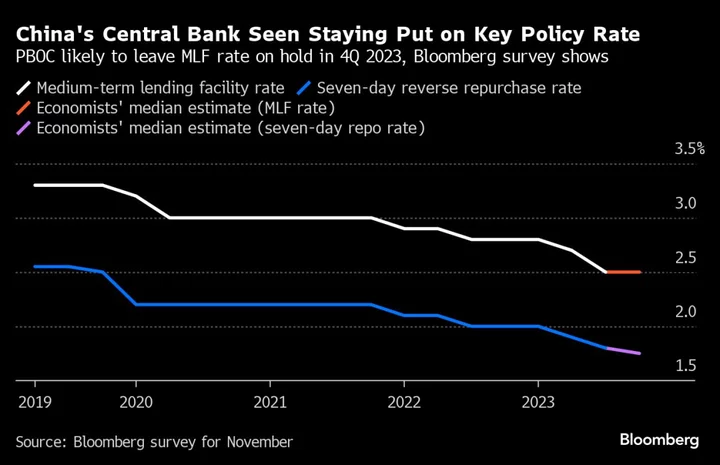

China will likely wait until early next year to cut policy rates to support the economy, though other forms of easing before the end of 2023 via trims to shorter-term rates or reserve ratios are still in the cards.

That’s according to the latest Bloomberg survey of economists, in which respondents said they see the rate on China’s one-year medium-term lending facility staying put at 2.5% by the end of the year, compared with the previous median estimate of a five basis point trim. Any reductions are instead likely to happen in the first quarter: 12 of 20 economists surveyed see the People’s Bank of China cutting the rate on its one-year policy loans then by five basis points or more.

“Monetary policy is playing second fiddle to fiscal policy in supporting the recovery,” wrote Duncan Wrigley and Kelvin Lam, China economists at Pantheon Macroeconomics Ltd., in a research note this week.

The survey results suggest Chinese policymakers may be done cutting that key rate this year. While recent data has still shown some trouble spots for the world’s second-largest economy, overall it’s on track to achieve or surpass the government’s official annual growth goal of around 5%. Respondents to the latest survey expect the economy to grow 5.2% this year and then moderate to an expansion of 4.5% in 2024, unchanged from last month’s poll.

The PBOC earlier lowered the MLF rate twice, in June and August, to help a recovery that had lost steam. Room to maneuver on rates remains somewhat constrained, given narrowing profit margins for banks before their savings rate drops again. A rise in time deposits has also pushed up costs for lenders.

Economists are still betting the government will consider adding liquidity to the financial system through other means, particularly to ensure the issuance of sovereign debt for infrastructure projects that is supposed to help growth.

“An RRR cut is quite likely, on top of additional MLF funding,” wrote the Pantheon economists, citing the need to facilitate that government bond issuance.

Those polled by Bloomberg see the reserve requirement ratio for major banks being cut by 25 basis points this quarter, unchanged from last month’s survey. They also projected a five-basis point trim to the central bank’s seven-day reverse repurchase rate, a short term policy rate. Respondents to last month’s survey expected a 10 basis-point cut.

A RRR cut before the end of the year was also floated in a front page report in the Shanghai Securities News this week, which cited analysts.

“The post-reopening bounce that China’s economy saw this year is fading,” said Erica Tay, economist at Maybank Investment Banking Group. “What’s left of underlying demand is less than robust, and fiscal support will need to be more forthcoming to boost GDP growth next year.”

Tay added that the “zeal to invest” among businesses will be worth watching in 2024.

“Whether entrepreneurial confidence comes back in a big way will have a lasting impact on job creation, wages and private consumption,” she added.

Other key highlights of the survey:

- Economists also delayed projections for cuts to China’s one-year loan prime rate. They now see that rate holding firm at 3.45% until the second quarter of 2024, when the median expectation for a cut is five basis points

- The five-year loan prime rate, a reference for mortgages, is likely to hold at 4.2% until next year

- The consumer price index is expected to rise 0.3% in the last quarter of 2023, slowly lower than an earlier forecast of 0.5%

- Producer prices are seen falling 2.3% in the fourth quarter, slightly worse than an earlier estimate of a 2.1% decline

- Exports are likely to drop 2.5% in the fourth quarter, far worse than an earlier expectation of a 0.1% increase

- Imports are expected to decline 0.4% in the period, improving from the previous projection of a 3% decrease

--With assistance from Yujing Liu.