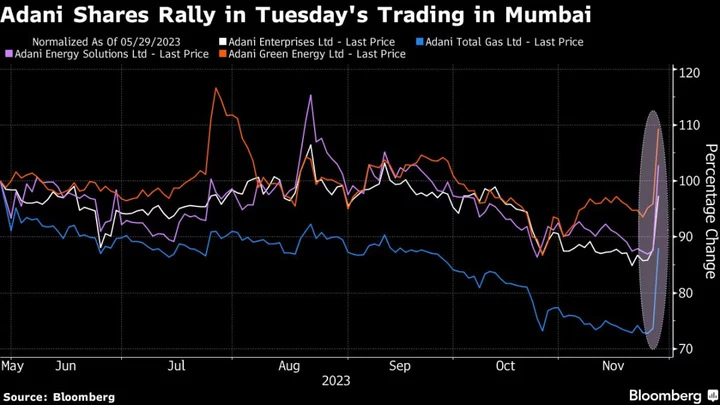

Shares of Adani Group companies rallied, with the flagship Adani Enterprises Ltd. surging 13%, after India’s Supreme Court Friday concluded hearing the arguments in a case relating to an investigation into the plunge in the conglomerate’s stocks earlier this year.

The jump added more than $15 billion to the ports-to-power conglomerate’s market value, the most since Hindenburg Research in its Jan. 24 report alleged wide-ranging corporate malfeasance against billionaire Gautam Adani’s group. India markets were shut on Monday for a holiday.

India’s top court reserved its judgment on the matter related to the market regulator’s probe into the Adani-Hindenburg case. During the court arguments earlier Friday, the Securities and Exchange Board of India told the court that it won’t seek additional time to complete the probe into allegations against the Adani Group.

“Some investors could have read the court arguments as the regulator has not found any substance out of the allegations, and this could have led to the stocks rally,” said Deven Choksey, a strategist with DRChoksey Finserv.

All 10 group companies advanced, with Adani Total Gas Ltd. surging almost 20% and Adani Energy Solutions Ltd. gaining as much as 19%. Adani Enterprises is set for its biggest surge since May 23.

“The mood among money managers has been to cut all shorts and go long, so I am not at all surprised by today’s move,” said Abhay Agarwal, fund manager at Piper Serica Advisors Pvt. The top court’s statement about the regulator’s probe was definitive but the stock rally today “seems more about short squeezing,” he added.

Adani Group’s market value of $138.4 billion is still about $97 billion below the level before US short seller released its scathing report accusing the conglomerate of long-running stock manipulation and accounting fraud. The group has repeatedly denied all wrongdoing.