A rare European Central Bank warning about the bond market risk of a Bank of Japan policy change comes at a time when Japanese outflows from the region are already at record levels.

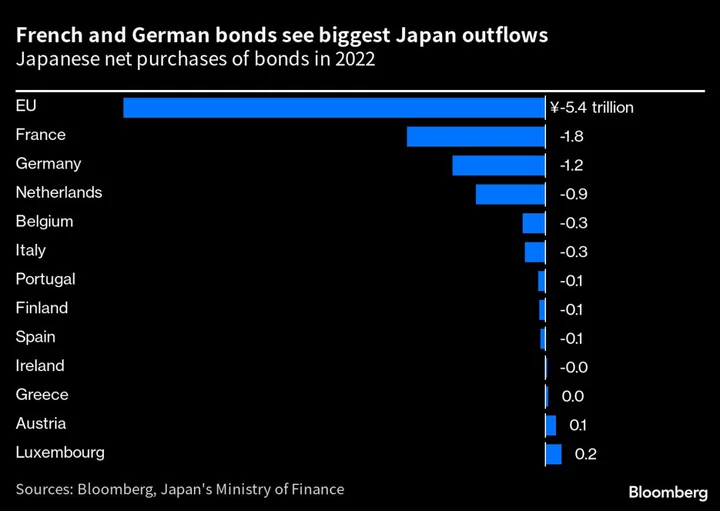

Investors from the Asian nation offloaded 5.4 trillion yen ($38.7 billion) of European bonds in 2022, the most according to Bloomberg-compiled data going back to 2005. While Japanese funds have been net buyers so far this year, they’ve spent a mere 81 billion yen on purchases — the lowest amount for a first quarter in six years.

“A shift away from the low interest rate environment in Japan could test the resilience of global bond markets,” the ECB noted in its biannual Financial Stability Review. Japan’s policy normalization “might influence the decisions of Japanese investors who have a large footprint in global financial markets, including the euro area bond market.”

The issue is that Europe’s most popular bond markets for Japanese investors are already loss-making for those who want to hedge the risk of the volatile yen. A benchmark 10-year French bond has a yield of about minus 0.7% for a yen-hedged investor, while an equivalent bund yields minus 1.3%.

That’s handily beaten even by the BOJ’s contentious yield target on Japan’s 10-year note of 0.5%, the focus of speculation for any policy shift.

“The BOJ is an anchor of global rates and raising borrowing costs would spell downside risks for global bond prices,” said Tsuyoshi Ueno, senior economist at NLI Research Institute in Tokyo. The ECB’s message marks “a very rare case of a central bank expressing concern toward BOJ’s policy normalization.”

With inflation pressures in Japan persisting, a majority of investors believe the BOJ will eventually have little choice but to join peers in hiking borrowing costs — a move that will only exacerbate waves of Japanese cash flowing out of global markets towards home.

Still, analysts are split on when any policy tweak might come. An early May survey of bond-market functioning — a key focus point for Japan’s central bank — showed signs of improvement, easing the pressure somewhat on policymakers.

A $3 Trillion Threat to Global Financial Markets Looms in Japan

For its part, the ECB warned about the impact of rising Japanese interest rates on carry trades and said that higher yields at home could encourage the repatriation of investors’ overseas assets. An abrupt withdrawal from European bonds could have a material effect on prices, it said.

“Such dynamics could be amplified by the increased net supply of these bonds resulting from quantitative tightening by the ECB,” the review said.

--With assistance from Yumi Teso and Greg Ritchie.

(Updates with gauge of Japan bond market functioning.)