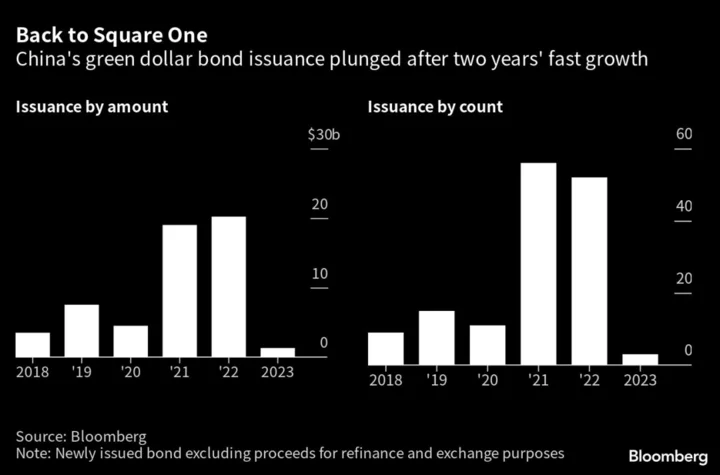

After tapping foreign investors for roughly $55 billion in the past five years to fund environmental projects in China, mainland companies have almost entirely given up on the offshore green bond market this year.

Excluding bonds for restructuring and refinance, three Chinese firms — China Merchants Bank, Industrial and Commercial Bank of China and Chong Hing Bank Ltd. — issued three green dollar bonds totaling $1.3 billion in the first half of 2023. In the same period last year, Chinese firms raised $17.2 billion across 38 bonds, according to data compiled by Bloomberg.

Foreign investors have soured on Chinese dollar bonds, green and otherwise, in light of the ongoing developer defaults and a softer-than-expected post-Covid recovery, said Zerlina Zeng, a senior China credit analyst at CreditSights Inc. “We do not expect offshore bond investors to turn overly enthusiastic toward Chinese issuers unless we see a sustainable rebound of the China property sector and an easing of US-China tension.”

- Is the ESG push a good thing? Take Bloomberg’s ESG Survey. (It’s not long, and we don’t collect your name or any contact information.)

China’s green dollar bond issuance fell more than for non-green issues. Chinese corporates sold $113.8 billion in dollar bonds in 2022, down 41% from the year previous; so far this year, issuance is down another 51%. Interest rates hikes in the US have also pushed up borrowing costs, said Puja Shah, head of ESG debt capital markets at JPMorgan Chase & Co. for Asia ex-Japan.

Still, Beijing’s support for green finance remains strong, and lower interest rates have lifted the domestic green bond market, said Jingwei Jia, an analyst at Sustainable Fitch. Chinese firms issued $42.5 billion onshore green bonds in the first half of this year, exceeding the $36.2 billion raised in the first half of 2022. Large Chinese state-owned entities will continue to be able to access the onshore bond market as well as low-cost bank loans.

Read more: Default Hits Another Chinese Builder That Sold State-Backed Debt

Despite the falloff in the offshore market, China remains the biggest green bond market in 2022 with $76.25 billion in issuance, according to data from the Climate Bonds Initiative. China is working with the European Union on a common ground taxonomy that will greater standardize green finance definitions to facilitate cross-border issuance and investment.

Author: Evelyn Yu, Alice Huang and Sheryl Tian Tong Lee