Cathie Wood bought more of Zoom Video Communications Inc. as the stock fell Tuesday in the wake of the video-conferencing company’s results.

Two funds run by Wood’s Ark Investment Management LLC bought a total of 122,831 shares of Zoom, marking the firm’s first purchase of the stock in about two months, according to daily trading data compiled by Bloomberg.

Zoom reported better-than-expected quarterly results and raised its full-year outlook after Monday’s close. Its stock fell 2.1% Tuesday, however, as analysts cited some concerns about longer-term growth visibility.

Fresh investment from Ark, which holds a combined stake in Zoom of more than 4%, demonstrates Wood’s continued faith in the pandemic poster child of remote work, even in the face of global return-to-office campaigns and competition from rivals such as Microsoft Corp.

Flexible Work Will Survive Ominous News From WeWork and Zoom

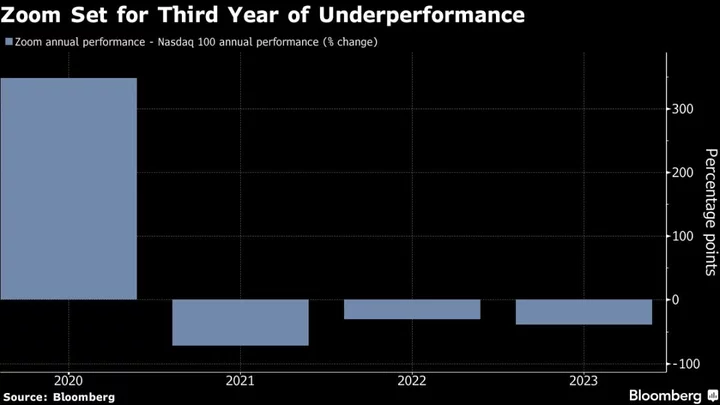

Zoom’s shares are down 2.1% so far this year, on course to underperform the Nasdaq 100 Index for a third-straight year. Wood’s flagship Ark Innovation ETF has risen 31% in 2023, compared with gains of 14% for the S&P 500 Index and 36% for the Nasdaq 100.