By Ankur Banerjee

SINGAPORE Asian shares slid on Thursday as risk aversion prevailed due to mounting worries over Middle East conflict, while the bond sell-off intensified, taking Treasury yields to fresh 16-year highs ahead of a keenly awaited speech from Fed Chair Jerome Powell.

Investors sought safer assets, keeping gold prices near two-month peaks and the dollar firm. MSCI's broadest index of Asia-Pacific shares outside Japan fell 1.42%.

The broad sell-off in U.S. Treasuries continued into Asian hours with the yield on 10-year notes touching a fresh 16-year high as investors come to grips with the Federal Reserve's messaging that interest rates may stay higher for longer. Yields rise when bond prices fall.

The gloomy mood is likely to continue as Europe wakes up. Futures indicated stock markets in the region were set for a lower open, with the Eurostoxx 50 futures down 0.61%, German DAX futures down 0.59% and FTSE futures 0.35% lower.

U.S. President Joe Biden pledged to help Israel and the Palestinians during a lightning visit on Wednesday.

The region remained volatile in the aftermath of an explosion at Gaza's Al-Ahli al-Arabi hospital late on Tuesday, which Palestinian officials said killed 471 people and blamed on what they said was an Israeli air strike. Israel and the U.S. said the cause was a failed rocket launch by Islamist militants in Gaza who denied responsibility.

"It's a fairly messy, uncertain situation at present," said Shane Oliver, head of investment strategy and chief economist at AMP in Sydney. "If the conflict remains limited to Israel, that'll be terrible but markets will learn to live with it as they have with the Ukraine war."

"If alternatively it expands to encompass key oil producers, notably Iran - which is where the risk is highest - that would be a major problem," said Oliver.

Oil prices eased on Thursday after OPEC showed no signs of supporting Iran's call for an oil embargo on Israel and as the United States plans to ease Venezuela sanctions to allow more oil to flow globally.

Oil prices had skipped 2% higher in the previous session on worries over disruptions to global supplies.

Meanwhile, investor concerns of geopolitical risks after a widening U.S. chip export ban cast a shadow over Chinese stocks despite some good news from a flurry of data on Wednesday that underscored an economy that was showing signs of stabilising.

Worries over China's property sector have also kept investors jittery.

Bondholders of Country Garden are seeking urgent talks with the company and its advisers after the troubled property developer missed a $15 million coupon repayment, putting it at risk of default, three sources told Reuters.

China's blue-chip stock index CSI300 fell 1.61%, while the Hang Seng Index sank 2%. Japan's Nikkei sank 1.58%.

AWAITING POWELL

The spotlight will now be on Fed Chair Jerome Powell, who will take the podium in New York on Thursday with his colleagues at the U.S. central bank in apparent agreement to hold interest rates unchanged at their next meeting in two weeks.

A Reuters poll of economists indicated the Federal Reserve will keep its key interest rate on hold on Nov. 1 and may wait longer than previously thought before cutting it.

While a slight majority still see a cut before the middle of 2024, a significant minority of forecasters, around 45%, now see no rate reduction until the second half of next year or later, up from 29% in the last poll.

"I think he (Powell) will hedge his bets in this environment," said AMP's Oliver, noting that Powell will likely reinforce the higher for longer view.

The yield on 10-year Treasury notes was up 6.4 basis points to 4.966%, touching highest since mid-2007.

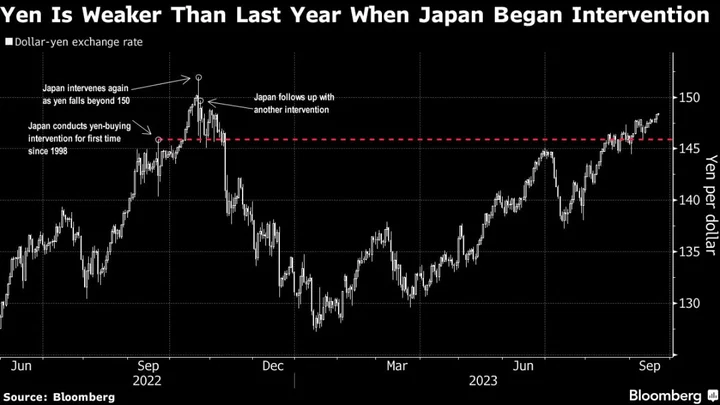

The dollar index, which measures U.S. currency against six rivals, rose 0.056%%. The Japanese yen was at 149.80 per dollar.

U.S. crude eased 0.16% to $88.18 per barrel and Brent was at $91.11, down 0.43% on the day.

Spot gold was at $1,948.42 per ounce, just shy of $1,962.39 its highest since Aug. 1 touched earlier this week. Gold prices are up 6% in the past two weeks.

(Reporting by Ankur Banerjee; Editing by Christopher Cushing and Lincoln Feast.)