Asian stocks are poised for a mixed opening after Wall Street struggled in the wake of a rally that put the S&P 500 near “overbought” levels. US trade was dominated by Treasuries which extended their powerful November advance.

Equity futures signal small gains for Japanese and Australian benchmark indexes, while Hong Kong may edge lower. Traders weighed mixed US government debt sales, with a $55 billion auction of five-year bonds seeing strong demand while a $54 billion sale of two-year notes was soft.

Benchmark 10-year yields dropped eight basis points to around 4.4% amid bets the Federal Reserve is done with interest-rate hikes. Australia and New Zealand yields also declined in early trading Tuesday.

Read: Billions Wiped Out as Stock-Safety Trade on Wall Street Misfires

The world’s biggest bond market has clawed its way back after spending chunks of 2023 underwater — heading toward its best month since March. The Bloomberg US Treasury Index recently shifted to a positive return for the year as signs of slowing inflation and measured jobs growth unleashed a rally that sent yields tumbling from their highest in more than a decade.

“The market appears to have embraced the idea that slowing economic data will hasten the arrival of market-friendly rate cuts, even though the Fed has continued to telegraph otherwise,” said Chris Larkin at E*Trade from Morgan Stanley. “This week will provide plenty of opportunities for traders to decide whether that cooling trend is intact.”

Read: Wall Street’s 5,000 Club Grows on S&P 500 Optimism: Surveillance

Traders will be closely watching another batch of economic data this week, including the Fed’s preferred measure of underlying inflation. US sales of new houses fell in October after a downward revision to the prior month as decades-high mortgage rates weighed on demand. The Fed Bank of Dallas manufacturing index for November came in softer than expected.

In Asia, there are signs China’s economic recovery remains fragile, with profits at industrial companies rising at a much slower pace than a month earlier as deflationary pressures persisted. The fallout from a criminal probe into shadow banking giant Zhongzhi Enterprise Group Co. continues, with one lawyer estimating investor losses could reach $56 billion.

Too Placid

Bets that US policymakers are done with the rate-hiking cycle have fueled a rally in the S&P 500 this month, sinking short-term volatility expectations. While some used the opportunity to buy protection on the cheap, it’s been far from ubiquitous — and calls saying the market environment is getting too placid are on the rise.

“The technical backdrop in the stock market right now is critically important,” said Matt Maley, chief market strategist at Miller Tabak + Co. “This does not mean that we’re about to see an important top in the stock market. It could just mean that we’ll see a mild pullback or even a ‘sideways’ correction at some point in the next week or two to work off this overbought condition.”

Volatility has collapsed, both the bond and equity markets have stabilized while the dollar has fallen significantly — which should be enough for investors to feel cautiously optimistic, according to Mark Hackett at Nationwide.

Read: Wall Street Goes All-In on Cross-Market Meltup as Bears Retreat

“At this point in the year, the direction of the current market – which is positive – is historically the direction the market finishes the year since there are few indicators that could drastically change its route,” Hackett noted. “But, in order for this to be true, we’ll need to see a ‘goldilocks’ approach from the Fed – not too weak and not too strong on policy.”

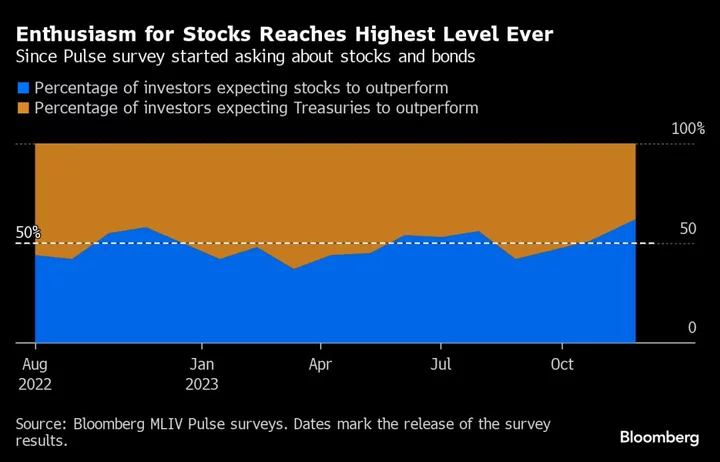

More than 60% of respondents in the latest MLIV Pulse survey expect stocks to provide better returns than bonds over the next month. That’s the highest level of excitement about equities that the survey registered since the question about the two assets was first asked in August 2022.

