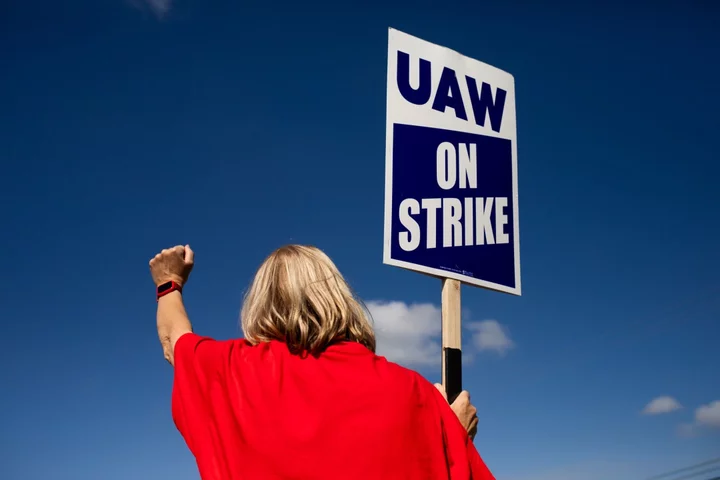

The United Auto Workers expanded its strike against General Motors Co. and Ford Motor Co. to more assembly plants, but the union spared Jeep maker Stellantis NV from additional walkouts after a last minute breakthrough.

The newly targeted facilities are a Ford factory in Chicago that produces the Explorer sport-utility vehicle and a GM plant in Lansing, Michigan, that manufactures the Chevrolet Traverse, UAW President Shawn Fain said Friday.

The union had also planned to strike at Stellantis, according to officials briefed on the matter, but changed course right before Fain’s announcement, which was delayed due to the negotiations. The union chief commended Stellantis for making progress in the talks.

“We are excited about this momentum at Stellantis and hope it continues,” Fain said in a livestreamed briefing. “Moments before this broadcast, Stellantis made significant progress on cost of living allowance, right not to cross picket lines as well as the right to strike over product commitments and plant closures and outsourcing moratoriums.”

Ford shares fell 1.2% at 1:34 p.m. in New York. Stellantis slipped 0.8% and GM dropped 0.6%. GM and Ford had seen steep declines since July amid uncertainty about the negotiations. Stellantis is the outlier, up 35% so far this year.

The additional strike action took effect as of noon local time in Detroit. The plants targeted by the latest work stoppage make mid-size SUVs which are an important volume product, but the labor action has yet to shut down the automakers’ engine, transmission or cash cow full-size SUV and truck factories.

Third Week of Strikes

Workers at 41 plants already have been on strike since Sept. 15, including all of Stellantis and GM’s parts distribution centers in the US. The strike already has affected 18,000 of the UAW’s 146,000 members at the three carmakers, and the two new plants will put an additional 7,000 on picket lines. It’s the first time all three of Detroit’s legacy automakers have been targeted simultaneously.

Ford typically makes about 5,700 vehicles weekly at its Chicago plant while GM’s Lansing plant makes about 3,600 vehicles per week, according to GlobalData Plc. As of Thursday, GlobalData estimates that the strike had cost Ford 8,000 vehicles in lost output, compared with 15,405 vehicles for GM and 12,900 for Stellantis.

The UAW is ratcheting up the pressure on carmakers as the work stoppage extends into a third week. Negotiators continue to haggle over issues including wages, pensions and future battery plant workers.

Ford Chief Executive Officer Jim Farley lashed out at the union in a video address Friday, accusing Fain of holding an agreement hostage over battery plants, which are mostly joint ventures and haven’t been constructed yet. He said Ford had already made a record offer on wages and benefits and is close to an agreement there, but any further concessions would jeopardize the company’s future and the supply chain that depends on it.

“The battery plant discussion has been very difficult,” Farley said. “I don’t think we’re at an impasse, but that day could come if this continues.”

GM also signaled its unhappiness with the UAW’s latest salvo and said in a statement it’s anxious to reach a deal that “doesn’t let the non-union manufacturers win” — a reference to rivals such as Tesla Inc. and foreign auto brands with US factories.

Each of the companies is negotiating separately on its own four-and-a-half-year contract, but they’re closely watching each other’s moves. Last week, Fain said talks with Ford were making progress and it was spared when the strike expanded to more locations.

Last-Minute Breakthrough

This time, Stellantis dodged the bullet. Its talks with the union, which had shown little movement since the company offered about a 20% raise on the eve of the strike, had a breakthrough at the last minute after the carmaker made concessions on key issues.

“Stellantis has been intensely working with the UAW to find solutions to the issues that are of most concern to our employees while ensuring the company can remain competitive given the market’s fierce competition,” the carmaker said in an emailed statement. “We have made progress in our discussions, but gaps remain.”

The right to strike over plant closures had been a key point of contention in the talks, with Chief Operating Officer of North America Mark Stewart arguing early on that the company wants to be able to “make the decision on product allocation and where it goes.”

Chief Executive Officer Carlos Tavares, who has made a point of delegating negotiations to Stewart, traveled to Detroit this week for a board meeting, but didn’t meet with Fain, according to a person familiar with the matter.

The UAW wants to emerge from the strike with at least a 30% pay raise, Bloomberg News has reported, down from the 40% hike it initially proposed. That would still be significantly more than they’ve received in prior years. The three carmakers have each offered about 20% more pay.

Expanded walkouts run the risk of depleting the UAW’s strike fund too quickly. Striking workers get $500 a week under union rules, and the fund had about $825 million in it when the strike began.

--With assistance from Catherine Larkin and Albertina Torsoli.

(Updates with Ford CEO comments in 10th and 11th paragraphs.)