The French government said it has identified at least €10 billion ($10.9 billion) of savings as part of efforts to restore public finances after years of increased spending during the Covid pandemic and energy crisis.

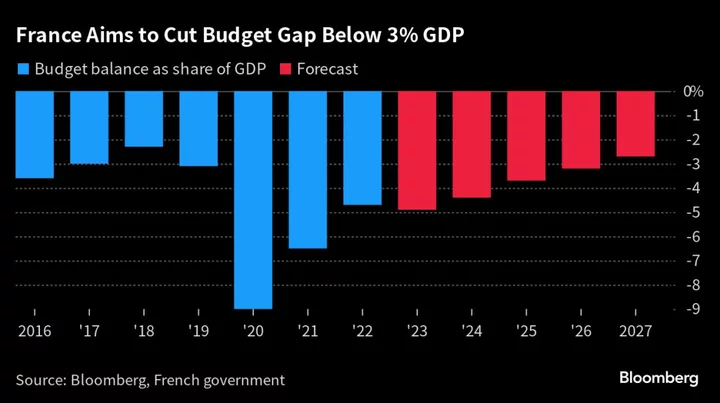

It is targeting a budget deficit of 4.9% of gross domestic product this year, dropping to 4.4% next year and falling below 3%, the limit set under European Union rules, by the end of Emmanuel Macron’s second term as president in 2027.

The first step would be to withdraw energy support for businesses and households. The shield for gas prices ends this month, while the equivalent measure for electricity will be abolished at the end of 2024.

“We’ve nothing to regret, but our decision to protect French people on a massive scale had consequences for our debt and deficits,” Prime Minister Elisabeth Borne said at a conference on public spending on Monday. “We must now consolidate our public finances to ensure debt sustainability.”

Savings Targets

To make €10 billion of annual cost savings by 2027, Finance Minister Bruno Le Maire said the government is focusing on the healthcare system, state support for housing and employment, and tax breaks for fossil fuels in some sectors.

Areas being targeted include:

- Spending on sick leave, which cost the state €16 billion in 2022 after a 10% increase in doctors writing off workers over the last decade

- Medical prescriptions, which currently amount to around €450 a year per patient

- Zero-rate home loans financed by the state and tax breaks for investment in rental housing

- Support for the labor market, including for apprenticeships and professional training

- Cash holdings of state operators — such as universities, environmental agencies and scientific institutes — that have increased to €65 billion from €35 billion in four years

- Fossil-fuel tax breaks for road transport, agriculture and construction

France’s public finances have been in the spotlight in recent weeks after Fitch Ratings cut its credit rating on the country and Scope Ratings put a negative outlook on its assessment. S&P Global Ratings fell short of downgrading the euro area’s second-biggest economy but kept its negative outlook, citing elevated government debt and downside risks.

Macron wants to show European neighbors he is tackling deficits and foreign businesses that France is attractive for investment, brandishing reforms such as an unpopular increase in the retirement age that comes into force later this year.

“Who do we want to be as a nation?” Le Maire said. “Do we want to be the champions of debt, deficits and tax? Or do we want to be the champions of investment, innovation and the ecological transition?”

Le Maire, who has pledged to accelerate debt reduction, said growth in France is resisting but that the economic environment is becoming more and more difficult. Statistics agency Insee last week predicted 0.6% GDP growth this year, below the government’s 1% target.

“We are proposing neither austerity nor wishful thinking: We are proposing responsibility,” Le Maire added.

(Updates with comments from prime minister in fourth paragraph, details of savings.)