Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

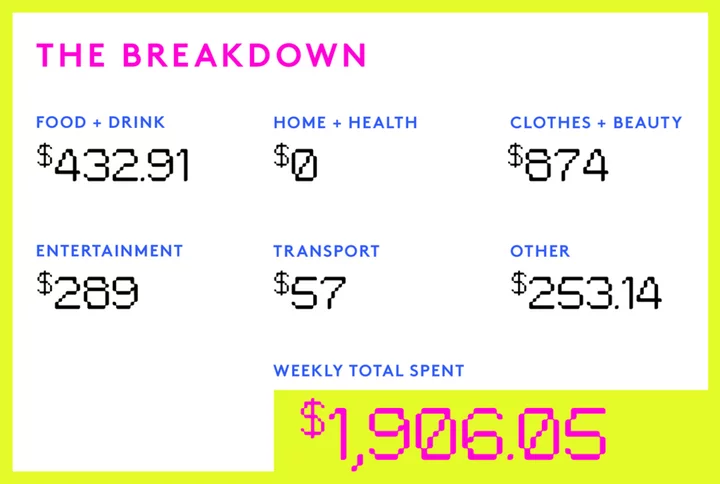

Today: a senior account executive who makes $77,380 per year and spends some of her money this week on a Sephora haul.

Occupation: Senior Account Executive

Industry: Public Relations

Age: 27

Location: San Francisco, CA

Salary: $77,380

Net Worth: $155,000 ($22,000 in my 401(k), $3,000 in savings, $130,000 in investment account).

Debt: $0

Paycheck Amount (2x/month): $2,250.05

Pronouns: She/her

Monthly Expenses

Rent: $1,750 (I live with three roommates).

Health/Dental Insurance: $72

401(k): $386

Utilities: $75

ClassPass: $89

Nuuly: $88

Renters’ & Car Insurance: $125

HBO Max: $16

Apple TV: $7

Netflix: $19

LinkedIn Premium: $30

Scribe Wine Membership: $80 (this is the monthly breakdown but it is billed quarterly).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

I’m not sure if it was an expectation but we never talked about me doing anything besides going to college and I never pursued any other option. It was just what we did and what every other student at my high school did as well. My parents paid for undergrad with an investment savings account they started when I was born.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

None. I got an allowance and my parents recommended I spend my money in a smart way but I never learned about smart saving habits or investing of any kind.

What was your first job and why did you get it?

I got a job at a local sporting goods/clothing store when I was 17. I got it because all my friends were gone for the summer and I needed something to do. The paycheck was nice too, but I didn’t get the job out of necessity.

Did you worry about money growing up?

No. We went on regular vacations, went out for meals, went shopping and always had gifts for birthdays and Christmas. I’m lucky I never had to learn about money growing up out of necessity but at the same time, it called for a rude awakening when I became responsible for my own spending/saving/earning.

Do you worry about money now?

Sometimes. Not in terms of not having enough of it but in terms of not being smart about it. A lot of my friends have an interest in investing/learning about money and how to best use/grow/save it and I don’t really. It makes me worried that I’m being ignorant about it.

At what age did you become financially responsible for yourself and do you have a financial safety net?

Probably around age 23 — my parents paid my rent for the first year after I graduated college. They are 100% my financial safety net. If I need money for something logical (taxes, security deposits, repairs etc.), I typically go to my dad.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes. I got $25,000 when my grandfather died and when I turned 21 I received the remaining balance of my college investment account — around $25,000 — as well. I have gotten various smaller financial gifts for birthdays/graduations throughout my life but those are the big ones.

Day One

6:35 a.m. — Good morning! My alarm goes off and as usual I snooze until 7.

7:30 a.m. — Out the door on my morning coffee walk. I take the same route every day and I find that it helps me start my day with more energy. I walk two miles and stop around the last half-mile to pick up coffee from my usual coffee truck. $6.60

8:30 a.m. — Settle into work and sort through my emails. I take some time to complete my benefits enrollment and select a more expensive plan than last year. I get up to make my breakfast of two fried eggs on toast with hot sauce. I take my daily Seed probiotics.

