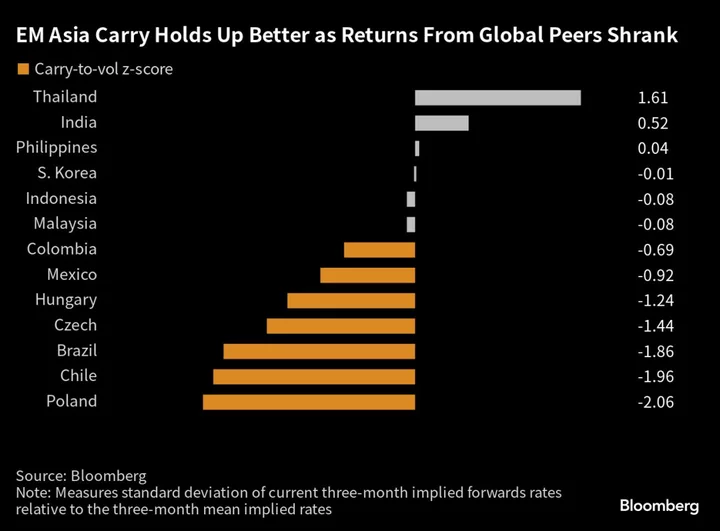

Emerging Asian currencies have been less attractive than most of their global peers as carry-trade targets over the past year but they are now catching up.

Policy makers in Asia have stayed relatively hawkish in a bid to contain inflation, just as their peers in other developing nations start to cut interest rates as domestic inflation is tamed. Thailand, India and the Philippines are all seeing implied returns from forwards higher than recent averages, while the opposite it true for every emerging market country out of Asia, according to a Bloomberg analysis.

“The rupee and rupiah have the highest carry in Asia at 7% and 6% respectively, and the central banks of both countries are not expected to trim rates this year,” said Alvin T. Tan, head of emerging-market currency strategy at RBC Capital Markets in Singapore. Still, Asian interest rates are still low relative to those in Latin America and central and eastern Europe, he said.

Asian central banks have pushed back against possible rate cuts as a surge in oil and food costs threatens to push up inflation. Higher rice prices have added to inflation concerns in Indonesia and the Philippines, while climbing energy costs have done the same in South Korea and Thailand. Traders aren’t pricing in a full quarter-percentage point rate cut in either of Korea, Malaysia, Thailand or India over the next 12 months, swaps show. Philippines and Indonesia are expected to keep rates unchanged on Thursday.

Dovish Pivot

In contrast, traders are adding to bets for further easing by emerging-market nations in Latin America and Europe. That comes after policy makers in Chile cut rates by a greater-than-expected 100 basis points in July, while those in Poland trimmed their benchmark by 75 basis points this month, three times as much as economists were predicting.

A measure of carry on-offer — based on implied returns from volatility-adjusted three-month forwards — shows carry returns in Latin America are now 1.4 standard deviations below their three-month mean, while in central and eastern Europe the reading is 1.6 standard deviations below. The same gauge for emerging Asia ex-China is positive 0.3.

There’s at least one factor supporting all emerging-market carry trades, and that’s declining volatility.

The JPMorgan EM currency volatility index, known as the EM-VIX, dropped to 8.32 this week, the lowest since March 2020, from as high as 12.97 in October. Still, the relatively low level leaves plenty of room for an upside surprise that may sap demand for carry trades globally.

(Updates upcoming rate decisions in paragraph four and pricing in paragraph eight)