Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a software engineer who makes $578,000 per year and spends some of her money this week on a vintage ring.

Occupation: Software Engineer

Industry: Artificial Intelligence

Age: 30

Location: San Francisco, CA

Salary: $578,000 total comp ($260,000 base + $255,000 stock + $52,000 expected bonus + $10,000 401(k) match + $1,000 HSA contribution)

Net Worth: $850,000 ($320,000 RSUs + $115,000 in a brokerage account + $245,000 in retirement accounts + $90,000 in crypto + $70,000 in NYC apartment equity + $10,000 HSA)

Debt: $255,000 left on my mortgage for my NYC apartment. I also usually carry about $10,000 on my credit card, but I pay it off every month.

Paycheck Amount (2x/month): $5,700

Pronouns: she/her

Monthly Expenses

Rent: $1,432 (rent-controlled studio apartment in SF)

Apartment Mortgage: $1,032 on a pied-a-terre co-op in NYC

Apartment HOA/Taxes: $598

HSA: $101.92

Netflix: $10

Google Storage: $1.66

Cell Phone Plan: $220 (I pay for the plan for my immediate family)

Utilities: $98

Internet: $50

Domain Names: $2.50

Web Hosting: $25

Donations: $100

Retirement Savings: At the beginning of the year, I usually put all of my yearly bonus into my retirement savings (my company has a 50% match) so I don’t consider it a monthly expense.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely. Both my parents got graduate degrees and expected me to do the same. I attended a private college that offered a generous financial aid package based solely on need, which covered almost all of my tuition. I did have to borrow about $18,000 total in federal student loans, but I was able to pay that off with my signing bonus at my first job. I also did a master’s degree right after undergrad. Tuition for that was covered by being a teaching assistant for three semesters (which also paid me a grad student stipend).

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Not really. My parents have a very basic concept of finances: they don’t cut corners when it comes to our health, safety, nutrition, or education, but we didn’t really spend money on anything else. We always wore the soles out on our shoes and never went on vacations other than to visit family. That said, they didn’t expect me to work while I was living with them either because I was focusing on my education. My parents also slowly funneled money into a savings account for me, so when I left for college I had about $6,000. I used that to fund my living expenses while at college, along with income from various campus jobs or internships. Beyond that, we never talked about finances.

What was your first job and why did you get it?

My first job was during my freshman year of college. I worked in a lab for $9.25/hour. I got the job because I needed something to do in the summer, and my financial aid package stipulated that I needed to have a job. Plus, I wanted to like biology research. It turned out that I hated it and was also abysmally bad at it. I never went back to biology research.

Did you worry about money growing up?

I didn’t worry at all about the basics, like food, medical care, or shelter. My parents were able to provide those things very well as teachers. However, we never had much money for incidentals, and my parents also didn’t believe in superfluous spending. I remember my schoolmates would have Tory Burch flats or UGG boots, which I could never afford. I once bought a used Coach purse on eBay for $80 (which I saved up from cleaning people’s basements) and had to lie to my mom about where it came from (I said my rich friend gave it to me) because she would never understand spending that much money for a purse.

Do you worry about money now?

Not in the usual sense, but I can be pretty irresponsible at times (for example, keeping almost no liquid cash in my bank accounts for emergencies).

At what age did you become financially responsible for yourself and do you have a financial safety net?

Growing up, I could never buy non-essentials without my parents’ scrutiny, so when I got my first credit card and some internship money in college, I went unchecked with the newfound freedom. I once had to borrow $5,000 from a then-boyfriend because I overspent on my credit card. I don’t think I ever became more responsible, but I live very comfortably with my current income. As far as a financial safety net, I’m very grateful that I can always move back in with my parents indefinitely if I lose my housing or job.

Do you or have you ever received passive or inherited income? If yes, please explain.

I receive about $2,000/month (give or take $1,000) from various side incomes, like reselling stuff (which I do, not to make a profit, but to prevent things from going to a landfill), and people sending me donations for websites that I maintain.

