Some Wall Street analysts are checking out of Airbnb Inc. stock as the company attempts to execute a turnaround.

The number of those with sell ratings on the vacation-rental site has risen to an all-time high, with six of the analysts who cover it recommending that investors dump the stock. They’re still in the minority, with the other three dozen nearly evenly divided over whether investors should buy or just stay put.

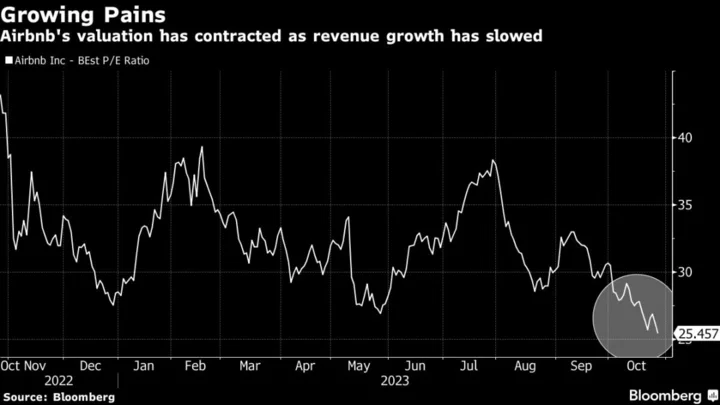

But the bears might be onto something. Just two years ago, when Airbnb’s market value was nearly twice what it is today, its annual revenue growth was pushing 80% as remote work and the pandemic unleashed a flood of demand. This year sales are projected to expand just 17% and fall further in 2024. Still, Airbnb’s stock is priced at about 26 times projected profits, roughly the same as Apple Inc.

Some analysts see a number of obstacles to Airbnb living up to that valuation. In September, New York City changed rules around short-term rentals in a way that drastically curbed the company’s listings, joining others that have sought to curb Airbnb as they contend with housing scarcities that have pushed up rents. Canada is also considering enacting new rules for short-term rentals that would hit Airbnb and VRBO.

“I just don’t see where their growth comes from, whether it be services or anywhere else,” said Ross Gerber, co-founder and CEO of wealth management firm Gerber Kawasaki Inc. His firm holds MGM Resorts International but not Airbnb.

Read More: Airbnb Is Fundamentally Broken and Needs to Be Fixed, CEO Says

On top of that, travel is expected to keep coming down from the post-covid boom. Keybanc in October downgraded Airbnb to sector-weight from overweight and removed its price target, saying that margins have reached a near-term peak and revenue growth could decelerate next year as the travel tailwind fades.

“We believe this could create an overhang on shares as ABNB transitions from a growth” investor base to one focused on GARP — or growth at a reasonable price, analysts led by Justin Patterson wrote, referring to Airbnb by its ticker symbol.

Seaport Research Partners initiated coverage of Airbnb with a neutral rating in an Oct. 24 note, saying that the risk-reward is “fairly balanced” given their expectation for moderating bookings growth.

“Given the robust bookings trends in 2021/2022 following the pandemic, we expect more steady growth going forward, particularly in the US,” analyst Aaron Kessler wrote in a note. “That said, there is still room for ample growth long-term with alternative accommodations representing less than 20% of total accommodations.”

Yet bulls are standing their ground ahead of the company’s third quarter earnings report, scheduled for Wednesday Nov. 1 after market close. One reason is that they still see pent-up demand for travel, especially with consumer spending continuing to drive the US economy.

“We feel like the revenge travel wave is definitely still in full effect,” said Brian Mulberry, client portfolio manager at Zacks Investment Management. “We’re not unhappy with how the market looks in terms of the demand structure and the ability for consumers to spend that money.”

He added that as long-term investors, Zacks has no issues with Airbnb’s business model and sees changing short-term rental rules as a near-term challenge the company can overcome.

Ivan Feinseth, chief investment officer at Tigress Financial Partners LLC, agrees. He’s one of the largest Airbnb bulls on Wall Street with a $185 price target, implying a roughly 60% gain ahead. He thinks rules curbing short-term rentals aren’t likely to stick around.

“When people travel to your city or country, those people, those tourists — or whatever you want to call them — are spenders,” he said.

Tech Chart of the Day

The Nasdaq 100 index dipped into the so-called correction territory on Thursday as tech stocks fell in recent days following disappointing results from Meta Platforms Inc. and Alphabet Inc. The tech-heavy benchmark fell 1.9% Thursday and has now fallen more than 10% since its July peak.

Top Tech Stories

- Amazon.com CEO Andy Jassy gave investors much of what they wanted this earnings season: robust sales and profit growth along with a hint that the cloud division earnings machine is regaining momentum.

- Intel Corp. surged in pre-market trading after predicting a return to sales growth in the fourth quarter, fueled by an improving personal computer market and a more competitive product line.

- In the race to rebound from a two-year slowdown in spending on cloud computing, Microsoft Corp. is pulling ahead of its chief rivals, Amazon.com Inc. and Google.

- Executives at X, the social media site formerly known as Twitter, said they see YouTube and LinkedIn as future competitors while pursuing new business lines in video and hiring.

- Tesla Inc. raised the price of its Model Y Performance sport-utility vehicle by around $2,000 in China on Friday, according to its local website, reversing a reduction made only in August.

- An import ban on certain Apple Watch models would begin on Christmas Day if the Biden administration declines to veto a US trade agency’s order over patented technology that measures the amount of oxygen in a user’s blood.

- Western Digital Corp. fell as much as 16% after deal negotiations with Kioxia Holdings Corp. broke down, quashing hopes for a combination of their flash memory businesses.

Earnings Due Friday

- No major earnings expected

--With assistance from Subrat Patnaik.