Wall Street forecasters have turned more optimistic about the outlook for next year as investor sentiment improves and expectations of a recession are dialed back.

In earnings, Crowdstrike Holdings Inc. will underscore how businesses are prioritizing cybersecurity after recent high-profile corporate hacks, while Salesforce Inc. and Dell Technologies Inc. are expected to post slower sales growth when they report this week, as overall corporate expenditure tightens.

Elsewhere, gold was back above $2,000. Oil dropped as easing geopolitical tensions and oversupply signals outweighed hopes that OPEC and its allies will deepen production cuts on Thursday.

Corporate Highlights:

- Amazon.com Inc.’s $1.4 billion deal for Roomba maker iRobot Corp. risks being derailed unless the firms fix a list of competition concerns highlighted by the European Union’s antitrust arm.

- Kraft Heinz Co.’s board approves a buyback for up to $3 billion common shares of the maker of Jell-O and Oscar Mayer hot dogs.

- Elliott Investment Management has revived calls for changes at Crown Castle Inc. after disclosing a roughly $2 billion stake in the tower operator.

- Foot Locker Inc., a sports-apparel retailer, was downgraded to sell from neutral at Citigroup Inc.

- Shopify Inc. said merchants set a Black Friday record with a combined $4.1 billion in sales.

- A top-performing European fund manager is calling time on “hype” around weight-loss drugs that has sent Novo Nordisk A/S’s stock price rallying more than 50% this year.

- Volkswagen AG signaled it’s willing to push for staff reductions at its namesake brand to reduce expenses and improve profitability.

- Bayer AG hired several teams of bankers for a strategy simulation game that studied various breakup scenarios, according to people familiar with the matter. Their conclusion: Sweeping changes to the troubled German conglomerate won’t be easy.

- Alibaba Group Holding Ltd. has shuttered its quantum computing research lab, a sign that the Chinese e-commerce and cloud operator is considering more cutbacks to bulk up the bottom line.

Key events this week:

- Meeting of NATO foreign ministers in Brussels, Tuesday-Wednesday.

- ECB governing council member Pablo Hernandez de Cos and Bank of England Deputy Governor Dave Ramsden speak, Tuesday

- US Conference Board consumer confidence, Tuesday

- Fed Governor Chris Waller speaks, Chicago Fed President Austan Goolsbee speak, Tuesday

- New Zealand rate decision, Wednesday

- OECD releases biannual economic outlook, Wednesday

- Eurozone economic confidence, consumer confidence, Wednesday

- Germany CPI, Wednesday

- Bank of England Governor Andrew Bailey speaks, Wednesday

- US wholesale inventories, GDP, Wednesday

- Cleveland Fed President Loretta Mester speaks, Wednesday

- Fed releases its Beige Book, Wednesday

- China non-manufacturing PMI, manufacturing PMI, Thursday

- OPEC+ meeting, Thursday

- Eurozone CPI, unemployment, Thursday

- US personal income, PCE deflator, initial jobless claims, pending home sales, Thursday

- Dell earnings, Thursday

- China Caixin Manufacturing PMI, Friday

- Eurozone S&P Global Manufacturing PMI, Friday

- US construction spending, ISM Manufacturing, Friday

- Fed Chair Jerome Powell to participate in “fireside chat” in Atlanta, Friday

- Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.2% as of 4 p.m. New York time

- The Nasdaq 100 fell 0.1%

- Hang Seng futures fell 0.3% as of 7:23 a.m. Tokyo time

- S&P/ASX 200 futures rose 0.1%

- Nikkei 225 futures rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was little changed at $1.0955

- The Japanese yen was little changed at 148.68 per dollar

- The offshore yuan was little changed at 7.1607

Cryptocurrencies

- Bitcoin was little changed at $37,046.64

- Ether was little changed at $2,015.88

Bonds

- The yield on 10-year Treasuries declined eight basis points to 4.39%

- Australia’s 10-year yield declined eight basis points to 4.49% on Tuesday

Commodities

- West Texas Intermediate crude fell 0.9% to $74.86 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.