Saudi Aramco raised its payout to investors and Saudi Arabia’s government by more than half, in a move that will help fill state coffers that had increasingly been expected to be in deficit this year.

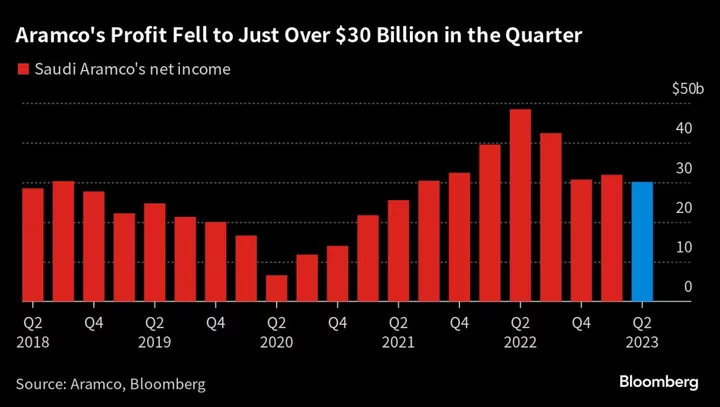

The total payout will be $29.4 billion, including a performance-linked portion, up from a regular dividend of $18.8 billion a year ago, according to a statement from the company. The boost to the dividend came despite profit dropped by more than a third to about $30 billion as a result of lower oil prices.

Aramco is a crucial source of funding for the Saudi government which announced last week that its budget deficit widened in the second quarter after an increase in spending on social benefits and multi-billion dollar projects meant to diversify the economy from oil.

Saudi Aramco followed other international oil producers in boosting payouts to shareholders even as profits declined. Oil majors have seen profits drop as crude prices retreated from last year’s highs when commodity markets were roiled by Russia’s invasion of Ukraine.

“The second quarter of 2023 was characterized by continued global economic uncertainty and market volatility,” Chief Executive Officer Amin Nasser said on a call with reporters. “This obviously affected energy prices, yet Aramco delivered strong earnings thanks to our low cost production, high supply reliability and strong demand for our products.”

Aramco stock rose as much as 2.2% to trade at 33 riyals a share before paring gains to 32.5 riyals at 1.32 p.m. in Riyadh on Monday.

OPEC+ Cuts

As leader of the OPEC+ producers group along with Russia, the Saudis have pushed the cartel to extend output cuts for the rest of the year. Aramco has been pumping the least crude since the depths of the Coronavirus pandemic after the kingdom began implementing an additional, unilateral reduction of 1 million barrels a day last month. Oil rose after the Saudis announced last week that they’ll extend that cut into September and could even deepen it if needed.

The Saudi efforts to stabilize crude markets have helped push Brent crude back to about $85 a barrel. That and the rising Aramco payouts highlight the state’s need for cash to fund Crown Prince Mohammed bin Salman’s aggressive growth plans as he looks to transform the economy into a technology, tourism and leisure juggernaut. The Saudi government stands to gain as the biggest owner of Aramco, while the increase in dividends may help to attract investors lured by returns for industry rivals.

Aramco has been trying to improve liquidity in the stock, that many investors had previously described as being ‘bond-like’ for its relatively low and stable returns. Attracting new investors is also important ahead of a potential secondary offering. Most large global investors had declined to buy Aramco shares during its 2019 initial public offering citing a lower dividend yield than peers.

After announcing the introduction of the new performance-based dividend in May, Aramco said it had brought forward the first payouts to be sooner than expected as a result of the record profits it made in 2022.

Demand that many analysts see reaching a record this year may help further boost prices as most forecasters see supply falling short of usage in the second half. Demand is set to reach 103 million to 104 million barrels a day later this year, Nasser said on the call.

While most traders and producers have been waiting for demand in China to recover and blame oil’s lackluster performance in the first half on that country’s sluggish growth, Nasser said he sees demand higher than expected in its biggest consumer. Aramco has sufficient supply, even after the output cuts, to meet obligations to its customers, Nasser said.

Aramco will go ahead with any acquisition or expansion plans, unimpeded by the greater call on cash from the dividend, he said.

--With assistance from Fahad Abuljadayel, Omar Tamo and Kateryna Kadabashy.

(Adds chart and share move in sixth paragraph. A previous version of this story corrected the currency conversion.)