Upstart Holdings Inc.’s breakneck rally is losing momentum after the lending platform that uses artificial intelligence provided a disappointing outlook.

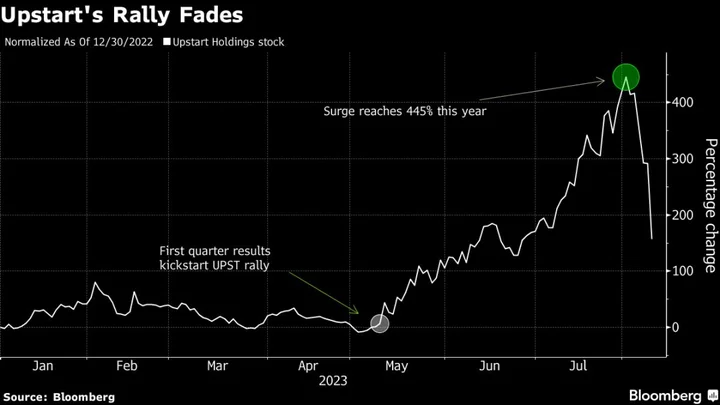

Shares dropped 34% on Wednesday, the worst tumble since May 2022, after its third-quarter revenue forecast fell short of consensus estimates. The stock’s recent weakness has sawed off more than half of a 2023 rally that at one point reached 445%.

“I think some of the air is popping out of that balloon today,” said Dan Dolev, analyst at Mizuho Securities. “When you don’t beat results by a massive margin, then people are seeing this as a negative sign. They just didn’t sound as bullish.”

Upstart tumbled earlier this week as Morgan Stanley analyst James Faucette encouraged investors to “fade what appears to be a low-quality rally.” He ascribed the stock’s rapid advance in part to declining short interest and the stock’s correlation with the rally in companies tied to AI. Short interest in the stock as a percent of the equity float is about 38%, according to S3 Partners data, after reaching nearly 47% earlier this year.

Read More: Upstart Slumps as Morgan Stanley Says Fade ‘Low-Quality’ Rally

The stock’s rally was jumpstarted when Upstart reported its first-quarter results in May, doling out a second-quarter outlook that was ahead of estimates. Now, its third-quarter guidance is taking the wind out of the stock’s run-up.

Despite the surge, Wall Street analysts mostly have sell-equivalent recommendations on Upstart, according to data compiled by Bloomberg. The expected return potential for the stock based on their price targets is among the worst in the Russell 2000 index.

“Outside of the disappointing 3Q guide for top-line, the quarter was actually pretty strong,” BTIG’s Lance Jessurun, who holds the lone buy rating on the stock, said. “Obviously expectations were ridiculously high.”

--With assistance from Carmen Reinicke.

(Updates shares throughout to market close.)