Day One

7:45 a.m. — My alarm wakes me up. I spent the weekend at my boyfriend, C.’s, house, so I take the bus to the office today. $6

9 a.m. — I get into my office and try to make myself a drink in the kitchen, but the espresso machine has been removed for repairs. I grab a cold can of Oi Ocha from the fridge instead.

9:30 a.m. — I do some eBay shopping before I start work. I buy a used Brooks women’s bike seat for a new-to-me bike I purchased from a friend for $250. The bike is great, but it has a grungy ’90s mountain bike look, so I want to add some finer touches. I debate getting one that has springs, but that one is $30 more and I don’t think the roads are that bad. $93.09

10:15 a.m. — I also buy postage for a few things I sold on eBay: a bunch of items that I no longer needed like unopened makeup, a purse, and some camera gear. I sell almost everything that has value, even if it costs me more money to ship because I hate throwing things out. $13.07

11:30 a.m. — I go to the cafeteria and grab myself a sandwich, a cup of chicken noodle soup, and some egg salad. I also grab a bunch of pastries (butter croissant, blueberry muffin, and a loaf of pumpkin bread) and pack them up in a compostable container. I eat the soup and salad and am already pretty full, so I pack the sandwich to go as well.

12 p.m. — A few friends invite me for dinner at their house, so I stick the sandwich in the fridge for another day.

1 p.m. — I go to my weekly team sync. It’s an hour long and usually involves alternating lightning rounds, deep dives, and announcements from higher-ups. At today’s meeting, two product managers take the stage to talk to us about this quarter’s priorities. I don’t have much to say in today’s sync.

2 p.m. — I do some work. At this very moment, my work is just responding to comments in a design doc that I authored. The doc has over 70 comments, which feels very overwhelming. I try my best to answer all of them, but it just feels like the more I reply, the more questions people have. I ping my mentor and ask him for advice. He tells me that my doc covers two separate topics, so it might be worth it to split it into two.

4 p.m. — I walk home. I play Dominion online with a few friends for about two hours. We started playing during the pandemic and have kept up the tradition even after lockdowns eased because it’s just nice to see old friends who live in different cities regularly. I browse Pinterest while I’m playing and find a cute fanny pack from Mlouye. I think there’s a 40% chance I’ll return the bag after I see it in person. $250.40

6:30 p.m. — I call a car service to my friend’s house to see a few friends. One of my company perks is a car service around the city and to/from the airport, so it’s free.

7 p.m. — I get to my friend’s house. They’ve ordered Indian food for everyone, and after eating we all spend some time cleaning the kitchen, gutting the refrigerator, composting expired food, and collecting boxes of unopened but unexpired food to give away to people living on the street.

10 p.m. — I call a car to take me home, which is again paid for by my company.

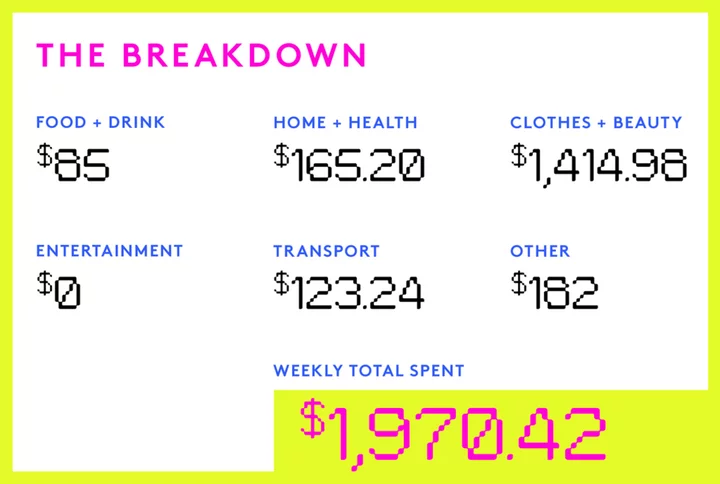

Daily Total: $362.56

Day Two

8:30 a.m. — I head out for my figure skating lesson. It’s an hour and costs $21 for the session plus $100 for my private coach. $121

10 a.m. — I’m done with skating. I walk to work and head to the company’s gym. I do some stretches, lift some weights, and shower.

