. It’s not looking great after four days of visitors.

1:30 p.m. — My meeting for this afternoon is canceled. I really don’t have much work to do so I spend the afternoon reading. I’m starting The School for Good Mothers, a recommendation from my local bookshop. I’m trying to more actively curate my bookshelf so I’m reading this as an ebook from my library before deciding whether or not to purchase it.

4 p.m. — My boss lets me know that I can stop working on my data task and just describe it in my exit memo. Huge relief! This is a good reminder that I am moving soon and need to pack so I start organizing my office. I want to sell my desk and bookshelf so I clear those out first. I’m leaving most shared purchases with Z. because I plan to stay here with him on breaks, and he will eventually follow me.

6:30 p.m. — I order a few things on Amazon for my next apartment: pillow protectors, laundry bag and a drying rack. I also get a bucket hat and new toothbrushes for Z. and me. I use points to cover $10. $107.16

6:30 p.m. — Z. gets home and starts dinner. He’s roasting a chicken in the air fryer with the baby potatoes I got at the farmers’ market. We try to avoid the oven during the summer and the air fryer has been a great alternative so far. I sauté the zucchini and summer squash on the stove.

9 p.m. — After a lovely meal together, we clean up and shower, then spend the rest of the evening hanging out in bed.

12 a.m. — Fall asleep.

Daily Total: $107.16

Day Seven

9 a.m. — I meant to wake up an hour earlier for a coffee date with Z. before work but it didn’t happen. The extra sleep is nice so I don’t feel too bad. Z. brings me my work laptop and I respond to emails from bed.

10 a.m. — I take a LONG shower in which I actually shave my legs and spend time styling my hair. It has been particularly greasy and frizzy lately so I think it is time to switch to a wavier style for the summer.

11 a.m. — I officially finish my exit memo. Woohoo! I have a long weekend starting tomorrow and when I get back to work next week, I will just be onboarding my replacement. I am so relieved that this is off my plate. I am already stressed about moving, trying to see all my family and starting a PhD after a couple years out of school.

12:30 p.m. — My go-to bakery recently closed when the owners retired. I decide to order a loaf of bread from Panera, which is not as good and way more expensive ($14.90 including delivery), but I have a gift card that covers it.

1:15 p.m. — I make a tomato sandwich for lunch. I love Melissa Clark’s method on NYT Cooking: garlic, olive oil, salt and mayo make the tomato so flavorful.

6:30 p.m. — I spend the rest of the afternoon watching Black Mirror and calling my dad. I run to the grocery store for a couple of items I forgot earlier this week: Fairlife for me, almond milk for Z., salted and unsalted butter, avocados and clementines ($25). It’s Z.’s turn to pay so I send him a venmo request.

7 p.m. — Z. is spending the evening with a friend so I make dinner for myself: caesar salad with the leftover chicken from last night. I watch more of Black Mirror while I eat.

9:30 p.m. — Shower and read more of The School for Good Mothers.

12:30 a.m. — Z. gets home. We recount our days (his was way more exciting than mine) and we go to bed.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.