10 a.m. — My friend who has been in town for the past few days comes by to say goodbye before going to the airport. All three of my roommates are in the office today so I appreciate having a little socialization work break. After she leaves, I join the Ticketmaster queue (curses) to buy concert tickets for a show in September. I have a habit of buying extra tickets and having people pay me for them closer to the show so I’m now the proud owner of four tickets. It sucks having the whole charge on my card and not having reimbursement for it but it will seem like free money in five months when I get paid back. $289

11 a.m. — Break from work to make lunch, which is heated up leftovers from our dinner two nights ago: pappardelle with white bolognese. It still slaps. I look at Google Flights for my upcoming college reunion. I find some options and send them to my friends.

12:30 p.m. — On a call while simultaneously shopping for socks. I’ve noticed a few pairs with holes recently and have lost a few single socks too. I order two pairs of ankle socks and one pair of no-shows. $48

4 p.m. — Scroll scroll scroll, type type type. I have a yoga class booked for 4:45 but my stomach hurts and I don’t want to go. I skip it and eat the cancellation fee (UGH). $31

6:30 p.m. — My roommates are home and we’re discussing Chipotle for dinner. I take a shower, pop an edible and my roommate, K., drives us over. I get a bowl with chicken and steak. I also get chips. $19.40

10:30 p.m. — We start The Night Agent on Netflix and it’s so good. I inhale my Chipotle while watching. I get in bed after three episodes and scroll TikTok for a little while before passing out at 11.

Daily Total: $394

Day Two

7 a.m. — Good morning! It’s Friday! Scroll for a little before getting up. I get dressed and head out on my walk.

7:30 a.m. — It is a gloriously beautiful day in San Francisco. Talk to my favorite coffee truck man for a few while waiting for my coffee. $6.60

8:30 a.m. — Breakfast, emails, probiotics.

12:30 p.m. — My roommate, D., and I walk to Sephora to shop the sale. My mom is a Rouge Sephora member so I use her phone number to get sale access early. I get roped into talking to a makeup artist for about 20 minutes even though he is talking to the wrong girlie — I am the most low-maintenance makeup-owner. I come out of the store with a new Shiseido moisturizer and sunscreen, Charlotte Tilbury highlighter, Rare Beauty blush, Paula’s Choice BHA exfoliant and body treatment, two Summer Fridays lip balms and a sample of NARS tinted moisturizer that the kind makeup artist man gave me. $224

1 p.m. — Stop at a nice local market for lunch. I get spicy veggie spring rolls, a BLT and two different canned oat milk lattes so I can do a comparison. $31

3 p.m. — D. and I do a Sephora haul in the living room while we watch Jury Duty on Freevee (which is SO funny). K. and I pull the trigger on flights — I buy a one-way since I’m unsure of my return plans. I have a credit with this airline after I canceled a trip to Hawaii earlier this year so it’s “free.”

6 p.m. — Take a quick shower and get dressed. My roommate and I are meeting up with two of our friends from college, one of whom is visiting from New York this weekend. We go to one of our favorite Italian restaurants and share calamari, fried mozzarella and a stuffed artichoke. I get carbonara and a glass of red wine and we get tiramisu for dessert. I pay and have everyone venmo me their portion. $72

9 p.m. — Meet up with our other friends at a bar. I get two Pacificos and we hang out for a while. $18

10:30 p.m. — Walk back to my apartment. Two of my roommates and I watch a few episodes of The Night Agent. I’m in bed by 11:30.

Daily Total: $351.60

Day Three

8 a.m. — Weekend! I’m still up at 8. D. and I walk to the coffee truck and I get my usual. Say hi to many dogs. $6.60

9 a.m. — Make my usual breakfast at home and scroll TikTok while I eat.

12 p.m. — Out the door with two of my roommates to go pick up our friend, B. We drive down to Half Moon Bay to explore and try to find wildflower superblooms. We stop for lunch at a cute little spot and I get a burger and a seltzer. $19

1:30 p.m. — We shop around the town a bit, which for me is mostly window shopping. I end up getting four greeting cards from a bookstore. $22

2 p.m. — Stop for gas before starting the drive home. $57

3:30 p.m. — We drop B. off and go to a few more shops before going home. I want a specific cardigan from Sézane but they don’t have the color I want. I see a sweater I really like but don’t feel like asking the associate to get it down from the shelf for me. I almost buy two shirts at Lululemon but put them back. Last stop is Sephora (again) — I get a full size of the NARS tinted moisturizer I sampled yesterday, a Charlotte Tilbury contour stick, The Ordinary hyaluronic acid and Ilia concealer. $122

