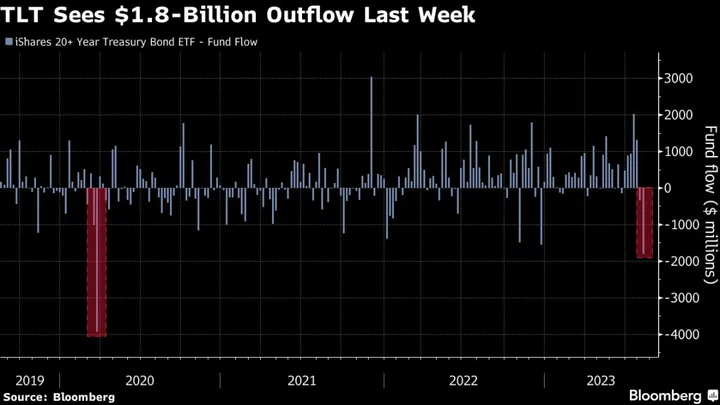

Investors are bailing out of the biggest exchange-traded fund devoted to Treasuries at the fastest pace since markets were hammered during the early months of the pandemic.

More than $1.8 billion came out of the $39 billion iShares 20+ Year Treasury Bond ETF (ticker TLT) last week, the most since March 2020, data compiled by Bloomberg show. The fund’s price had dropped more than 3% the week prior and another 1.2% in the five-day stretch ending Friday.

Sentiment toward long-dated Treasuries has soured over the past month amid growing conviction that the Federal Reserve will keep interest rates at elevated levels for an extended period to quell still-sticky inflation. That’s sent yields on the longest-maturity US debt sharply higher, dampening demand at last week’s sale of 30-year Treasuries.

With more supply on the way as the government contends with mounting deficits, it’s possible that investors are freeing up cash and pulling out of products such as TLT, according to Winnie Cisar, global head of credit strategy at CreditSights.

“It could also be a delayed reaction/acceptance of the bearish yield view that got amped up after the combo of Fitch downgrade, higher-than-expected UST refunding and BoJ announcements,” Cisar said. “I also suspect that generally light liquidity and seasonals are coming into play; we’ve found historically that August, September and October tend to be seasonally higher-yield months (by 5-7 bp on average).”

Yields on 10- and 30-year Treasuries are hovering near the highest levels since November. The past month’s selloff has slammed longer-dated debt more than the shorter-term maturities, fueling a resteepening of still-deeply inverted segments of the yield curve.

“I’m probably still more worried about us retesting those highs from last fall than I am about the downside risks here for yields,” Wells Fargo’s Erik Nelson told Bloomberg Television’s Real Yield. “I’m not necessarily expecting 50 basis points of upside here, but I think the carry and the upside risks here make it such that it’s not too enticing, in our view, to get long right now.”