Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a private equity associate makes $144,000 per year and spends some of her money this week on a pair of earrings.

Occupation: Associate

Industry: Private Equity

Age: 23

Location: New York, NY

Salary: $144,000 (plus a bonus of $48,000-$96,000).

Net Worth: $561,000 (savings: $1,000, investments: $5,000, Roth IRA: $5,000, 401(k): $6,000, home equity: $550,000 (my half of the apartment I own with my parents, they have a small mortgage but my name is not on it so I don’t have any debt related to the property) minus debt).

Debt: ~$6,000 (I pay off my credit card in full, but I have some large travel/furniture expenses that I have on a payment plan)

Paycheck Amount (2x/month): $4,000

Pronouns: She/her

Monthly Expenses

Rent: $2,700 (I pay my “rent” to my parents towards home equity and my roommate lives in the flex room for $2,500 which goes towards HOA/taxes).

Loans: $1,000 (payment plan for expensive international travel for a wedding later in the year and furniture when I moved in).

ClassPass: $95

Netflix: $16

WSJ: $4

AMC Stubs: $20

Amazon Prime: $15

Mealpal: $90

Phone: $0 (company covered).

Health Insurance: $0 (company covered).

Oura Ring: $5

Spotify: $7 (shared with my roommate).

Annual Expenses

Credit Card Fees: $360

Uber One: $100

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, absolutely. Both my parents grew up poor and immigrated to the US, but were lucky enough to receive a free college education in their home country. They both worked in higher education and instilled the importance of school from a very young age. My older sister attended a pretty elite institution despite not having much money growing up, so the expectations for me were much higher. I was lucky to receive free tuition as a faculty dependent for college, and have a 529 plan that I can use if I choose to attend grad school.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents were very frugal growing up and I remember only being able to shop from the sale section at Kohl’s. I was never allowed to order drinks at restaurants and we very rarely purchased toys or games once I started elementary school. My parents always emphasized the importance of saving, but I think the suppression of spending has kind of triggered my poor habits now that I’m older.

What was your first job and why did you get it?

My sister is much older and is very accomplished, so I had big shoes to fill. I worked paid internships pretty much every semester in college to get experience (and some extra cash) and realized that I needed a high-paying job to keep up with my lifestyle, which is how I got into investment banking.

Did you worry about money growing up?

My parents were frugal on most discretionary things (sale-only for everything), but spent freely on educational things (piano lessons, SAT summer camp, etc.). From that point, I knew that financially we were stable enough to afford those privileges so I didn’t have to worry about money.

Do you worry about money now?

From a survival standpoint, I don’t worry about money — I have a great education, a high-paying job, friends and family to support me, and a permanent roof over my head that I’m extremely grateful for. However, I do worry about not saving much, which is partly because of lifestyle creep in NYC and partly because I’m launching a small business that I’m putting money towards.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially independent at 22 when I graduated from college. I do have a safety net as my parents would stick an arm and a leg out for me if needed, and some savings I can pull from and physical assets I can liquidate.

Do you or have you ever received passive or inherited income? If yes, please explain.

I suppose the property ownership is the biggest question mark here. I currently live in an apartment that is jointly owned by my mother and me. I pay rent to them towards home equity, but I didn’t put any money down or take on a mortgage.

Day One

8 a.m. — I wake up, get ready for work (I’ve learned to get ready in under 10 minutes for maximum efficiency), and haul myself to the subway station. Subway fare is $2.90 and on my way to work, I order a Starbucks coffee for pickup. I’ve learned to customize my order such that I can save a few dollars instead of ordering from their menu. It’s the little things! $10

12 p.m. — I use Mealpal for weekdays when I’m in the office. I prepay a monthly fee for a set number of meals and it’s usually discounted by 10-30%. Today, I grab a Sweetgreen salad and a snack from the kitchen and eat at my desk.

6 p.m. — I truly miss the days of banking when my dinners were comped. Earlier hours mean fewer perks I guess, so I’ve been scrambling to figure out a sustainable dinner plan for myself. I take the subway home and order something on Uber Eats (for some reason I keep getting 50% off promotions). The inner child in me remembers my mom always saying to maximize discounts so I feel obligated to order two portions of food to hit the max $15 discount. $23.02

8 p.m. — I book a last-minute ClassPass Pilates class. I’ve been trying to work out more and going to classes is the only way to keep me accountable. The class is brutal but I always come out on the other side feeling much better. I try to buy a water bottle, but they don’t take Apple Pay so I just head home.

