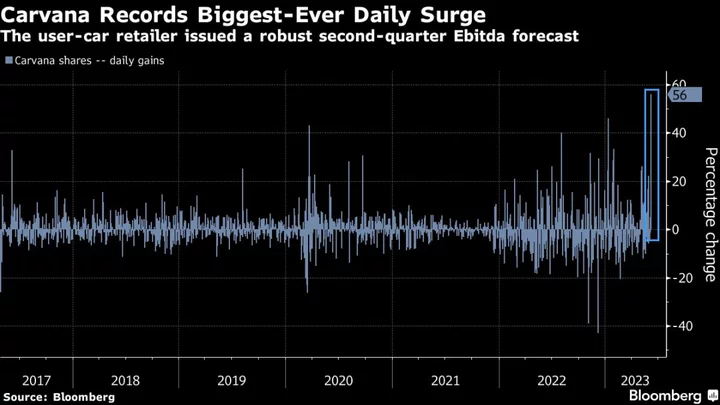

Short sellers in Carvana Co. just passed a grim milestone: more than $1 billion in losses this year.

A hot streak for the struggling used-car dealer has spelled only trouble for bearish investors with Carvana rallying 411% so far in 2023. After the latest run-up — with about about 56% of the company’s free float held short — shorts are down $1.04 billion in mark-to-market losses for the year, according to S3 Partners data.

“Shorting Carvana has not been a profitable trade this year and today’s price move has made it an even worse trade,” Ihor Dusaniwsky, S3’s head of predictive analytics, said in an interview. Before Thursday’s rally, shorts were already down about $600 million in year-to-date mark-to-market losses.

The day’s trading volume was more than 10-times the three-month daily average, according to data compiled by Bloomberg. But, only a portion of that “can be attributed to short covering due to a painful short squeeze,” Dusaniwsky said. The majority of the trading was long investors buying the shares, he added.

The online auto dealer’s stock soared 56% on Thursday to close at $24.23 after the company said its operations were improving in the second quarter. That remains a far cry from the all-time high of $370.10 touched in August 2021.

Read more: Carvana Shares Soar on Forecast of Better Financial Results