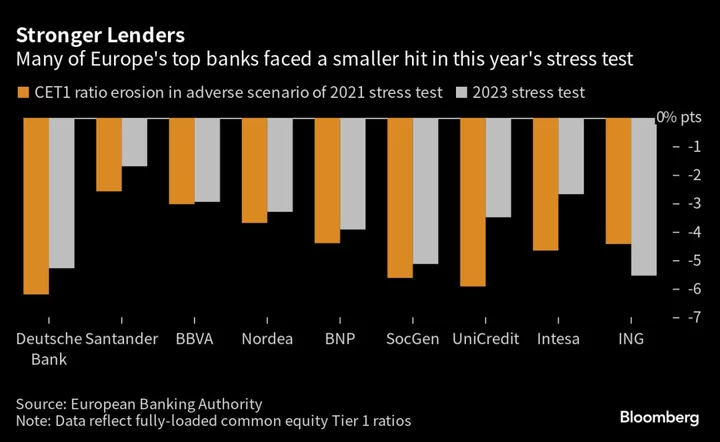

Most European banks emerged stronger from a stress test on how they would weather a sharp economic downturn, giving them a sound footing to continue paying dividends and buying back shares.

On aggregate, the 70 lenders in the test saw their key capital-ratio slide by 4.59 percentage points to 10.4% under an adverse scenario, the European Banking Authority said in a statement on Friday. That’s less than the 4.85 percentage-point hit in the last exam two years ago, which covered fewer banks.

While the test was billed as the toughest to date, banks benefited from their strong balance sheets and a revenue bump from higher interest rates. Lenders are likely to use the results for lobbying regulators to maintain, or even increase, payouts.

Despite €496 billion ($547 billion) of combined losses in the test, European banks “remain sufficiently capitalized to continue to support the economy also in times of severe stress,” the EBA said.

Most of Europe’s major banks saw a smaller erosion of their common equity tier 1 ratio than in the last exam. Deutsche Bank AG saw its hit narrow to 5.28 percentage points, from 6.2 percentage points, while the impact at BNP Paribas SA narrowed to 3.92 percentage points from 4.4 percentage points. ING Groep NV of the Netherlands faced a bigger erosion.

The European units of major US banks were included for the first time and faced bigger-than-average hits.

Shortfalls

Two banks showed a “minor shortfall” to their capital requirements in the stress test, the EBA said. A third with a “large shortfall” meets its obligations when applying new accounting standards that took effect this year, according to the EBA.

The test’s adverse scenario foresaw inflation and a global recession as well as increased interest rates. That would lead to a contraction in real economic output of 6% over three years, a more severe situation than in the previous tests.

The EBA said comparing the results with previous exams “is difficult and may be misleading,” given that the test used different scenarios, a bigger pool of banks and changed values for capital ratios and balance sheets.

The test doesn’t have a pass or fail grade. However, regulators such as the European Central Bank use the results to set individual capital requirements and review banks’ plans to maintain sufficient levels of financial reserves, including the effect of shareholder payouts.

Uncertainty over how the economy will fare shows “the importance of remaining vigilant and that both supervisors and banks should be prepared for a possible worsening of economic conditions,” the EBA said.

The impact of the test on dividends and buybacks could give banks an incentive to make optimistic assumptions. To counter this, the ECB made a forceful intervention after lenders took what the regulator viewed as an unrealistic approach, Bloomberg reported last week.

The EBA said it will continue to improve the framework for the stress test, including work on the role of so-called top-down elements which allow regulators to replace some calculations done by the banks.

(Updates with individual results in fifth paragraph)