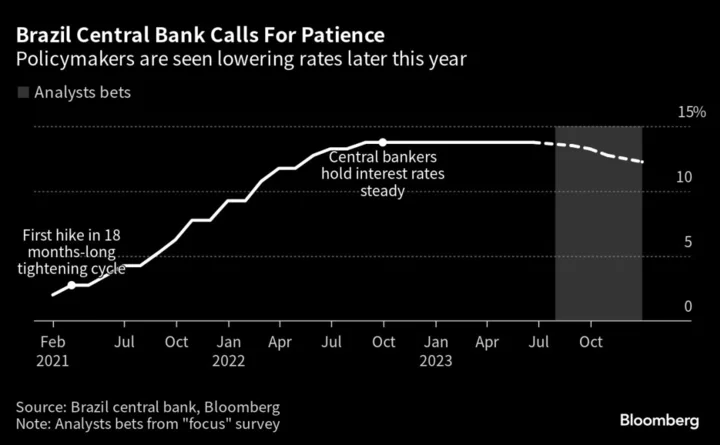

Brazil’s central bank said it may be able to start cutting interest rates in August after President Luiz Inacio Lula da Silva and top members of his economic team demanded clarity about the timing of an expected monetary easing cycle.

While policymakers hadn’t ruled out an August rate cut in a short statement issued together with their June 21 decision, the minutes of that meeting published on Tuesday were much more explicit about that possibility. The change in tone followed growing outrage in the administration about the board’s decision to hold borrowing costs at 13.75% last week, without clearly saying when cuts could start.

The minutes revealed a disagreement among policymakers led by Roberto Campos Neto about how explicit they should be about their next steps. Part of the board was “more cautious,” arguing that easing inflation estimates and “more evidence” of lower price pressures were needed before they could clearly indicate looser monetary policy.

Yet the “the prevailing assessment was that the continuation of the ongoing disinflationary process, with its consequent impact on expectations,” may allow for the beginning of a “parsimonious process of inflection at the next meeting,” central bankers wrote. Copom, as the board is known, still warned that “premature” rate cuts could accelerate inflation, hurting the monetary authority’s credibility as well as financial conditions.

“It’s clear we are on the right path,” regarding monetary policy with a “consensus” on rate cuts, Finance Minister Fernando Haddad said after the minutes were published. Last week, he had called the central bank’s post-meeting statement “very bad,” saying it failed to recognize the government’s efforts to shore up fiscal accounts.

“Monetary and fiscal harmonization will happen very soon,” he told journalists on Tuesday.

Planning Minister Simone Tebet struck a harsher tone, saying Campos Neto must be summoned to provide explanations to the senate if the central bank fails to cut rates in August.

“We can’t understand why the post-meeting statement had a harsh tone, while the minutes were softer,” she told journalists. “Why create unnecessary stress in Brazil?”

What Bloomberg Economics Says

The minutes of the Brazilian central bank’s June meeting brought mildly dovish messages — a response to political criticism for another rate hold, in our view. They suggest an August cut is on the table, especially if the National Monetary Council maintains a 3% inflation target for the coming years at its June 29 meeting.

— Adriana Dupita, Brazil and Argentina economist

— Click here for full report

Swap rates on the contract due in January 2024, which indicate investor bets for the benchmark Selic at year-end, fell 4 basis points. Prior to the release of the minutes, traders were already pricing in a quarter-point rate cut in August.

“There’s consensus on delivering rate cuts in August,” said Leonardo Costa, economist at asset management Asa Investments, who previously expected an easing cycle beginning only next year. “We now believe they will begin fairly gradually, with a 25-basis-point cut” at their next rate-setting meeting.

Read More: Brazil Holds Key Rate Steady, Avoids Clear Signs of Easing

Brazil’s monetary authority was among the first to hike interest rates in the wake of the pandemic, but policymakers have said “patience and serenity” are still needed to assess their next steps. After more than nine months of holding rates steady at a six-year high, credit flows are freezing for small and medium companies, retail sales are slowing down, auto purchases have all but stalled and industrial production is falling.

Slowing Inflation

Lula has publicly criticized monetary policy since taking office in January, as interest rates remain an obstacle to economic growth. Top cabinet members have echoed his criticism, and key business leaders are now joining his public demands for immediate cuts.

Annual inflation in early June slowed to its lowest level since September 2020, helped by drops in transportation and food costs, the national statistics institute reported in a separate release on Tuesday. Consumer prices rose 3.4% from a year prior, just above the median estimate of a 3.38% gain from analysts in a Bloomberg survey. Monthly inflation stood at 0.04%.

In their minutes, central bankers reiterated the cost-of-living slowdown is more gradual than expected. Their next steps will be based on “inflationary dynamics” like long-term consumer price estimates and measures of economic slack.

Estimates of future price increases “declined slightly” but remain above the monetary authority’s goal, requiring “parsimony and caution in the conduct of monetary policy,” board members wrote.

Resilient Activity

Latin America’s largest economy is showing mixed signals, with stronger agriculture production while other sectors grow modestly, policymakers wrote in their minutes. With more resilient activity, central bankers raised their estimates for neutral rates, which neither stimulate nor restrict the economy, to 4.5% from 4% previously.

“They are opening the door slowly, cautiously, given the uncertainty that remains around inflation targets,” said Cristiano Oliveira, chief economist at Banco Pine. “If current 3% goals are kept unchanged, rate cuts will begin in August.”

Investors are awaiting a decision on long-term inflation targets later this week, when Campos Neto, Haddad and Tebet will meet to set the goal for 2026.

“Decisions that induce the reanchoring of expectations and that raise confidence in inflation targets would contribute to a faster and less costly disinflation process, allowing monetary easing,” central bankers wrote in their minutes.

Read More: Brazil’s Inflation Outlook Improves on Bets 3% Target Will Hold

Lula’s first two picks for the bank’s board are likely to participate in August’s rate decision meeting, with former deputy Finance Minister Gabriel Galipolo seen as an advocate for lower borrowing costs.

--With assistance from Andrew Rosati, Giovanna Serafim, Josue Leonel, Daniel Carvalho and Bruna Lessa.

(Updates with comments from planning minister in paragraphs 7-8.)