Exxon Mobil Corp. fell short of analysts’ expectations with a third straight drop in profit — the longest decline since the 2014-2016 oil-market crash — amid weaker natural gas prices and shrinking returns from fuel sales.

Adjusted earnings of $1.94 per share were 6 cents below the Bloomberg Consensus. Net income dropped to $7.9 billion, less than half the level of a year earlier when Russia’s invasion of Ukraine upended global commodity supplies and trading.

Exxon’s performance was worse than many analysts were prepared for, given the substantial downgrades they made to estimates after the company surprised the market with lower-than-expected guidance earlier this month. The last time the oil giant’s profits fell on a sequential basis for three consecutive periods was seven years ago, when a worldwide crude glut crushed prices.

Exxon followed Shell Plc and TotalEnergies SE in missing estimates as the impact of lower gas prices and poor oil-refining margins rippled across the sector. Exxon pledged to continue buying back shares at a steady pace despite slipping cash flow and a recently announced $4.9 billion purchase of carbon-dioxide pipeline operator Denbury Inc.

Overall, Exxon paid out $8 billion in the form of buybacks and dividends during the second quarter. Although those payouts exceeded the period’s free cash flow, Exxon had enough capital amassed during previous quarters to cover them.

“We’re delivering that largely through delivering cash flow from operations in the first half,” Chief Financial Officer Kathy Mikells said during an interview. “That more than covered our capital expenditure and left us with enough cash flow after that to basically cover the dividends and share repurchases.”

Read More: Oil Majors Keep Buybacks at the Forefront Even as Profits Plunge

Exxon’s production from key growth projects in Guyana and the US Permian Basin rose 20% during the first half of 2023 compared with a year earlier. Capital spending, meanwhile, is trending toward the high end of its $23 billion-to-$25 billion target for the year, while refining throughput was the highest for any second quarter in 15 years.

Lower commodity prices were a key test for big US oil companies that have promised to shower shareholders with ample cash at a steady pace. This is in contrast to European rivals that are paying more variable returns linked to cash flows.

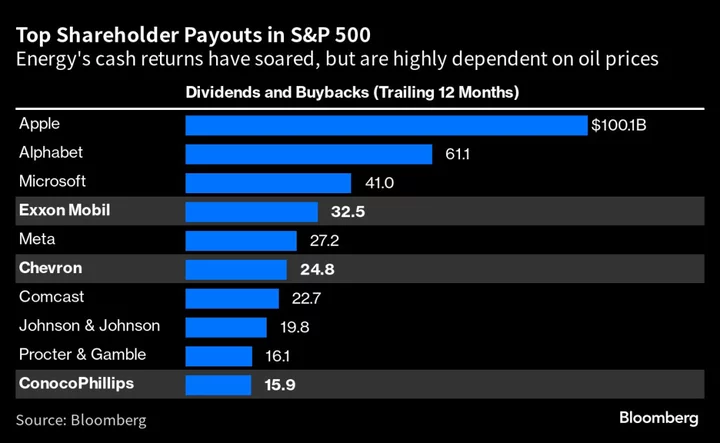

Prior to Friday’s announcement, Exxon was on course to pay out more than $30 billion in dividends and buybacks this year, which would make it the S&P 500 Index’s fourth-highest returner of cash behind Apple Inc., Microsoft Corp. and Alphabet Inc.

But energy is still relatively out of favor with investors, meaning Exxon still has a long way to go to regain the stock-market premium of the early 2010s, when it was the S&P 500’s biggest company.

Chief Executive Officer Darren Woods’ strategy of growing oil and gas production while also building a low-carbon business is gaining momentum after being derailed for two years during Covid-19. Production is finally rising after a decade-long decline due to highly profitable, fast-growing operations in Guyana and the Permian Basin.

Oil and gas production from Exxon’s Permian wells reached a record equivalent to 622,000 barrels during the April-to-June period and is on track to increase 10% this year, Mikells said. Output from Guyana also reached a record daily equivalent of 380,000 barrels.

Read More: Big Oil’s Weak Chemical Margins Add to Pain of Cheaper Crude

Exxon’s fossil-fuel growth stands in marked contrast to its peers. Shell and BP expect output to essentially flatline for the rest of the decade even after recent announcements to spend more on fossil fuels. Chevron Corp. expects to expand by just 3% annually but has faced problems in its top-growth operation, the Permian Basin.

The biggest challenge for Exxon is funding growth and paying out record sums to shareholders at a time of volatile commodity prices. Expectations for $100 a barrel oil by many banks, hedge funds and oil executives earlier this year failed to materialize amid high interest rates and China’s stalled economic recovery.