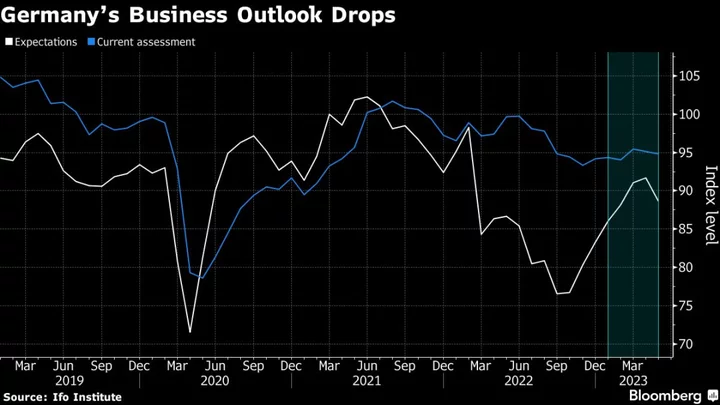

Germany’s business outlook deteriorated for the first time since October as a struggling manufacturing sector threatens to undermine the recovery of Europe’s biggest economy.

An expectations gauge by the Ifo institute slipped to 88.6 in May from 91.7 the previous month, worse than expected by every single economist in a Bloomberg survey. A measure of current conditions also slipped.

“The mood in the German economy has taken a significant hit,” Ifo President Clemens Fuest said Wednesday in a statement. “The German economy is skeptical about the summer.”

Germany is poised to learn whether the energy shock induced by Russia’s war in Ukraine tipped it into a winter recession, with data due Thursday to provide an updated assessment of first-quarter output. After weakness in March, a downward revision of the initial reading of stagnation may well materialize.

While the economy has fared better than initially feared, growth has become increasingly uneven. Services are propped up by robust demand from consumers that emerged from the pandemic with large amounts of savings, but manufacturers have seen demand crater.

What Bloomberg Economics Says...

“While the economy has fared better than initially feared, the recovery appears more polarized. Recent data showed a sharp plunge in German industrial production and factory orders despite supply-chain constraints easing.”

—For full note, click here.

Business surveys by S&P Global released Tuesday confirmed that trend. A separate poll by the DIHK lobby group this week signaled a lack of momentum and a murky outlook.

Interest-rate increases by the European Central Bank also pose a headwind. Officials have raised borrowing costs by 375 basis points since July in a bid to to return inflation to their 2% goal and say they’re not yet finished.

--With assistance from Joel Rinneby and Kristian Siedenburg.

(Updates with Bloomberg Economics after fifth paragraph.)