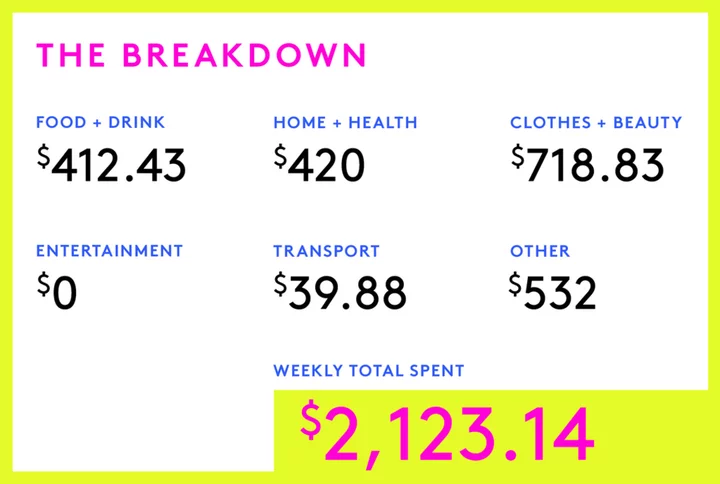

Daily Total: $33.02

Day Two

8 a.m. — I repeat the same routine every morning — wake up, get ready, run to the subway, drop by Starbucks, and log in to work. Corporate life is quite mundane. $10

12 p.m. — Sometimes my boss feels like eating out for lunch and will take the team out, but it’s usually pretty random. Today we go to Shake Shack.

3 p.m. — I take a break from click-clacking at my keyboard all day and eat a cheese stick in the office kitchen. I go to the bathroom (it’s usually all mine since I’m the only woman in the office) and have a crisis when I see myself in the mirror. I have a pretty important meeting happening later in the day so I’ve been pretty stressed and picking at my skin all day. My skin is red and some of my acne is bleeding. I decide to book a dermatology appointment. I book a consultation with a pretty well-known doctor I’ve seen on social media and am taken aback by the $400 new patient consultation fee. I book it anyway. $400

7 p.m. — I make the trip home on the subway and quickly prep something from the fridge for dinner. Today’s menu is the jerk chicken burrito from Trader Joe’s. I’m a terrible cook so most of my fridge is frozen food or simple ingredients like eggs and guacamole. I continue to prep for the meeting happening at 10 p.m. The jerk chicken burrito is pretty flavorless, so I microwave another TJ specialty — the chicken sausage breakfast burrito. Yum! $2.90

11 p.m. — I finish the presentation and finally can relax for the day. I do all of my household chores with some YouTube videos playing in the background and see an influencer purchasing the cutest dress. Do I need it? Absolutely not. I would consider myself someone that’s pretty introspective and I know I have a shopping problem, usually stemming from the idea that every purchase will somehow magically improve all of the gaps in my life. I’m working on it (tracking my expenses, staying in more, etc.), but on days when I’m stressed I cave into my wants. I buy the dress. I pray that it looks terrible on me and I’m obligated to return it. $150.25

11:30 p.m. — I call my boyfriend. Currently in an international LDR which is not ideal but he’s moving to NYC soon. It’s difficult managing different time zones, but I have him order me some slippers online to pack in his suitcase when he comes back to the US. The exchange rate is pretty good and I save myself a ~$30 shipping fee. A win is a win. $95

Daily Total: $658.15

Day Three

8 a.m. — I take the subway to work. Sometimes, the management of my office building will host events in the lobby and today there is free coffee and pastries. I grab an iced cortado and a blueberry muffin and begin to work. $2.90

12 p.m. — For lunch, I pick up my Mealpal and head back to the office. The rest of the week should be more relaxed so I take a longer lunch break. I order some things on Amazon for the small business I’m running. This side gig has been taking up a ton of working capital and my credit usage has gone up so I just recently got a business credit card to help separate personal and business expenses. I put this on my business account and do not count it as a personal expense.

3 p.m. — I grab a bag of chips from the kitchen as a snack. I check my bank account and it’s looking pretty bad. It’s a slow process moving all of my business expenses to the new card I got this week so the numbers are pretty inflated. I see an AMC Stubs charge (I got it to see Barbenheimer) and try to cancel the subscription. It tells me there’s a $20 termination fee. I decide to keep the subscription. I want to see Joy Ride anyways.

7 p.m. — I take the subway home and look through my fridge. I have my usual girl dinner — two eggs, yogurt and granola, and a pack of smoked salmon. $2.90

9 p.m. — I unbox some packages I have. My doormen know me as the girl who has packages every day. Today’s haul is pretty big. I’m addicted to buying home improvement stuff from Amazon and purchased a bathroom storage cart, vacuum storage bags, a hand frother, a water bottle, and some pill organizers. The water bottle is pretty disappointing and leaks so I repackage the return. A return feels like a reward; it’s twisted but it’s true.

11 p.m. — This is the first day I’ve been able to truly relax all week so I take a full routine shower. Shampoo, hair mask, callous removal, leg shave, cleanser, all the works. I then use my new Korean face sculpting device I bought after seeing it on TikTok (I am guilty of being one of those people) and my at-home laser hair removal device I purchased from Amazon. Some much-needed self-care.

