The European Union is launching an investigation into Chinese subsidies for electric vehicles as the bloc frets over the ability of its industry to compete.

European Commission President Ursula von der Leyen announced the probe Wednesday, saying that the global market is flooded with cheap Chinese cars.

“Their price is kept artificially low by huge state subsidies. This is distorting our market,” the head of the EU’s executive arm said in her annual speech to the European Parliament. “And as we do not accept this distortion from the inside in our market, we do not accept this from the outside.”

The probe is being opened despite concerns about retaliation from China, a sign of growing alarm over the ability of European manufacturers to compete with China’s industry.

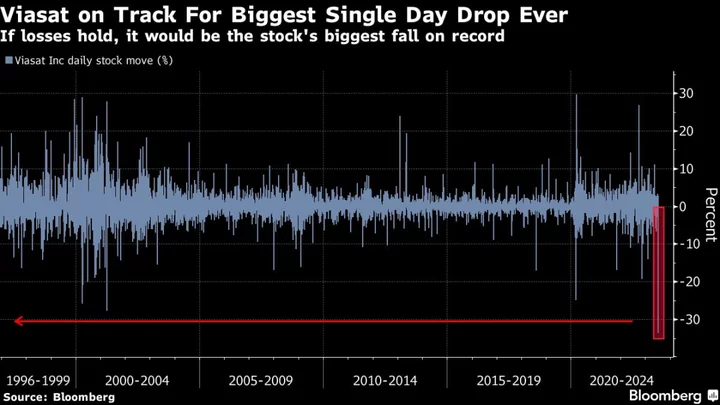

EV leader BYD Co extended losses to as much as 2% in Hong Kong. Meanwhile, XPeng Inc. also fell as much as 2.8% and Li Auto Inc. is also down, trading at intraday lows of as much as 0.5%.

The Stoxx 600 Automobiles & Parts Index gained as much as 2.2%, the most intraday since July 27, and is the best performing subsector on the broader European equity gauge. Renault SA was up 4.9% and Volkswagen AG up 2.6%.

China is home to a slew of EV makers supported by government incentives for both industry and buyers, and many of its upstart companies have yet to consistently generate profits.

Boosting Sales

Chinese carmakers, including BYD and newer entrant Nio Inc., are preparing to increase sales in Europe with a range of competitively priced electric models that, if successful, will hit mass-market manufacturers like Stellantis NV and Volkswagen. At home, China’s automakers are under pressure amid slowing consumer demand that has sparked an aggressive price war.

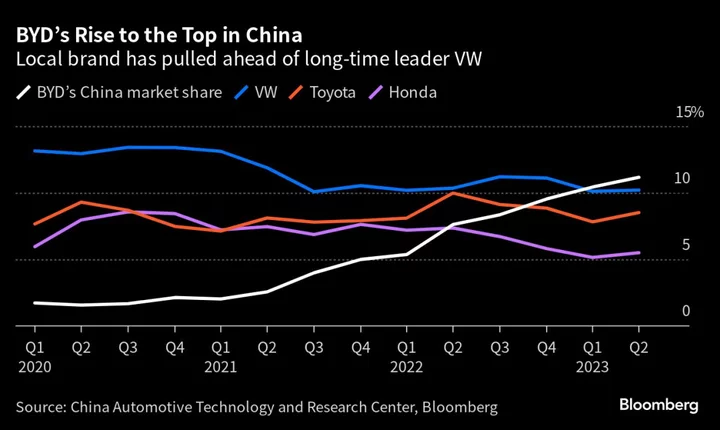

BYD, which this year dethroned Volkswagen as China’s top-selling auto brand, has expanded to around 15 countries in Europe. Its Atto 3 crossover SUV was the best-selling electric vehicle in Sweden in July. The company plans to offer new models including the Seal sedan, which will start from around €45,000 in Germany when it goes on sale later this year. That puts it in direct competition with Tesla’s Model 3 and several of Volkswagen’s cars.

Read more: China’s EV Graveyards Show Dark Side of Frenetic Development

As part of its ambitious Green Deal plan to cut emissions, the EU has implemented an effective ban on combustion engine cars starting in 2035.

The EU this year conducted a temporary review of its state aid rules to counter massive subsidies provided by the US and China, especially in green technologies. The bloc is particularly concerned about China’s economic practices, calling on Beijing to open up its market to rebalance the bilateral trade relations and putting in place new instruments to address China’s coercive practices targeting countries including Lithuania.

An investigation into Chinese EVs is a win for the French government that has long warned of an influx of Chinese vehicles undercutting Europe-made equivalents.

The Finance Ministry is already working on adjusting its own state-funded bonuses for EV purchases in France, ostensibly with the aim of limiting subsidies to vehicles equipped with batteries that have a low carbon footprint. But Finance Minister Bruno Le Maire has said the measure would favor European production and stop French public money financing factories in Asia.

Le Maire is in Berlin Wednesday to push Germany for tougher measures to protect European industry.

“We now need a European industrial strategy that is much more proactive, much more innovative, much more protective of our industrial interests in relation to China and the US,” Le Maire said Tuesday on French television LCI. “There isn’t a day to lose.”

Read more: China Muscles In on Germany’s Least-German Car Show in History

Von der Leyen will also need to decide soon on whether to stick with plans to introduce a tariff starting next year on electric vehicles shipping between the EU and the UK, which some officials and the industry say will damage European carmakers and boost competition from China.

The matter is still being debated internally and a final decision on whether to delay the move has yet to be taken, Bloomberg has previously reported.

--With assistance from Jorge Valero, Elisabeth Behrmann, Katrina Nicholas, William Horobin, Catherine Ngai, Blaise Robinson and Katharina Rosskopf.

(Updates with stock moves starting in fifth paragraph)