11:30 a.m. — I have an idea to build a new website. It will primarily be for my own personal use. I buy a new domain name and some web hosting for one year. I’ll figure out the rest of it later. $118.49

11:45 a.m. — I go to the cafeteria to get some lunch. Whenever I skate in the morning, I’m absolutely ravenous by lunchtime. My company provides us with three free meals per day on weekdays. I get some chicken soup, sushi, and shrimp étouffée. The sushi is pretty good so I go back for seconds. I go to the coffee and juice bar and order a matcha latte. The drinks bar is another company perk.

12:30 p.m. — I have three meetings back-to-back. The first meeting is with my manager. I tell him how it’s been difficult getting consensus from three other teams about a design that we are trying to push. It feels like our team’s goals and the other teams’ goals are not aligned, and we can’t find common ground. My manager is empathetic but reiterates that I’m on the right track. I leave the meeting feeling frustrated because my manager doesn’t have a deep understanding of my work, so he can’t offer concrete advice. I also meet with my mentor who offers to switch me to his team. This is something I really need to think about.

2:30 p.m. — I’m done with my meetings. I go to the barista to get a glass of fresh-squeezed orange juice and a berry smoothie. The drinks bar used to be available five days a week, but recently the company had to cut costs. Part of the cost cuts include limiting the bar to three days a week and laying off 10% of the staff. Travel expenses are also tightened and the car service is limited to 25 rides per employee per month.

3 p.m. — I complain to my boyfriend about my job. My work has gotten to a point where I’m writing more docs and dealing with people more than solving interesting technical problems. I find talking to people exhausting and much prefer to just sit down and write code. I’m also scared that my peers at other companies are outpacing me technically. I want to quit, but I feel uncertain about leaving without having another job lined up in this economy.

5:30 p.m. — I head home. I want to pick up an important package that was delivered today (handbags I sent for repair) because there’s been an uptick in package theft in my apartment complex. Before I head home, I use the company printer to buy and print shipping labels for stuff I sold. $4.13

7 p.m. — I head to a friend’s dinner party where we do math and physics problems while eating pizza and drinking wine.

9:30 p.m. — I walk home and spend the rest of the day in bed, finishing up some work tasks and watching YouTube videos. I use my red light therapy face mask for 20 minutes. Eventually, I fall asleep on my computer without turning off the lights.

Daily Total: $243.62

Day Three

7 a.m. — I wake up to the sound of the garbage truck before my alarm even rings. I pull out my laptop while still on my bed and start working. I browse the jewelry section of Etsy at the same time, but I don’t end up buying anything.

12 p.m. — I head to the office to meet a coworker for lunch. I get there around 12:10, and we grab lunch together in the cafeteria. We commiserate about some of the problems at this company, including how inefficient things are and how many people seem to simultaneously have too few and too many opinions.

12:55 p.m. — I order a lavender latte from the coffee bar, but they bring me a lavender mocha. I don’t like bitter drinks (no coffee for me), so the barista remakes my drink for me and brings it to my desk. It’s moments like these that make me so so so so thankful for this place and the bar staff!

3:00 p.m. — I go back to the coffee bar and try to order a berry smoothie, but they ran out of berries! I grab some Tropicana from the fridge and a slice of key lime pie instead. I text my boyfriend and ask if I should switch teams. He suggests that I should only switch if I’m willing to commit to working here for another year. He tells me that I should just do what I want to do so I can put 100% into it instead of making sub-optimal lateral moves. I decide that I will give my two weeks’ notice in one month.

3:30 p.m. — I write two new design docs. The number of design docs written per engineer on my team seems to have increased after the layoffs.