Daily Total: $5.80

Day Four

9 a.m. — I love the end of the week because I work from home. I do my skincare routine and brush my teeth. I pour myself a glass of OJ and log on for work. I check some emails to prep for the day and get dressed to go outside.

10 a.m. — I take the subway uptown. I love lox bagels and I got ticket on Resy to pick up a limited edition caviar summer bagel. I booked the ticket last week, but it was an obscene price ($59.43). The bagel is pretty small but loaded with 20g of caviar. It makes my morning 10 times better.

11 a.m. — I pick up my dry cleaning after ignoring the notifications for a week. I finally found a place in my neighborhood that charges less than $9 for an item and I am elated. The clerk at the desk is the sweetest woman. At least half of my work clothes are dry-clean only so I’m becoming a regular here. The costs really begin to add up. $21.73

2 p.m. — I like to think of my closet as a living work in progress and try to resell items if I find myself not reaching for them. I usually only purchase secondhand anyways, so I don’t lose that much off of retail and it’s a good way to declutter. A concierge person from The RealReal stops by my apartment to pick up some items. I have a love-hate relationship with the platform; I love shopping, but I usually hate selling because of their low commission. She picks up some pieces that haven’t been getting traction on my Poshmark.

5 p.m. — I log off of work and begin to get ready for dinner with some college friends.

8 p.m. — We order dinner and a pitcher of sangria. We then head back to my apartment to chat and decide to end the night there. $62.07

Daily Total: $83.80

Day Five

11 a.m. — I wake up late and get ready for the day. I’m usually too tired to do anything on weeknights so I maximize my weekends. I take the subway to Brooklyn for brunch. $2.90

12 p.m. — My friend and I decide to split two toasts and a dessert, and I order a latte for myself. The food is delicious. The cafe has a lovely home decor shop section and I buy a flower vase as a souvenir. It was $20 and the cheapest item for sale. $42.80

2 p.m. — My friend wants to day-drink so we head to a popular place in Williamsburg that we’ve been meaning to try. I have three cocktails (being a heavyweight is definitely not the most economical characteristic) and a plate of the most delicious fries. Life is good. $59.34

4 p.m. — I’m exhausted after being in the sun for so long so we head to another cafe. I order a pastry and a matcha to wake myself up. $18.24

6 p.m. — I get an Uber back to my apartment. $19.58

7 p.m. — I remember to pre-order a cake for my friend’s birthday in a couple of days. I split the cost with some friends. $32

8 p.m. — It’s a food spree. I’m meeting up with a former colleague who’s in the city and we decide to go to a nice restaurant. It’s a prix-fixe menu and ends up being just over $100 with tip. I take note of the price because three years ago the price was cheaper and the quality was better. $101.79

10 p.m. — This is the end, I promise. We go to K-Town and finish off the night with some drinks and good vibes. $33.31

12 a.m. — I walk home and then take a shower. I light a candle and watch a new documentary on Netflix before going to bed.

Daily Total: $309.96

Day Six

12 p.m. — I get ready and head out to meet a friend for brunch. I order a plate of eggs and we split a French toast. $28.45

2 p.m. — I head to my bi-monthly golf lesson at a simulator in Midtown. I’m finally seeing some improvements in my swing after having about five lessons. It is so tough. I initially started for professional/networking purposes, but realized it’s actually pretty fun. I want to get good, but it is so expensive and pretty hard to master (or at least more than it looks on TV). I’m at the end of my lesson package, so I purchase another one. $500

4 p.m. — I stop by the Levi’s store since they’re having a sale and pick up a pair of jeans. It’s so hard to find a pair that fits me right, but I decide that these are good enough and I will have to get the waist tailored. $28.22

5 p.m. — I head to another store to pick up a pair of earrings I pre-ordered for my birthday. I got a 15% discount which was great and I love how they look. I can’t help myself and decide to purchase some cute home decor from the store as well. $205.67

8 p.m. — It’s a girl dinner night again. I have eggs, salmon, and tomatoes on toast. I have a smoothie.

10 p.m. — I pack some orders from my business and organize my bags for work the next day. Truly having some Sunday scaries.

Daily Total: $762.34

Day Seven

8 a.m. — Subway and coffee at the office. $2.90

12 p.m. — I head out to grab my Mealpal. The weather is beautiful and I decide to eat outside.

5:30 p.m. — I head to a Barry’s class that I got on Classpass. I I am sweating like crazy but afterward and it feels great. I get a smoothie after the workout. $16

8 p.m. — I order Uber Eats. I get a sandwich and fries from one of my favorite restaurants. $33.21

10 p.m. — I can’t help but shop when I’m not busy. I purchase a huge haul from ThredUp because of their discount. $217.96

11 p.m. — I go through my spending from the past two weeks and log it into Notion. I’m trying to track every expense to hold myself accountable and I think it’s working. It usually takes me a while, so I spend around an hour digging through my bank account and receipts.

12 a.m. — Bedtime!

Daily Total: $270.07

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.