A South Korean fund whose bets on stocks tied to electric vehicles helped it outperform most of its peers with a 50% return so far this year has turned bearish on the sector and is buying semiconductor-related shares instead.

Riding advances including the more than tripling of battery-materials maker CosmoAM&T Co., the Daol Asset Management Co. fund has beaten 99% of its peers in 2023. The fund — which has scored similar performance over the past one, three and five years — is now seeking gains in chip stocks amid the boom fueled by artificial intelligence.

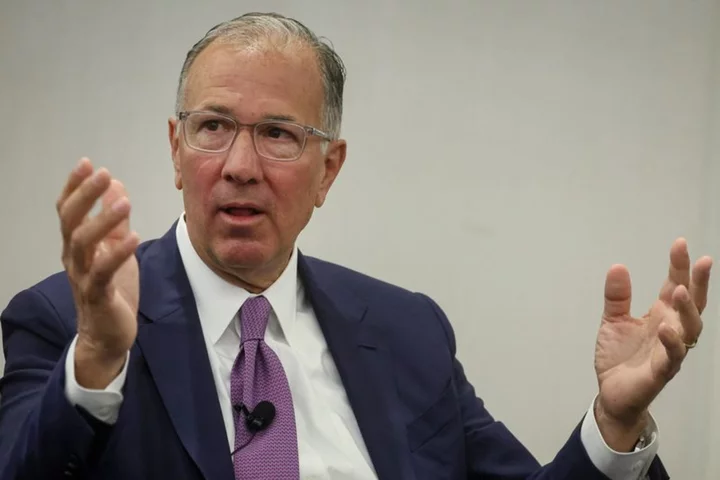

EV battery stocks are “taking a breather” on slowing earnings momentum, Lee Jongchan, the $260 million fund’s manager, said in an interview. “We reduced exposure to EV batteries and increased chip materials and equipment suppliers, which served us well lately.”

While global EV investors have become more selective of late, indiscriminate buying of Korean stocks that trade on the theme has helped drive a world-beating 32% rally in the small-cap Kosdsaq Index this year. Lee said his fund made big bets on EV-related shares going into 2023 but exited CosmoAM&T and Ecopro BM Co. after they rose too quickly.

READ: Korean EV Battery Stock That Rallied 647% Gets First Sell Rating

Ecopro BM is “a good company if you don’t look at its stock price,” he said. “Even with great growth potential, we take a conservative approach when it comes to investing in stocks with a more than 30 times price-to-earnings ratio.” The cathode maker is trading at about 60 times 12-month forward estimated profits.

The steep ascent in EV stocks has made other investors nervous as well, with a surge in short-selling amid continued buying by retail investors. Ecopro BM jumped as much as 12% Tuesday while CosmoAM&T gained 5% on apparent short covering.

Earnings Potential

Not that Lee has totally given up EVs. He still holds W-Scope Chungju Plant Co., citing an outlook for strong battery separator orders. Among the big battery-makers, he favors Samsung SDI Co. on expectations for more tie-ups with automakers and cheaper valuations than rival LG Energy Solution Ltd.

In the chip space, Hansol Chemical Co. and ISC Co. are among the fund manager’s top picks for the second half, as beneficiaries of the AI-related boom driven by Nvidia Corp. and others. With his fund focused on smaller stocks, earnings growth potential is one of the most important factors Lee looks at.

Large-cap chip stocks such as Samsung Electronics Co. are “too cyclical,” he said. “There are too many ups and downs” in their profits.

(Adds background on short-selling, share moves in sixth paragraph)