Carrier Global Corp. and Tapestry Inc. are tapping investment-grade bond investors to raise funding for planned mergers and acquisitions as lower spreads lure in borrowers.

Carrier, which manufactures heating and cooling systems, is raising $3 billion to help pay for the €12 billion ($13 billion) purchase of Viessmann’s climate solutions business, in addition to a €2.35 billion sale priced earlier Wednesday in Europe. The company is selling the bonds in three parts, with pricing for the longest portion — a 30-year note — set at 152 basis points over Treasury rates, according to a person with knowledge of the transaction, lower than earlier discussions for around 190 basis points.

Tapestry, the New York-based owner of fashion brands including Coach and Kate Spade, is in the market with a $4.5 billion, five-part deal to help finance its $8.5 billion purchase of Michael Kors parent Capri Holdings Ltd., according to people familiar with the matter. The longest portion — a 10-year note — could price at 340 basis points over the benchmark rate, 20 basis points tighter than initial price discussions, according to a person familiar with the matter.

A thawing in the US investment-grade market this week following a better-than-expected inflation report is helping to draw in issuers, with Deutsche Bank AG, Toyota Motor Credit Corp. and Charles Schwab Corp. also looking to raise debt. Barclays Plc earlier on Wednesday entered the market with an additional tier 1 bond.

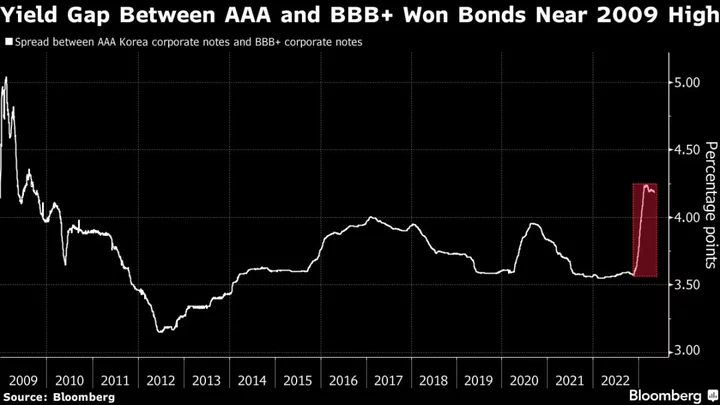

The spread on blue-chip bonds dropped below 120 basis points to the lowest level since Sept. 27, making it cheaper for companies to borrow. The average risk premium on high-grade bonds denominated in euro has also fallen.

M&A volumes in North America have been at a decade-long low, sitting at just $1.4 trillion for the US, according to data compiled by Bloomberg.

M&A activity is showing promising signs of recovery, however, sparking optimism for 2024, Jens Kengelbach, Boston Consulting Group’s global head of M&A said in an October statement. Dealmakers have confronted their most prolonged challenges since the 2008–2009 financial crisis in the past year amid rising interest rates, geopolitical tensions, and recession fears and more “have returned to the negotiation table and M&A activity appears to be stabilizing.”

Tapestry had previously secured the largest bridge loan this year at $8 billion to help fund its $8.5 billion deal, adding to a growing pipeline of M&A funding that’s likely to be sold in the investment-grade market as bonds.

Meanwhile, Carrier paid for its transaction using 80% cash and 20% equity. At the time, it said it expected to maintain its investment grade credit rating at the time of the Viessmann acquisition announcement and return to its pre-transaction leverage profile within about two years.

The dollar portions of the Carrier and Tapestry deals are being organized by two groups of banks including Bank of America Corp. and JPMorgan Chase & Co. Both banks are also part of a group that managed Carrier’s euro offering.

The companies didn’t respond to a request for comment.

(Updates with M&A vols, details about acquisitions.)