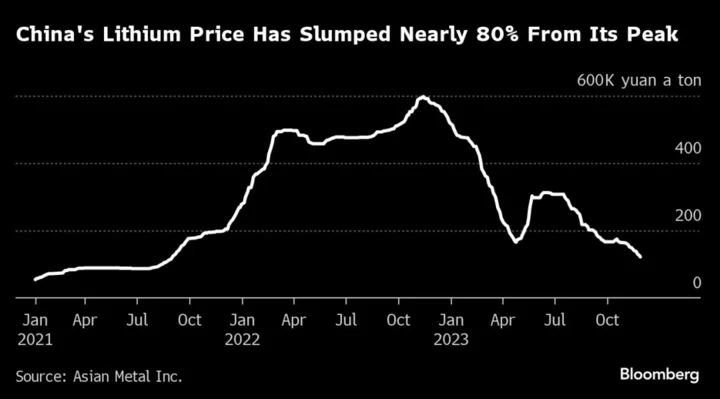

Lithium’s price slump over the past year has been as dramatic as its climb — and it’s probably not finished yet.

The battery material’s benchmark price in China is now down about 80% from its November 2022 record high. At that time, lithium miners were enjoying soaring profits and carmakers were bemoaning surging costs.

Now, lithium’s sharp decline, together with steep drops for nickel and cobalt, are driving battery prices to all-time lows, according to BloombergNEF.

For at least the next year, it looks like carmakers can cross off lithium costs as a major concern, with prices under pressure from a wave of new supply. The focus now is on how much further prices need to fall to stem the tide through production cuts.

“Prices are still substantially above the levels required to balance the market,” Goldman Sachs Group Inc. analysts wrote in a note earlier this week.

Half of market participants BNEF surveyed see prices falling further next year, with only 11% expecting gains. Industry consultancy Benchmark Mineral Intelligence reckons the global lithium market won’t return to a deficit until 2028.

Lithium’s pullback has been driven by a rapid expansion of production, especially from relatively low-grade mines in China that have surprised the market with their rapid growth. Slower expansions, if not outright production cuts, may be needed to stabilize prices.

Top lithium miner Albemarle Corp. has said this is already starting to happen as prices reached levels that are threatening a number of higher-cost projects.

Demand is obviously an issue, too. While global EV sales are still growing at a fast clip, they’re not expanding as rapidly as many in the industry expected amid economic uncertainty in China, rising borrowing costs and inflation pinching consumers in other major economies.

That demand softness is wreaking havoc on a too-much-of-everything supply chain. EV makers are waging price wars, there’s a glut of batteries and there are surpluses of battery materials and components. The price of nickel slid this week to its lowest in more than two years.

Lithium’s downturn has already made some mining stocks cheaper. The Global X Lithium & Battery Tech ETF is around its lowest level since November 2020, while the Sprott Lithium Miners ETF is wavering near the lowest since its February inception.

For margin-squeezed carmakers, though, a world with too much lithium is a boon. It supports the rampant build-up in battery capacity that’s needed for more widespread EV adoption, and gives manufacturers leeway to win over price-conscious consumers.