Some of the world’s biggest investors are backing emerging-market currencies to outperform their rich-nation peers as monetary tightening pauses, growth slows and calls for a weaker US dollar become louder.

T. Rowe Price, which oversees $1.3 trillion, Fidelity International and abrdn plc are among those placing bullish bets in Latin America, where two years of aggressive interest-rate hikes have stymied inflation, putting it on course for rate cuts earlier than most other regions in the world. Amundi SA, Europe’s largest money manager, expects the Mexican peso and Brazilian real to lead the rally.

With average consumer-price increases easing for two successive quarters from an 11-year high, more developing nations are seeing their inflation-adjusted rates turn positive and widen their gap over developed countries. Latin America is at the forefront of this change: Brazil and Mexico offer real yields of 9.1% and 5%, respectively, compared with near-zero returns in the US and minus 5.6% in the UK.

“For the most part, high-yield currencies will outperform,” said Edwin Gutierrez, the head of emerging-market sovereign debt at abrdn. He remains “constructive” on the assets “given the softening of the US economy and the Federal Reserve hiking cycle drawing to an end.”

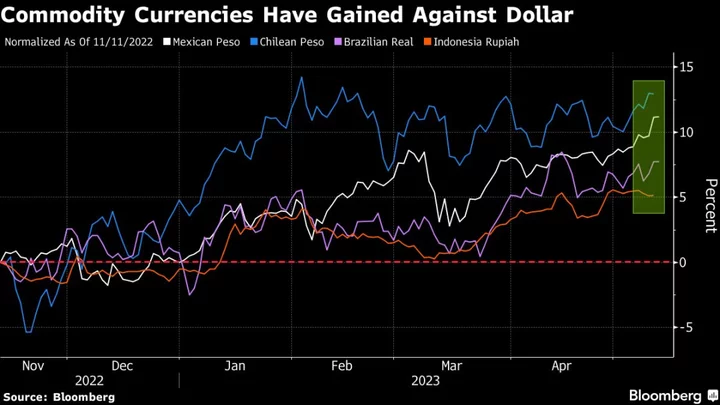

Developing-nation currencies have risen this year even as economic data from both China and the US sent mixed signals and investors’ wait for a Fed policy pivot prolonged. The MSCI EM Currency Index has steadied after a roller-coaster start, adding 1.3% since the end of February.

Investors are betting the gains can continue as bulk of the Fed’s hikes are done and the dollar’s rally runs out of steam. That, and the ongoing struggle to resolve a US debt-ceiling standoff, are boosting the case for a rotation away from the greenback.

“Currencies with good real yield and strong external balance of payments should benefit,” said Esther Law, a senior money manager at Amundi, which manages $2.1 trillion. “Once there’s more clarity on the impact of the banking concerns and the Fed is clearly pausing, then I think it will offer a good opportunity for emerging currencies.”

Gains are being led by currencies in Mexico, Chile, Brazil and Colombia, as well as the Hungarian forint, Polish zloty and Indonesian rupiah.

The outlook for emerging-market currencies outside Latin America is mixed. The rupiah is favored by money managers including T. Rowe Price, while a few other Asian currencies — such as India’s rupee — are supported by rapid economic growth. But others remain vulnerable to risks including debt overhangs, political turmoil and diplomatic stand-offs.

That vulnerability was in display in South Africa last week as the rand tumbled to successive lows after the US accused the nation of arming Russia. Geopolitics is only the latest in a series of risk factors troubling the currency, including a domestic energy crisis and the waning popularity of President Cyril Ramaphosa.

The potential for such flare-ups continues to keep some investors away from emerging markets. Man Group Plc, the world’s biggest publicly-listed hedge fund, warned that a “violent” rout is coming to to the asset class. Lazard Asset Management cautioned investors to be “highly selective” as the full impact of the US banking worries on global growth is yet to be seen.

Such threats are on Leonard Kwan’s radar as well. The Hong Kong-based money manager at T. Rowe Price still favors the Chilean peso, rupiah and Mexican peso. He remains “constructive” on the currencies even as he watches out for any ripple effects from a US economic slowdown.

Meanwhile, all eyes are on the Fed for any signals of a pause in tightening. Should the US central bank signal a shift in priorities away from firefighting inflation, the dollar should weaken and emerging markets should benefit, according to Paul Greer, money manager at Fidelity in London.

“From a valuation perspective, emerging-market currencies are still cheap,” said Brendan McKenna, strategist at Wells Fargo & Co. in New York. “EM currencies can not only strengthen against the dollar this year as the Fed reaches the end of its tightening cycle, but they can outperform relative to G-10 peer currencies.”

What to Watch

- Turkey’s tightly controlled lira is set for a jolt regardless of the outcome of Sunday’s election between President Recep Tayyip Erdogan and opposition contender Kemal Kilicdaroglu

- Bloomberg Economics expects a pivot toward orthodox policies no matter who wins, though the change may come faster and sooner on an opposition victory given the fragility of the economy

- Sunday’s election in Thailand will also set the tone for its markets

- Looking back at six general elections and two military coups since 2005, the baht had appreciated on average by 1.2% in the one month after the voting day

- In China, the central bank is set to cut its one-year medium term lending facility rate on Monday by 10 basis points to 2.65%, the first since August, to stoke an uneven recovery, according to Bloomberg Economics

- Data on Chinese industrial production and retail sales — which are expected to show a recovery from last year’s Shanghai lockdowns — will also be closely watched

- Central banks in Mexico and the Philippines will probably keep interest rates unchanged this week

- Inflation data in Israel, Nigeria and Poland will offer clues on the nations’ monetary policy path

- Colombia, Thailand, Hungary, Israel, Russia and Chile will publish GDP numbers

--With assistance from Akshay Chinchalkar and Netty Ismail.

Author: Ruth Carson, Malavika Kaur Makol and Karl Lester M. Yap