The Federal Reserve’s top bank watchdog is calling for more oversight of how bank executives are compensated after several lenders collapsed this year.

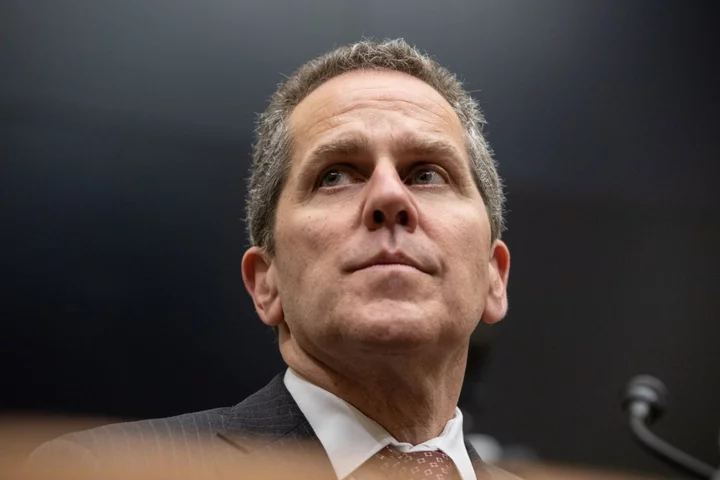

Senior executives at Silicon Valley Bank weren’t properly encouraged to manage the firm’s risk, said Michael Barr, the Fed’s vice chair for supervision. It’s the latest critique from US regulators about how executives ran the firm, known as SVB, before its collapse in March.

“Our oversight of incentive compensation for bank managers should also be improved,” Barr said in remarks prepared for his Tuesday appearance before the House Financial Services Committee. “SVB’s senior management responded to the poor incentives approved by its board of directors; they were not compensated to manage the bank’s risk, and they did not do so effectively.”

Barr and other top regulators, including Federal Deposit Insurance Corp. Chairman Martin Gruenberg, are expected to face a slew of questions from lawmakers Tuesday about their oversight of Silicon Valley Bank and Signature Bank, which was also seized by regulators in March.

Barr said that supervisors should act faster when they spot vulnerabilities and increase the intensity of oversight as lenders grow in size and complexity. The Fed should also evaluate how it regulates banks’ management of interest-rate risks and liquidity risks, such as taking on a large amount of uninsured deposits, he said.

Meanwhile, at the same time on Tuesday, the Senate Banking Committee will get a chance to grill former executives of the banks.

One likely line of questioning in that hearing will be executives’ stock trades prior to the bank collapses. Gregory Becker, former chief executive officer of SVB Financial Group — the holding company of Silicon Valley Bank — sold $3.6 million of company stock under a trading plan less than two weeks before the firm disclosed extensive losses ahead of its failure.

In written testimony for the hearing, Becker said that during his tenure as CEO, he “regularly sold the underlying shares of my stock options before they expired” through trading plans.

“SVB’s legal team approved that plan on the basis that I was not in possession of any material non-public information at that time, which I also believed,” he said.

Becker also said there was “nothing irregular or accelerated” about bonuses certain employees received for 2022 performance shortly before the bank was seized.