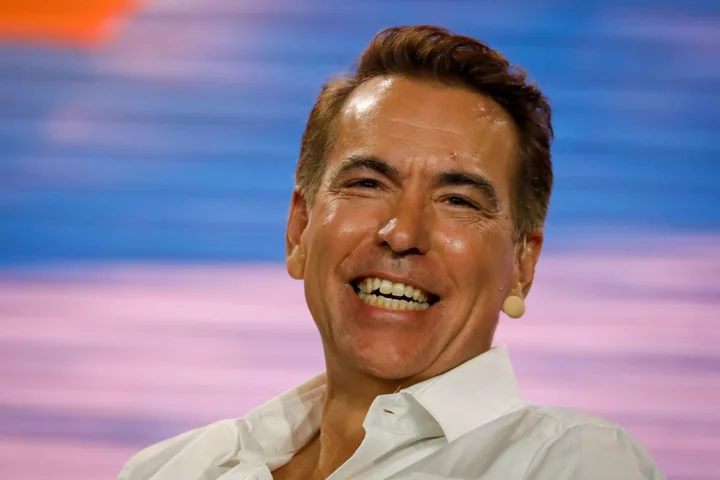

Bank of England Chief Economist Huw Pill gave the clearest indication yet that officials think they might be able to pause their rate-hiking cycle, saying inflation has hit a “turning point” and is likely to slow.

Pill told an online call with business leaders Friday that inflation should start to tumble as the base effects of huge energy rises this time a year ago start to fall out of the calculations. Domestic demand was likely to weaken as mortgage holders feel the impact of higher borrowing costs when their fixed-term deals finish, he said.

The remarks follow the BOE’s decision on Thursday to lift its base interest rate for a 12th consecutive time to 4.5% in an effort to ward off a wage-price spiral. Inflation hit the highest in four decades last year and remains stuck in double digits, five times the BOE’s 2% target.

But Pill said the “crucial question” is whether the slowdown will be sufficient to bring inflation back to target, referring to worries over food prices highlighted in Thursday’s Monetary Policy Report.

“We are seeing evidence in that direction,” but this may be “interrupted” by more persistent price pressures, Pill said. “There is at least a question about whether price-wage-cost-setting behavior, and the interaction between those things, will change as a result of the high level of inflation.”

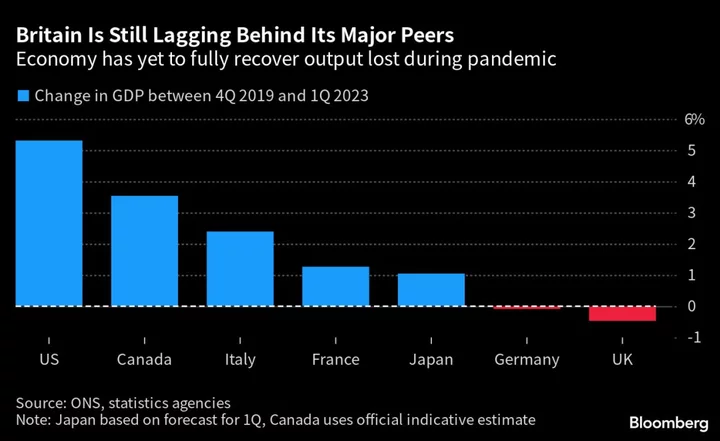

Earlier Friday, fresh data showed the UK economy expanded by an anemic 0.1% in the first three months of the year. An unexpected contraction of 0.3% in March as strikes and wet weather weighed on consumer spending, contributed to the economy’s stagnant performance.

Governor Andrew Bailey told Bloomberg TV on Thursday that the Bank of England was “approaching a point when we should be able to in a sense rest” on rate hikes. “But we haven’t seen the evidence yet to give a stronger sense of the read of that, so that’s why I’m very clear that we have to be evidence driven,” Bailey said.

When assessing whether further rate hikes would be needed, Pill said his colleagues on the Monetary Policy Committee were looking at “tightness in the labor market, the behavior of pay growth, and the behavior of services prices.”

Currently these measures had not diverged too far from Bank forecasts, he said, but added that recent data “do not leave too much room for comfort.”

Asked about the Bank’s 2% target for inflation, Pill said it was “still relevant” as it gives a framework for what monetary policy “can and should do.”

“There’s a danger that monetary policymakers are asked to serve a whole range of different tasks” that they are not suited to, he added, while they should be focused on “creating an environment of price stability.”

Pill didn’t address the fallout from controversial comments he made last month about Britons needing to accept they’ve become poorer because of the pandemic.