Britain’s bond market is approaching an inflection point, with inflation data and a Bank of England decision set to shape the outlook for traders after yields rose to the highest level since 2008.

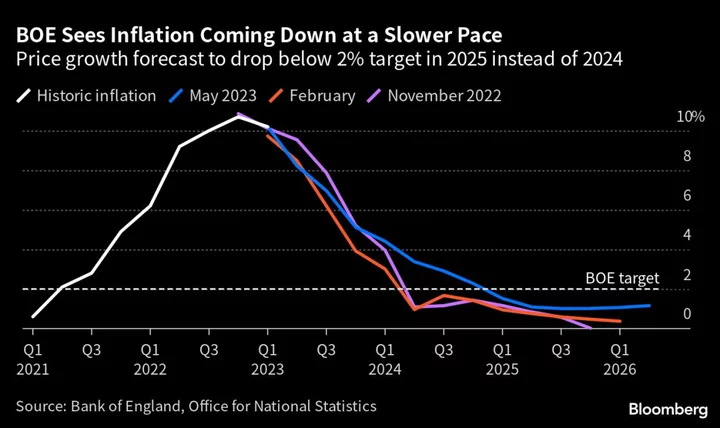

Those two events, due over 30 hours starting Wednesday morning, could bring a halt to upward momentum in interest-rate bets. Official data is expected to show inflation slowed to its lowest in 14 months, while investors are pricing in a 13th consecutive rate hike from the BOE to bring wage-price pressures under control.

BlackRock Inc., Invesco Asset Management and Royal London Asset Management are already dipping back into the market. They argue — along with many economists — that traders are anticipating more hikes than the BOE is likely to deliver, and it’s an opportunity to lock in some of the highest bond yields in the developed world.

“The market’s pricing of five more hikes from the BOE is very unlikely,” said Alexandra Ivanova, a fund manager at Invesco. “The Bank has a lot of constraints making it unable to deliver on these expectations. Growth is one of them, and inflation is almost certainly a structural issue.”

Britain has the worst inflation problem in the Group of Seven nations but the outlook is improving, thanks largely to a sharp drop in electricity and natural gas prices as well as slower growth in the cost of food.

Economists expect the inflation rate to decelerate to 8.4% in May from 8.7% in April. BOE officials see inflation easing further for the rest of the year.

The release will loom large over the Monetary Policy Committee’s thinking as it prepares to set rates on Thursday. The median estimate in a Bloomberg survey is for a quarter-point increase to 4.75%, the highest since 2008.

“The BOE’s near-term messaging will depend heavily on the inflation print,” said Bruna Skarica, an economist at Morgan Stanley. She is penciling in a 25 basis-point hike, yet doesn’t anticipate “overly hawkish messaging” from the MPC ahead of the August forecasting round.

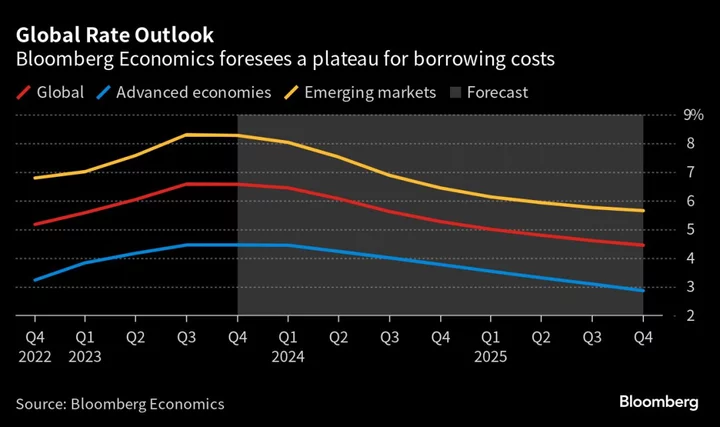

The market is less sanguine. Traders drove up rate expectations over the last few weeks after labor market data showed an unexpected tick down in unemployment, indicating wage pressures will continue for some time.

They now see four additional hikes until the end of the year and attribute a small chance of final move to 6% in early 2024, which would be the highest since the turn of the century.

For some investors that means a turning point in interest rates is near. They are moving to lock in returns, betting yields may not rise much further.

Invesco bought long-duration gilts last week, when yields surged to the highest since 2008. BlackRock recently ditched a long-held underweight position, while Royal London Asset Management also used the selloff to buy UK government bonds.

What Bloomberg Economics Says ...

“There is some speculation among investors that a string of hotter-than-expected pay and inflation data could prompt the Bank of England to opt for a 50-basis-point hike at its June meeting. We think that’s unlikely. Rate expectations have already moved materially higher — the central bank doesn’t need to provide a further impulse with a hawkish surprise. Our base case is for a 25-bp move.

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the PREVIEW.

Another issue the market must weigh is that the tightening priced in now would be a disaster for what’s an already fragile economy.

The BOE anticipates medium-term growth around 1%, far lower than the rate of inflation and tightening a cost-of-living crisis. Rates anywhere near 6% would squeeze the economy further, with more than 1 million households due to refinance their mortgages this year.

That all points to a stagnating economy with slower price growth, opening the door for the BOE sometime this year to halt its quickest series of rate hikes in four decades.

Still, if inflation keeps pushing higher there’s likely more pain in store for bond holders. The rate has surprised on the upside in each of the three previous reports.

“It’s hard to say they are not cheap at the moment,” said Stuart Cole, chief macro economist at Equiti Capital in London. “But there is probably room for them to cheapen a bit further still. If we get a strong CPI number, then I think we will see yields tick higher once more.”

--With assistance from Joel Rinneby, Andrew Atkinson, Lucy White and Naomi Tajitsu.