5 p.m. — Finally get home and put my purchases away. I scroll on the Sézane website and find the sweater I want, along with the sweater I liked in the store. I order both. $303

6:30 p.m. — We meet up with a few of our other friends at a wine bar. We share three bottles of orange wine between seven of us and chat for a few hours. I venmo my friend for my portion. $26

8 p.m.— Get home and immediately order Chinese food. Drama ensues because the map shows the Dasher “waiting to pick up order” at the restaurant for over an hour! I text and call him multiple times and he ignores my calls and messages. By 10:10, I decide to call it quits and get a refund from Caviar for my order. We order from another Chinese restaurant to make up for it. We finally are eating by 11 (ugh!). I pay and my roommates venmo me their portions. $30

11 p.m. — We’re still watching The Night Agent. I get in bed after another episode (we have ONE left) and scroll for a while. I see a TikTok about Abercrombie having a sale so obviously I go check that out on their app. I end up buying two dresses and a skirt, with 35% off. $177

12 a.m. — Back to TikTok. Asleep by 1.

Daily Total: $762.60

Day Four

8:30 a.m. — Who was I kidding setting an alarm for 10 a.m. I haven’t slept until 10 in years. I scroll for a little before getting out of bed to go to the farmers’ market with my roommates. I put on my new moisturizer and sunscreen before leaving. It’s a mile walk.

9:30 a.m. — I come away from the farmers’ market with a breakfast burrito, strawberries and blackberries. Win! $21

10:30 a.m. — Stop at the coffee truck on my way home. Get my usual and drop $10 cash in the tip jar since I never have cash. $16.60

11 a.m. — Two of my roommates are going on a hike and I’ve decided I don’t like hiking. I hang back and cross things off my to-do list while I have the house to myself. I sort a few bins in my closet, clean out the fridge, do a load of laundry and organize my section of our bathroom storage. I then decide to go really all-out and do my taxes. Most Bay Area counties have an extended tax deadline (until October) but I want to get it out of the way since I don’t have any claims/issues to organize because of the weather damages. I use TurboTax because it’s easy and I don’t trust myself to do this right on my own.

12 p.m. — Done with my taxes! I end up having to pay for the premium offering but I don’t really care. I owed so much money in taxes last year that anything is easier than having to pay the IRS almost $12,000. I’m getting a $645 return and owe $170 for the premium TurboTax product. I have them route my return to my checking account and pay the fee with my credit card because points. $170

1 p.m. — Our third roommate is home from a weekend away. She gets back just as our other roommates text us that they’re done hiking and are going to get lunch. We get in the car to go meet them.

1:45 p.m. — I’m still full from my breakfast burrito but I’m powerless to resist my favorite lunch spot. We share poke and guac and chips, and I get a beer and a poke burrito. It hits every single time! I take half of my burrito for the road. $32

3:15 p.m. — Since we’re out, might as well do the grocery shopping. We stop at Whole Foods and I get eggs, three Olipop sodas, a sushi roll, cereal, a frozen pizza, two boxes of Banza pasta, ground chicken, chicken thighs and parmesan cheese. $75

4 p.m. — There were a few things I didn’t get at Whole Foods because I kept reminding myself how much cheaper Trader Joe’s is. I stop there with one of my roommates before going home and get sourdough, cilantro, green onions, 2% milk, marinara sauce and tulips. $24

7 p.m. — Eat my burrito leftovers, fold laundry and watch Succession. I have some Jeni’s ice cream while we watch. Afterward, we watch the first episode of The Last Thing He Told Me. Pretty good! I’m in bed by 9 and asleep by 10:30.

Daily Total: $338.60

Day Five

7 a.m. — Back to the grind. I set my alarm later on Mondays to ease me into the week. I get up, brush my teeth, take my probiotics, moisturize and SPF, and get dressed in leggings and a sweatshirt. I make my usual breakfast first today because the coffee truck is closed on Mondays. Eat at my desk while catching up on email. One of my friends is doing a charity bike ride next week so I donate to her fundraiser. $10

8 a.m. — Order a Starbucks coffee for pickup. I get a venti shaken brown sugar oat espresso. Use my prepaid Starbucks card.

