Stocks in Asia are poised to open lower in the wake of a slide on Wall Street as traders boosted bets on a US rate hike after a surprise increase by the Bank of Canada.

Futures for shares in Australia, Japan and Hong Kong declined. Tech shares bore the brunt of jitters over higher rates, sending the S&P 500 down for a second day this week and the Nasdaq 100 to its worst day since April. Contracts on the US benchmarks were slightly lower in early Asian trading.

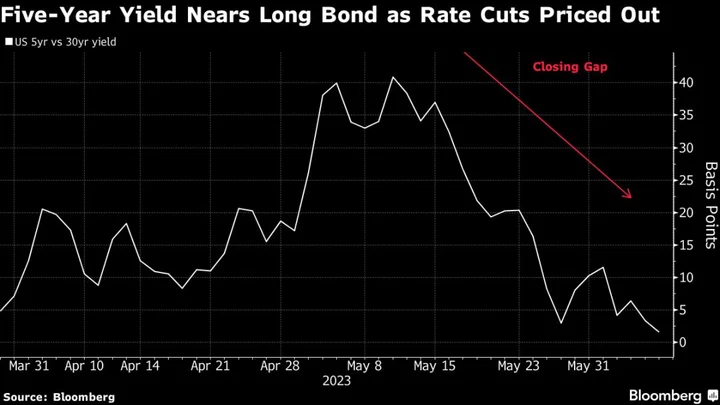

US Treasuries fell across the curve Wednesday, with the benchmark 10-year yield rising 14 basis points to 3.8%. Traders boosted wagers on Federal Reserve tightening, with swaps at one point fully pricing in a quarter-point hike for the July meeting, while those for next week’s decision edged higher but still pricing less than 40% odds of such an increase.

US stocks gained early in the session Wednesday, bringing the S&P 500 to the brink of a bull market. But that all ended abruptly after the Bank of Canada upended markets by unexpectedly restarting its rate-hiking campaign. The move also comes after the Reserve Bank of Australia earlier this week wrong-footed investors with an increase. Australia’s three-year note yield rose 13 basis points to 3.83%, the highest since 2012, early on Thursday.

“In marked contrast to the Fed, the Bank of Canada seems comfortable going into a meeting without its rate decision presignaled to the market,” said Deutsche Bank strategist Alan Ruskin. He expects a “hawkish hold” as the more likely decision from the US central bank.

Bridgewater Associates’ billionaire founder Ray Dalio said while interest rates won’t go much higher, the economy will get worse.

“We are at the beginning of a late, big-cycle debt crisis when you are producing too much debt and have a shortage of buyers,” Dalio said from the Bloomberg Invest conference in New York.

Read more from the conference

The Reserve Bank of India will take center stage Thursday and is widely expected to keep rates on hold. BI economist Abhishek Gupta sees the central bank switching its policy stance to neutral, tempering its shift with hawkish rhetoric that reflects rising upside risks to inflation.

Japan is scheduled to release its final reading on first quarter GDP, which is seen revised higher from the preliminary estimate. The euro-area is scheduled to release its final reading later in the day.

Elsewhere, oil rose amid dollar weakness while traders pointed to the highest refinery runs in the US since 2019 as a harbinger of strong summer demand to come. West Texas Intermediate settled above $72 a barrel on Wednesday.

Key events this week:

- Eurozone GDP, Thursday

- Rate decisions in India, Peru, Thursday

- Japan GDP, Thursday

- US wholesale inventories, initial jobless claims, Thursday

- China PPI, CPI, Friday

Some of the main moves in markets as of 7:35 a.m. in Tokyo:

Stocks

- S&P 500 futures were little changed. The S&P 500 fell 0.4%

- Nasdaq 100 futures fell 0.1%. The Nasdaq 100 fell 1.8%

- Hang Seng futures fell 0.3%

- S&P/ASX 200 futures fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0701

- The Japanese yen was little changed at 140.08 per dollar

- The offshore yuan was little changed at 7.1468 per dollar

- The Australian dollar was little changed at $0.6656

- The British pound was little changed at $1.2440

Cryptocurrencies

- Bitcoin fell 0.3% to $26,282.16

- Ether fell 0.7% to $1,829.76

Bonds

- The yield on 10-year Treasuries advanced 14 basis points to 3.80%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold rose 0.1% to $1,942.52 an ounce

This story was produced with the assistance of Bloomberg Automation.