LONDON--(BUSINESS WIRE)--Oct 12, 2023--

The FICO UK Credit Card Market Report for July/August 2023 paints a picture of erratic consumer financial management which could challenge how lenders look after vulnerable customers in the winter months.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231012454670/en/

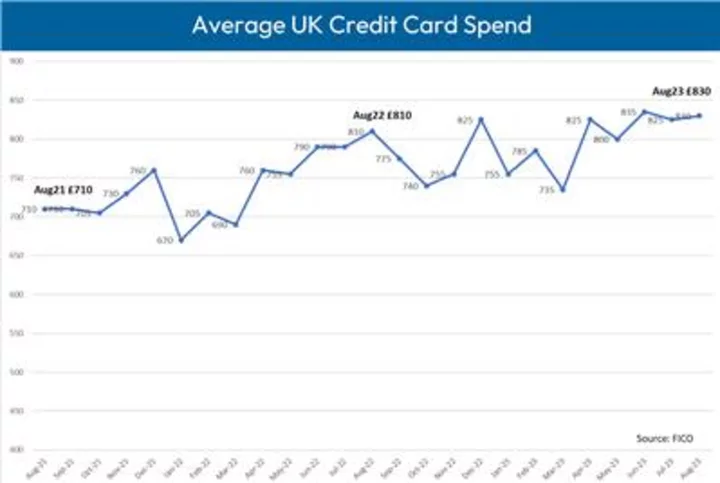

FICO data on UK credit cards shows that average spend levelled out over the summer months to £825 in July and £830 in August, but remained significantly higher than the same period in 2022 (Photo: FICO)

Highlights

- Average spend levelled out over the summer months to £825 in July and £830 in August, but remained significantly higher than the same period in 2022 (£790 and £810, respectively)

- The average credit card balance increased slightly in July to £1,710 and in August to £1,729, continuing the upward trend seen over the last two years

- Although the percentage of payments to balance has increased from 38% in June to 38.7% in August, it remains a much lower level that the same period last year. Intramonth movements demonstrate erratic financial management, having increased 1.5%, to 39.5% in July, before falling back again in August.

- Year on year, the percentage of customers missing one, two and three payments has risen, with customers missing two payments 11.9% higher and for those missing three payments a worrying 20.3% higher

- The use of credit cards to take out cash was at 3.6% in July and 4% in August, which is still significantly lower than the 6% seen before COVID. However, cash usage has been steadily increasing since March.

FICO Comment

Average spend on credit cards over the summer has been relatively flat, albeit still at the highest point since FICO records started in 2006. The average balance has also continued to increase month on month, trending upwards for the last two years. Both of these factors reflect the general inflationary pressures across the UK economy.

The FICO analysis also illustrates the delicate balancing act cardholders are managing, with the percentage of payments to balance yo-yoing over the last few months following a significant drop in the spring. This can be expected to continue whilst households struggle with the combined burden of higher prices and higher credit card balances. The percentage of customers missing one, two and three payments is also significantly higher than the same period in 2022, reflecting the challenges faced by those without a savings cushion to fall back on.

The initial increase in missed payments began during the Christmas 2022 period and has trended upwards across one, two and three missed payments since. In particular, the average missed payment balance has been increasing since May 2023 for those customers missing one payment and since March 2023 for those with two missed payments. The erratic pattern of payments continued in August with the number of customers missing one payment down 6.3% after an increase of 5.8% in July. However, the increase seen in July has rolled through to August for those customers now missing two payments.

The other warning flag for lenders is the use of credit cards for cash withdrawals. Recent reports from UK Finance stated that consumers paying for items in cash had risen for the first time in a decade. This increase in cash usage is reflected in the FICO benchmarking figures, which have shown a steady increase since March 2023 in the percentage of customers using their credit cards to take out cash. However, this is still significantly lower than before COVID, when over 6% of customers used credit cards to take out cash.

The new data provides important insights for lenders as they prepare for the next wave of winter fuel costs hitting customers’ disposable income.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO ® TRIAD ® Customer Manager solution in use by some 80% of UK card issuers. For more information on these trends, contact FICO.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 215 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, insurance, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in nearly 120 countries do everything from protecting 2.6 billion payment cards from fraud, to improving financial inclusion, to increasing supply chain resiliency. The FICO® Score, used by 90% of top US lenders, is the standard measure of consumer credit risk in the US and other countries, improving risk management, credit access and transparency. Learn more at www.fico.com.

FICO and TRIAD are registered trademarks of Fair Isaac Corporation in the U.S. and other countries.

View source version on businesswire.com:https://www.businesswire.com/news/home/20231012454670/en/

CONTACT: For further comment on the FICO UK Credit Card activity contact:

FICO UK PR Team

Wendy Harrison/Parm Heer

ficoteam@harrisonsadler.com

0208 977 9132

KEYWORD: UNITED KINGDOM EUROPE

INDUSTRY KEYWORD: PERSONAL FINANCE FINANCE BANKING PROFESSIONAL SERVICES OTHER PROFESSIONAL SERVICES

SOURCE: FICO

Copyright Business Wire 2023.

PUB: 10/12/2023 04:10 AM/DISC: 10/12/2023 04:10 AM

http://www.businesswire.com/news/home/20231012454670/en