5 p.m. — I head to the ice rink for practice. The hour-long sessions are usually $21/session, but I get 15% off for booking five weeks at once. $17.85

6:30 p.m. — I’m done with skating and walk home. I’ve been having extremely bad acne recently, so I decide to apply a DIY trichloroacetic (TCA) acid peel. I got a peel at a cosmetic dermatologist once for $200 and realized how easy it was to DIY. I apply the peel with a paintbrush, swab the skin around my eyes with a Q-tip, leave it on for 30 seconds, and hop in the shower to wash it off. Skin care is one of my largest recurring expenses. Every other month, I rotate between a few treatments: TCA peel (DIY), Clear + Brilliant ($360), microneedling ($333), and Intense Pulsed Light Therapy ($360). I spend about $2,000 annually on these treatments. My home skin-care routine includes the Glow Recipe Watermelon moisturizer ($39), Bioré sunscreen ($11), Clean + Clear face wash ($7.99), Curology ($39.99), and a Skinceuticals Vitamin C serum ($182).

7:25 p.m. — I head out to go to a friend’s place for a friendly $30 cash poker game. I try to call a car, but no cars are available. I call an Uber instead. $13.15

7:30 p.m. — I place my order (two fish tacos) in a group Uber Eats order at Dos Tacos. My friend places the order for all of us.

7:45 p.m. — I get to my friend’s apartment complex. I start off with a few really good hands (including pocket aces one round) so I quickly make double my buy-in. I even get a few more aces in a few other hands, and at some point, I have the most chips at the table.

8:30 p.m. — The food arrives and we all take a break to eat. One of my friends is contemplating getting an apartment in New York City because she goes on business and leisure trips there all the time. I tell her how much I LOVE having two apartments and the convenience of not having to deal with hotels and being able to keep your stuff in one place.

9:30 p.m. — We go back to playing poker. My luck has turned on me, and I fold about a dozen hands. I bleed out a lot of money and end the night with $35 ($5 profit). It’s getting late, so I cash out for the night and take the car service home.

11 p.m. — I see a message from my org director praising me for the number of design docs I’ve written lately. I go to bed.

Daily Total: $31

Day Four

7:45 a.m. — My alarm rings, as it usually does. I snooze it a few times. Eventually, I check my email to wake myself up. One subject line looks alarming: Warning! Your checking account balance is low. I look at my Bank of America account, and indeed my balance is at -$35.35 after my credit card auto-payed the night before. I withdrew most of my money to invest in the stablecoin USDC last week when news of Silicon Valley Bank’s collapse drove USDC to 88 cents. In the frenzy, I totally miscalculated how much money I needed to pay my bills. I go to my credit card and request a cash advance of $150 + 3% fee. Another stupid mistake — the cash advance takes one business day to land. I frantically check my Venmo account and find that I have $30 in there. I do an instant deposit which costs me a 2.5% transfer fee. That still leaves me in the red by -$6.10. I check PayPal and eBay…no go, I have no money there. I text my friend to Venmo me $10, which brings my account to $3.65. Crisis averted hopefully. $5.50

10 a.m. — Today is a meeting-heavy day for me. My first meeting is at 10 a.m., so I get out of bed slightly before that to make myself presentable, which honestly just means putting my hair in a ponytail and putting on some pants.

11:30 a.m. — I have a short reprieve from meetings, so I walk to my office to grab lunch. I have chimichurri pork loin and chicken and corn soup for lunch today. I also grab a lavender latte and a berry smoothie from the drink bar.

12:30 p.m. — My meetings start again. I take them in the cafeteria so I can get a cup of tea or some snacks in between meetings. It’s still lunchtime so it can get a bit loud in the cafeteria. Thankfully, Zoom’s noise-filtering technology does a good job of removing ambient noise.

