Speculation is mounting the European Central Bank will shrink its bond portfolio at a quicker pace to ensure it keeps financing conditions tight as the end of its rate-hiking cycle approaches.

Traders are betting the ECB is almost done lifting borrowing costs as evidence of the economic damage inflicted by tighter monetary policy builds up. But with longer-term real rates failing to rise in response this year, analysts at ING Group NV, Mizuho International Plc and AFS Group suggest the central bank may seek to shrink its bond holdings at a faster lick.

Comments by Executive Board member Isabel Schnabel fueled the debate last week. She cited ECB analysis that showed that, as of Aug. 29, real risk-free rates — swaps tied to the Euro short-term rate adjusted for inflation — had declined across the maturity spectrum and were back at the level seen at the February policy decision.

The risk is that the trend could undermine the steps taken so far by the ECB in its campaign to bring inflation to heel. The central bank has hiked another four times since then, taking the deposit rate to 3.75%.

Evelyne Gomez-Liechti, a rates strategist at Mizuho, said the ECB will start considering changes to quantitative tightening, or the process by which it shrinks its balance sheet, even if, as she expects, policymakers choose to hike rates again next week.

“Accelerating QT would surely help to normalize policy even further and see long-term rates rise further,” she said. “I think they will use a combo of fine-tuning plus hold rates higher for longer.”

For Arne Petimezas, an analyst at AFS Group in the Netherlands, it’s the right time to switch from rate hikes to faster QT.

Still-elevated inflation “calls for a tight policy stance, especially where policy is still loose –- the long end of the curve,” he said.

Widening Gap

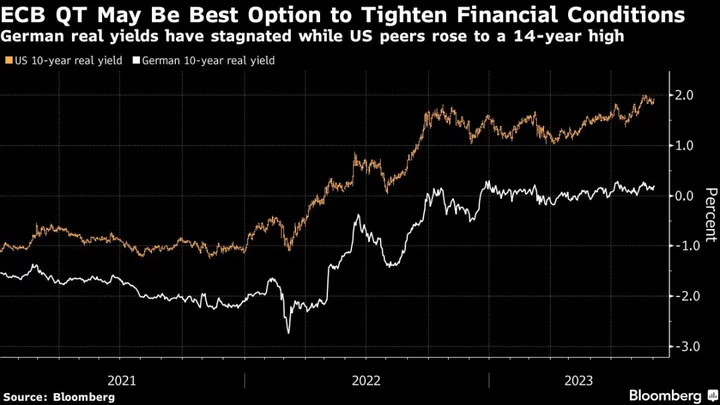

The gap between US and German 10-year real yields has grown to around the widest since late 2022, as inflation-protected Treasuries sold off and German equivalents stagnated.

Long-term real-rate expectations, as measured by the euro five-year forward, five-year real swap rate, stand at around 0.48%, about 2 percentage points below where they were prior to the global financial crisis in 2007.

In theory, QT impacts the longer end of the yield curve due to the composition of the ECB’s bond holdings. The weighted average maturity of the public sector purchase program was around seven years as of July.

For now, reinvestments under its pandemic program of debt purchases — PEPP — are expected to run at least through the end of 2024, even as bonds bought under an older program are allowed to roll off.

Changing the terms of the PEPP is complicated by the fact that it’s also the first line of defense against the phenomenon known as fragmentation, when the borrowing costs jump more for weaker euro-zone countries relative to stronger ones.

Still, some ECB officials have already explicitly called for QT to be amped up. Governing Council member Robert Holzmann said last week that PEPP reinvestments should begin sooner than currently envisaged.

“The upcoming decisions might be less straightforward than markets think,” said Benjamin Schroeder, senior rates strategist at ING Group NV. “If not a hike, the hawks might want to get more than a vague promise of high for longer, meaning a renewed QT debate.”