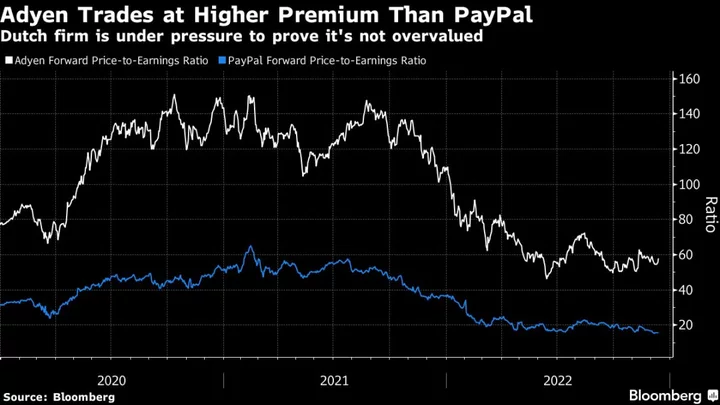

Payments giant Adyen NV will need to assure it can deliver on its lofty margin goal when it reports this week — and justify the stock’s premium relative to peers’. The lineup also includes Danish brewer Carlsberg A/S.

A maturing e-commerce market, underscored by a report from Adyen’s European rival Nexi SpA earlier in August, raises questions about the Dutch company’s competitiveness as its hiring spree continues while peers — and consumers — cut back.

Consumer behavior also dominates at Carlsberg as brewers face a delicate balancing act to pass on higher raw material costs to money-conscious customers without driving them toward cheaper brands.

Investors who didn’t see much upside to European stocks in the run-up to the second-quarter earnings season may feel vindicated as it nears a close. The Stoxx Europe 600 index hasn’t budged much since the beginning of July and the outlook for Europe’s economy, crucially in Germany, has darkened.

Still, it hasn’t all been dismal. A spate of upbeat results from companies including Carlsberg’s rival Anheuser-Busch InBev NV helped lift investors’ spirits, after what had looked like the weakest breadth of earnings beats since 2020 for the region.

This will be the last EMEA Earnings Week Ahead fixture for this season. We will resume in October. Thank you for subscribing.

Highlights to look out for this week:

Monday: Plus500 (PLUS LN) reported a 12% drop in new customers in the first half of 2023 and a 19% decline in the number of active customer accounts, year-on-year. Average revenue per user also slid, 11%, to $2,097, the online trading platform said on Monday. It also announced plans for a further $120 million in shareholder returns, $60 million of which stem from of a new share buyback, bringing total returns to almost $350 million so far in 2023. Investors were keen to hear about the company’s progress in expanding in new markets and diversifying its products after a trading update last month.

- MTN Group’s (MTN SJ) units in Nigeria, Ghana and Rwanda — which make up almost half of group revenue — have all reported a drop in first-half profit as finance costs rose on foreign-exchange losses and higher interest rates. Still, MTN has flagged that its earnings per share could come in 10% to 20% higher than in the first half of 2022. Despite the drag of power cuts in South Africa, the company may succeed in keeping its underlying Ebitda margin stable, aided by pricing moves and cost cutting, Bloomberg Intelligence’s John Davies said.

Tuesday: Legal & General’s (LGEN LN) bottom line may have taken a hit from wariness among asset management clients in the second quarter, although buy-in deals probably remained strong, according to BI’s Kevin Ryan. Higher interest rates make buy-ins, where insurers take over liabilities from companies’ pension plans, more attractive as higher bond yields help insurers meet future payments to pensioners. A switch to new IFRS 17 accounting rules might also prevent Legal & General from hitting its targeted 5% dividend increase, Ryan said.

Wednesday: Carlsberg’s (CARLB DC) cost focus and strong execution probably helped it outperform competitors in a quarter that saw rival Heineken NV cut its forecast after forcing through double-digit price increases. That may prompt the Danish company to move its organic growth guidance — currently at -2% to +5% — closer to consensus at the top of that range. Investors will also focus on whether it writes off the rest of its Russian business, valued at about 7.5 billion kroner ($1.1 billion) at the end of 2022, following Russia’s decision in July to take “temporary” control.

Thursday: Adyen’s (ADYEN NA) Ebitda margin likely stayed near 50% in the first half, as it pressed ahead with plans to hire 1,200 more people in 2023, according to BI. Adyen has maintained its hiring pace against a backdrop of job cuts in the tech sector to support its longer term growth strategy. Its revenue outlook will be key as competition mounts in a slowing e-commerce market, said BI’s Tomasz Noetzel and Mar’Yana Vartsaba. Price pressure is growing for Adyen, which competes with the likes of Stripe Inc. and PayPal Holdings Inc.’s Braintree unit.

Friday: No major earnings of note

- To subscribe to earnings coverage across your portfolio or other earnings analysis, run NSUB EARNINGS.

- Follow our Top Live blogs for real-time coverage and analysis of the biggest results.

- For more on what’s going on in other regions, see the US Earnings Week Ahead or the Asia Earnings Week Ahead, and see the ESG Week Ahead for a selection of the environmental, social and governance themes that may come up on the week’s earnings calls.

--With assistance from April Roach, Alastair Reed, Rene Vollgraaff, James Cone, Joe Easton and Jan-Patrick Barnert.