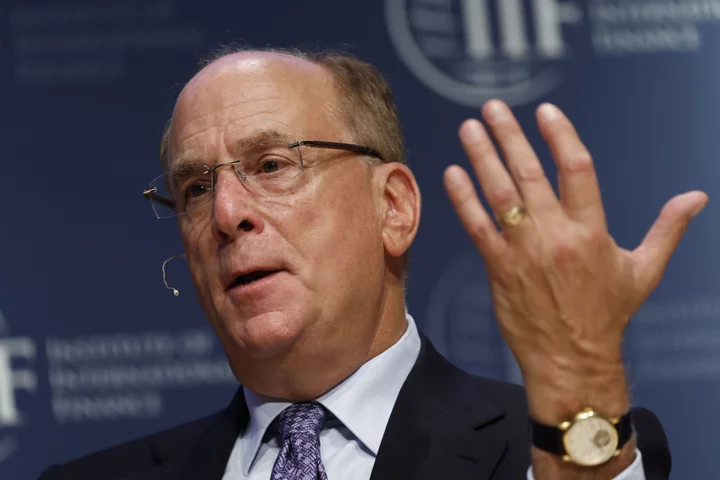

BlackRock Inc. Chief Executive Officer Larry Fink called Bitcoin an “international asset” and said the money manager wants to use its heft to make it less expensive and easier to invest in the cryptocurrency.

“It costs a lot of money right now to transact Bitcoin,” Fink said Wednesday in an interview on Fox Business. “We hope our regulators look at these filings as a way to democratize crypto.”

The money management giant filed paperwork last month to set up an exchange-traded fund that invests directly in Bitcoin, which prompted a flurry of similar applications from rival issuers and a rally in Bitcoin’s price to more than $30,000. Bitcoin rose more than 12% in June alone and is up more than 80% year-to-date.

Read More: Why Crypto Is Counting on Spot Bitcoin ETFs: QuickTake

Nasdaq recently refiled BlackRock’s application, adding details about the proposal to indicate that Coinbase Global Inc. will provide market surveillance for the new product. BlackRock wants to hear from US regulators such as the Securities and Exchange Commission, Fink said.

“We look at this as an opportunity,” Fink said. “We work really closely with our regulators.”

Bitcoin can represent an alternative, international asset akin to “digitizing gold,” Fink said. Initially, he said, he was skeptical because “it was heavily used for, let’s say, illicit activities.”