9 a.m. — Wrap up my 8:30 call and get an email that I won a work raffle! I did my benefits enrollment before the deadline and got automatically entered to win. I get a $50 Amex gift card!

10 a.m. — I pay some scary credit card bills ($66 for my Apple card, $787 for my Chase accounts and $425 off my Amex). I’m really bad about managing my finances/living within my means and get freaked out by how quickly my bills pile up. I also have seven credit cards, which I know is incredibly out of hand, so sometimes I forget I’ve charged something to a certain card and then get overwhelmed when I find another statement I have to pay off. I’m working on it! I luckily still have 100% on-time payment frequency and a really good credit score so I’m managing it while trying to improve.

1:30 p.m. — Break for lunch after calls. I have the sushi roll I bought yesterday and then some leftover Chinese food because I’m still hungry.

4:15 p.m. — Wrap up work for a little bit to go to a yoga class. I booked through ClassPass so it’s already paid for. Feels SO good to stretch after not going to yoga for a few weeks.

6 p.m. — Home, shower and make dinner, which is Banza pasta with ground chicken and marinara. It’s such a lazy dinner but it’s high in protein and tastes good so I don’t really care.

8 p.m. — Watch the last episode of The Night Agent with roommates and have some ice cream.

9:30 p.m. — In bed and scrolling, asleep by 10:30.

Daily Total: $10

Day Six

7 a.m. — Oof, I did not sleep well last night. My eyes are half-shut while I get ready. I left my (new) moisturizer open on my dresser last night. What’s going on? Mercury isn’t even in retrograde!

8 a.m. — Stop for my usual coffee towards the end of my walk. $6.60

8:30 a.m. — Make my breakfast and sort my emails before a block of morning calls.

10:30 a.m. — Break from calls to go meet my friend for coffee. We meet at a café around the corner from my apartment and chat for a while. I get a dirty chai and tip a dollar. $7.50

1:15 p.m. — Finally done with calls. I make a TJ’s caesar salad kit and add some chicken meatballs. I also have the lemon-lime Olipop, which I expected to be like a Sprite, but is sweeter and not as crisp. A healthier alternative, obviously, but doesn’t hit the same as a Sprite.

5 p.m. — Wrap up work and make soup for dinner. I have all the ingredients except limes so I go to the market around the corner and buy two. $1.90

6:30 p.m. — The soup is so good. Molly Baz, I love you. Except I burn my tongue and it hurts.

8 p.m. — Drive to my friend’s house to pick up something my sister left behind when she was in town last week. I’ll have to overnight it to her tomorrow.

9 p.m. — Home, usual routine, straight to bed.

Daily Total: $16

Day Seven

6:30 a.m. — I actually get up when my alarm goes off this morning because I’m going into the office. I get dressed (black Madewell jeans, black sweater, Vans) and make breakfast. I take 30 seconds to put on tinted moisturizer and concealer. I remember that my high school is doing a fundraising challenge today so I donate the amount of my graduation year. $20.14

8 a.m. — Order my coffee on the app on our way to the office. Ordering the exact same thing from a brick-and-mortar location is more expensive for some reason. $7.85

9:15 a.m. — I venture to the FedEx in our building to send my sister’s stuff to her. I have to overnight it so it’s mad expensive but she venmos me immediately ($78, she pays).

11 a.m. — The discussion of what to get for lunch is a lively one. As an incentive for being in the office, we can expense lunch up to $15, but being in San Francisco, that amount is tough to achieve. We land on Chipotle and I order from my account since I have a free guac reward. It nets out to $14.90 per person, which is impressive for us. My coworker pays on her corporate card.

1 p.m. — Feeling antsy being inside so I text my friend to get a coffee with me. He doesn’t drink coffee (lame) but I get a cold brew with oat milk and we sit outside and chat for an hour. $5.26

3:15 p.m. — Leave the office and stop at Sephora on our way to the car. I don’t get anything but I let my coworkers use my account number to get the VIB Rouge discount.

4 p.m. — Get home and finish work from my bed.

5:30 p.m. — My friend comes over to go for a walk. We walk around and sit on various benches for around two hours. I drive her home afterward.

8:30 p.m. — I eat a bowl of reheated pasta. Get in bed at 9 and ponder for a while. Fall asleep by 10:30. BYEEEEEEE.

Daily Total: $33.25

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.