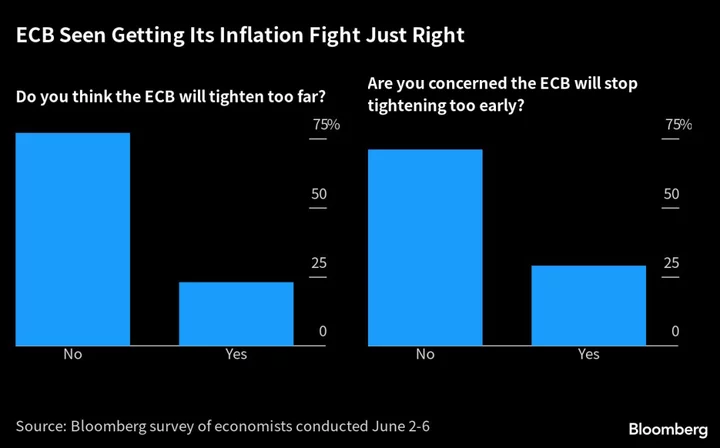

The European Central Bank will neither raise interest rates too far nor stop lifting them too early, according to economists surveyed by Bloomberg who see borrowing costs peaking in July.

Following two quarter-point moves this month and next, the deposit rate is expected to remain at 3.75% for nearly a year to ensure inflation — still more than three times the target — retreats sustainably. Only seven of 42 respondents anticipate a third hike to 4% in September.

The poll signals confidence in the ECB from economists who long deemed it to be behind the curve in tackling the greatest price shock of the euro era. The optimism implies inflation can be restored to 2% without the euro zone’s 20-nation economy succumbing to a major downturn in the process — a so-called Goldilocks scenario that central banks the world over are desperate to deliver.

Once rate increases are complete, officials want to maintain that level of borrowing costs for a prolonged period to make sure there’s no resurgence in prices. Doing this smoothly may yet pose another test.

“The biggest challenge for the ECB is how to communicate any shift from ‘how high’ to ‘how long,’” said Carsten Brzeski, ING’s head of macro. “As we are approaching the end of the hiking cycle, this communication and also the reaction function that can explain exactly this transition will be crucial.”

To steer them, policymakers have been looking to the price outlook, underlying inflation trends and the impact of past hikes on the economy. They’ll also have fresh economic forecasts to digest this month after data Thursday showed the euro region suffered a mild winter recession.

Economists don’t anticipate major changes to the outlook. While some revisions for this year and next are expected, forecasts for 2025 will likely be confirmed.

“The market will focus on the guidance that the ECB will provide,” said Piet Christiansen, chief strategist at Danske Bank. “The new staff projections will feature prominently in forming the baseline for that guidance.”

With inflation on the back foot and the economy facing growing headwinds, investors have dialed back bets on a quarter-point hike in July, though still assign an 80% likelihood to that outcome.

As well as prices, bank lending, credit conditions and demand are also signaling that the ECB’s tightening campaign is showing some effect, though unemployment continues to fall amid worker shortages.

The Governing Council will have to “balance now-falling headline inflation and weakening credit growth with sticky wage growth and services inflation,” said Veronika Roharova, head of euro-area economics at Credit Suisse. “The surprising resilience of the labor market and wage growth can increase the stickiness of underlying inflation and lead to yet more tightening.”

While rate increases will remain the primary tool in that regard, a shrinking balance sheet may also help.

About €477 billion ($509 billion) of cheap, long-term funding for banks expires this month and economists expect some early repayments of other loans on top. In addition, the ECB plans to halt reinvestments of maturing assets purchased under its older quantitative-easing program from July.

Survey respondents don’t see the ECB speeding up the reduction of its bond holdings by adding sales to rolloffs, though almost two-thirds say policymakers will replace debt from carbon-intense issuers in its corporate-bond portfolio with greener options.

The ECB’s balance sheet is seen shrinking to €6.8 trillion at year-end and €4.4 trillion in the longer term, from €7.7 trillion currently.

With the ground prepared for two more rate hikes, several economists consider the June and July meetings as stepping stones to a possible shift in course at the next decision, in September.

“I do not see any big challenges at the upcoming meeting,” said Rainer Singer, an economist at Erste Bank. “The current policy stance should be continued.”

--With assistance from James Hirai and Constantine Courcoulas.