3:15 p.m. — I’ve been in and out of meetings for the whole day. My last scheduled meeting finally ended. I leave the office to go to the skating rink for an hour-and-a-half session. Someone pings me and wants to chat through my design doc together, and I tell him I’ll be back around 6 p.m. $26.35

5:15 p.m. — I’m done with skating and walk back to the office. I hop on an ad-hoc Zoom call with my coworker, and we chat for a full hour. It’s late in the day, but I feel like we had a really productive discussion and came to some hard-fought conclusions. Someone is handing out green cupcakes for St. Patrick’s Day, so I treat myself to one.

7 p.m. — I head to the cafeteria for dinner. I have a bowl of tomato soup, some fish fillet over pork fried rice, and some mixed vegetables. After that, I head home.

9 p.m. — I do my own gel manicure. I invested in an Essie gel curing machine ($200) in order to do my own nails and not have to pay $50 + tips at a salon. I lather my hands with sunscreen to protect myself from the UV rays.

11 p.m. — My nails take me about two hours to paint and cure. I want a less sheer pink next time, so I order a bottle of OPI Bubble Bath on eBay. I used to own lots of nail polish, but I sold it all when I switched to using gel exclusively. Now I only buy a bottle if I’m going to use it immediately. $23.34

11:30 p.m. — I give myself a haircut. I’ve had the same haircut for most of my adult life (slightly layered straight hair with bangs) so I can give myself a better haircut than most salons. I chop off two inches of split ends and trim my bangs. I contemplate going to a salon sometime to get a short bob and maybe donate some hair.

Daily Total: $55.19

Day Five

7:45 a.m. — My alarm rings. I groggily sign into Bank of America because I’m expecting to get paid today. I’m feeling anxious about having only $3 in my checking account. I did get paid today, and my balance is now a reasonable amount.

10 a.m. — I start working. I’m too lazy to go to the office today. I also notice that my face is peeling a lot, so I put on an extra layer of sunscreen. My acne has mostly dried out, thankfully.

11 a.m. — I call a medical spa and make an appointment for Botox. I get 10 units of Botox in my forehead twice a year ($12/unit). It’s not enough to freeze my face (which obviously I don’t want), but it does stave off any fine lines or wrinkles for some preemptive anti-aging. I’ve been doing this for over five years.

1:30 p.m. — I play online poker with five other coworkers on Zoom. We aren’t playing for real money, which means people play wild strategies they would never actually use in real poker. Iit’s just for fun and team bonding. I microwave a sandwich and eat it while we’re playing. It’s a bit stale and not very good.

3 p.m. — There are three people left at the table, but I have to run to a meeting with my manager now. I go all in on a bad hand and lose it all.

3:45 p.m. — Time to go skate again for another hour-and-a-half session. $26.35

6:50 p.m. — C. and I head out to dinner. We take the MUNI, which conveniently gets us almost exactly door-to-door. I see a question from my manager on my phone, but I ignore it. I’ll reply some other time. $2.75

7:30 p.m. — We order a dozen oysters, white bolognese pasta, black cod with mussels, two martinis, and a mandarin ice box pie. The total comes to $146 + $28 tip = $174. C. pays for it.

10:30 p.m. — We take the bus back to my place. $2.75

11 p.m. — We watch Spettacolo on the Criterion Channel (C.’s subscription). I fall asleep about halfway through.

Daily Total: $31.85

Day Six

10 a.m. — I wake up today and waste some time browsing Etsy in bed. I see a message from an Etsy seller. I messaged him last week about a beautiful antique sapphire that someone had already put a layaway payment on. He just responded that the other buyer had financial problems and could not complete the sale. I quickly add the sapphire to my cart and check out. I shoot a picture to a jewelry designer on WhatsApp, asking if she could make an east/west ring for me to set it in. As I’m doing this, my friend sends me a link to an 18k Victorian ring made in 1903. It’s so cute that I couldn’t say no, so I purchase that too. I think that’s enough online shopping for me today. I contemplate whether I should really quit my job. $1,073.69

11:15 a.m. — I head out to a farmer’s market, which requires me to take the BART and then transfer to the AC Transit. These two transit companies are separate, so I pay the fare twice. $5.50

12 p.m. — I walk around taking photos with my camera, a 1950s Hasselblad medium-format that I purchased on eBay for $1,100. I use up about half a roll of film (six photos). After that, I go to a dim sum stand and order some dumplings, sticky rice, and scallion pancake for lunch. $36.50

1 p.m. — I head to C.’s place. He brings home some pastries and we eat the dim sum together. He makes some tea with mint leaves from his garden.

