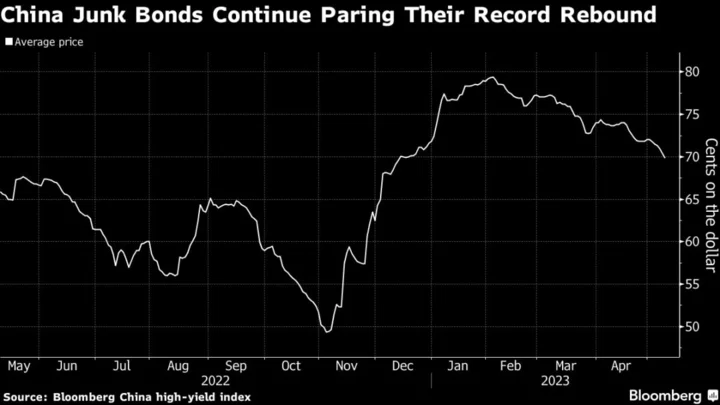

Chinese high-yield dollar bonds are at their lowest level of the year, as liquidity worries about property firms dash optimism about rising new-home sales.

Junk notes fell at least 1 cent Wednesday morning, according to credit traders. Average prices dropped for a seventh-straight session a day earlier, according to a Bloomberg index of the market, putting them below 70 cents for the first time since December.

The high-yield sector is dominated by developers, which despite several months of growing home sales continues to see firms run into trouble. From concerns increasing last month about Sino-Ocean Group Holdings Ltd. and conglomerate Dalian Wanda Group Co. to a smaller builder facing court-ordered liquidation and KWG Group Holdings Ltd. defaulting, weakened sentiment for high-yield notes resulted in early 2023 gains being erased.

Wanda dollar bonds plunged to record lows Tuesday after Bloomberg News reported that the firm has been in talks with major Chinese banks regarding a loan-relief plan. That evening, distressed builder Sichuan Languang Development Co. said it received a delisting notice from the Shanghai Stock Exchange because of a low share price, an example of investors’ lack of faith in smaller developers’ ability to restructure their debt.

Optimism for China’s high-yield dollar bonds was strong by early February, after a record three-month rally thanks to myriad government steps to bolster the property market.

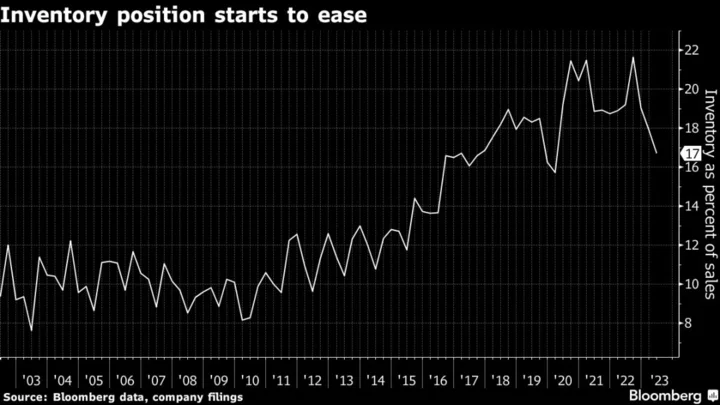

The real estate sector is undergoing an uneven recovery, which is set to keep credit stress high among junk-rated issuers, Goldman Sachs analysts said in an April report. They expect an still-elevated 19% default rate for China property high-yield bonds this year.

--With assistance from Alice Huang.