By Howard Schneider

WASHINGTON Any decision by the Federal Reserve to hold its benchmark overnight interest rate steady at an upcoming meeting should not be taken to mean the U.S. central bank is done tightening monetary policy, Fed Governor and vice chair nominee Philip Jefferson said on Wednesday.

In remarks that leaned toward what some have called a "hawkish pause," with rates held steady but the door left open for further increases, Jefferson said that "skipping a rate hike at a coming meeting would allow the (Federal Open Market) Committee to see more data before making decisions about the extent of additional policy firming."

"A decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle," Jefferson said in remarks prepared for delivery to a financial conference in Washington.

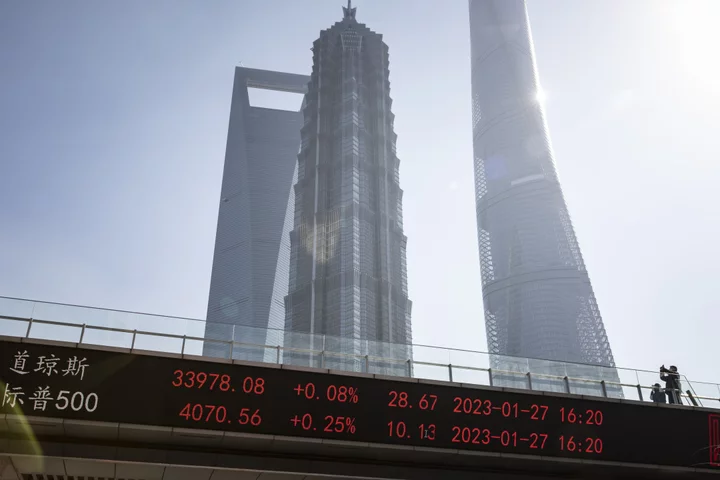

Jefferson did not single out the June 13-14 meeting, but markets have been on a seesaw trying to determine if the Fed is going to indeed pause its hiking cycle - if only temporarily - or drive rates higher after a run of stronger-than-expected economic data.

The Fed's main measure of inflation accelerated in April and remains more than twice the central bank's 2% target, and new job market data on Wednesday showed a jump in open positions.

Jefferson acknowledged inflation remains "too high" and that "by some measures progress has been decelerating recently."

But he also said he expected the economy would remain sluggish for the rest of the year as households spend down savings built up during the COVID-19 pandemic, and credit gets scarcer and more expensive.

Just how tight lenders limit borrowing after a string of high-profile bank failures remains uncertain, he said, while companies may start to struggle to service loans as the economy slows.

"I expect spending and economic growth to remain quite slow over the rest of 2023," Jefferson said. While he does not expect a recession, he noted that there are reasons to be careful after 15 months in which the policy rate was raised by 5 percentage points.

"History shows that monetary policy works with long and variable lags, and that a year is not a long enough period for demand to feel the full effect," he said.

(Reporting by Howard Schneider; editing by Paul Simao)