2 p.m. — We leave for C.’s friend’s birthday gathering at a local bowling alley/arcade joint. We take our bikes for a ride in beautiful weather. I see a few of C.’s close friends whom I’ve met before and also meet a few new people. The birthday friend orders pizza, pretzels with cheese dip, and other bar snacks for the table. There’s also cake. I order a lemonade and share a whiskey and coke with C. The birthday friend pays for the food and drinks.

6:20 p.m. — I leave a bit early to pick up some groceries at Whole Foods. I buy spinach, cream cheese, ground beef, buns, onions, and kombucha. I’m pretty sure the price of the spinach rang out slightly higher than what it’s marked, but I’m too lazy to flag down the attendant at the self-checkout. $22.38

6:30 p.m. — The jewelry designer replies to my WhatsApp with some cute ideas. I pay a deposit for her to start making something for me. $41.20

7 p.m. — C. starts to prepare dinner. He’s making cream spinach and burgers (yum!). I briefly contemplate going to my friend’s fundraiser party for her Burning Man camp, but I’m too lazy to dress up or leave the house at this point.

8:50 p.m. — The food is finally done. It’s a bit later than we usually eat, but we were still full from the birthday party. We finish with lots of leftovers, and I wash the dishes.

10 p.m. — We drink kombucha and play the computer game Factorio.

Daily Total: $1,179.27

Day Seven

10 a.m. — I wake up and read my email. Someone has replied to my Craigslist ad for a big box of ~100 plastic coat hangers. I listed it for $1 in the “for sale” section because people in the “free stuff” section are extremely flaky. I put the hangers outside the front door and text them my address to pick it up.

10:30 a.m. — I buy five rolls of expired film on eBay. I also find an estate lot of 25 rolls of film for $100. I click “buy,” but upon further inspection, the film looks like it’s already been used. I message the seller to try to cancel the order. $40.81

11 a.m. — C. and I contemplate where we can go for lunch. He’s on call this weekend, which means he needs to be able to reach his computer within 30 minutes for any emergencies. He’s never been paged, but we can’t go far. We bike to an Ethiopian restaurant. It’s drizzling, so we get a little drenched.

12:00 p.m. — We order the Veggie Combo, a classic Ethiopian dish of injera (sour flatbread) with vegan wat (stew eaten with the injera as a dip). It’s delicious with coffee and sugar. The total comes to $39 + $4 tax + $8 tip = $51. C. pays for it.

1:00 p.m. — We bike home. It’s raining a little bit harder now and we get a bit more drenched.

1:15 p.m. — We get home, dry off, and make some warm oolong tea. It’s a cold, wet day, so we decide to stay indoors for the rest of the day. I spend about two hours triaging some user feedback on a website that I own. C. spends this time doing physics problems and reading the London Review of Books. We have a short discussion about Glaze, a tool that protects artwork from being used as training data for generative AI.

6 p.m. — The rain has either taken a pause or stopped for the day. I feel extremely cooped up, so I decide to go out for a walk to Whole Foods. While at Whole Foods, I buy some dried mangos, kombucha, and tiramisu for C. Both because I know C. really loves this tiramisu and also to justify to myself my visit to Whole Foods. $26.12

7 p.m. — I get back home. C. has started preparing dinner: a simple pasta with leftovers from yesterday. We eat the tiramisu and each have a scoop of chocolate ice cream from the freezer.

11 p.m. — We finish watching Spettacolo and get ready to go to sleep.

Daily Total: $66.93

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Send us an email here.