As the climate changes, how doctors treat patients, and medical program curricula, are evolving

As extreme and slow onset weather events increase, so too are the public health issues that come with those changes

2023-08-04 00:08

Every Saudi Pro League club's 2023 summer transfer window - ranked

Ranking all 18 Saudi Pro League clubs' 2023 summer transfer window.

2023-09-08 20:00

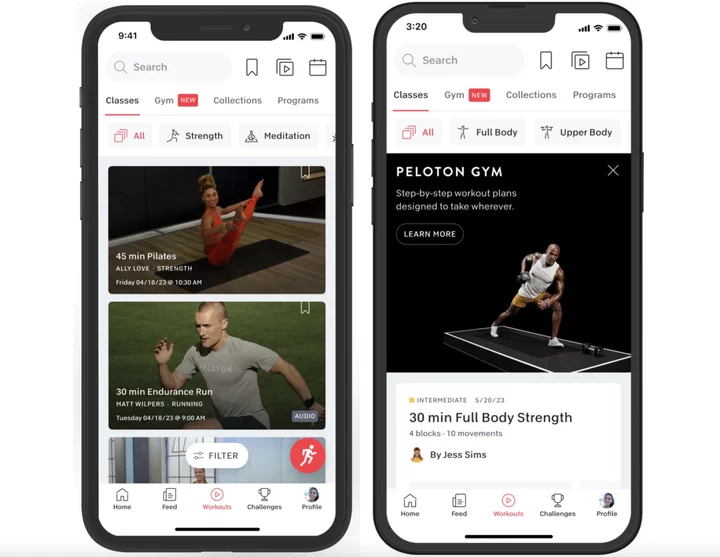

Peloton Revamps Workout App with Free and Pricier Tiers in Services Push

Peloton Interactive Inc. is revamping its mobile fitness app to offer three different tiers, including an upscale version

2023-05-23 22:14

America's national emergency alert test is coming to your phone at 2:20 pm ET today: Here's what you need to know

Today is the day for the US government's big emergency alert drill, which will send a test message to every TV, radio and cell phone in the nation.

2023-10-04 18:35

Sarcoma Awareness Month: What you need to know about these cancers

Although most people have heard of sarcomas, research suggests the majority don’t really know what they are. A study by Sarcoma UK found 75% of people didn’t know what a sarcoma was – but there’s no better time than July’s Sarcoma Awareness Month to learn. Sarcomas are rare cancers that can either form in the bones or soft tissues that connect, support and surround other body structures and organs, explains Sarcoma UK. “If you’ve never heard of sarcoma before, you’re not alone,” says Dr Sorrel Bickley, director of research, policy and support at Sarcoma UK. “Sarcoma can affect any part of the body, on the inside or outside, including the muscle, bone, tendons, blood vessels and fatty tissues.” She says around 15 people are diagnosed with sarcoma cancer every day in the UK, and stresses: “It can affect anyone, at any age, and it’s vital that healthcare professionals can recognise its signs and symptoms.” During Sarcoma Awareness Month the charity is running a campaign called Does Size Matter?, in a bid to draw attention to the fact that a lump getting bigger is a key sign of sarcoma. “Most lumps and pains won’t be sarcomas, but it’s important to keep an eye on symptoms and to seek medical help if you’re worried,” stresses Bickley, who explains that many patients tell the charity it’s taken a long time for them to get a correct diagnosis. She adds: “Many people don’t consider their symptoms might be serious. Delays cost lives, and people have a better chance of surviving sarcoma if their cancer is diagnosed early. ” There are around 100 different subtypes of sarcoma, grouped into soft tissue sarcomas and bone sarcomas, and Bickley explains: “Soft tissue sarcomas may not have obvious symptoms in the early stages when the tumour is very small. The symptoms can become more obvious as the sarcoma grows, but this can depend on where in the body it’s found. ” She says there are several main sarcoma symptoms to be aware of… A lump that grows or changes Bickley says sarcoma is a “complicated cancer”, but the most common symptom is a lump, which could be anywhere on the body – including the arm or leg. “Most lumps aren’t harmful and a lump that isn’t getting bigger, isn’t causing any pain, or that has been there for a long time isn’t likely to be anything to worry about,” she says. “But if it’s growing quicky or measures more than five centimetres – about the size of a golf ball – then you should get it checked by your GP.” Swelling or pain in or around a bone Sarcoma cancer can also start in a bone – the most common symptoms are unexplained pain or tenderness around a bone, which may come and go and may be worse at night, explains Bickley. “If the pain is getting worse and doesn’t go away with rest or at night, you should go and see your GP to get it checked,” she advises. Stomach pain, feeling sick and loss of appetite Some forms of sarcoma – known as a gastrointestinal stromal tumours, or GISTs – can start in the gastrointestinal tract. “With this type of sarcoma, people most often experience symptoms like fatigue, anaemia, weight loss, feeling sick or discomfort around their stomach,” Bickley says. Blood in poo or vomit Noticing blood in your poo or vomit can also be a sign of a gastrointestinal stromal tumour, says Bickley, who adds: “There are lots of causes for blood in poo or vomit, but it needs to be checked by a medical professional.” For more information or advice about sarcoma, call the Sarcoma UK support line on 0808 801 0401, email supportline@sarcoma.org.uk, or text 07860 058830 to contact a specialist adviser. Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live Bjork’s controversial swan dress to go on display in new exhibition Chrissy Teigen welcomes fourth child – how does surrogacy actually work? 11 ways to work the colour clash trend at home

2023-06-30 14:00

This is the potential reason humans experience deja vu, according to experts

It’s happened to us all. Maybe you’re walking down the street, or sitting on the bus, or even just sending an email – then suddenly, you realise you’ve been here before. Déjà vu can be a puzzling thing. It literally means already seen in English, and it remains pretty mysterious as to why we feel it. Now, scientists have a couple of theories. Sanam Hafeez, a clinical psychologist, told Fox News: "It refers to the eerie and distinct feeling that one has already experienced the current situation or event, even though it’s a new and unfamiliar occurrence. "It feels like a powerful wave of familiarity with the present moment as if the person is re-living a past experience. "Some suggest it may be linked to how memories are processed in the brain, potentially involving delays or errors in memory retrievals." She added that it may be because the brain is processing information through multiple pathways at the same time, creating the illusion of a memory when you are living in the present moment. She said: "Regardless of the precise mechanism, déjà vu is a transient and common experience that lasts only briefly, affecting people of all ages and not considered a pathological condition. "While it remains a puzzle, déjà vu continues to be a fascinating facet of human consciousness." "It is also important to note that déjà vu is not associated with any particular medical or psychological condition. It is usually a brief and transient experience and is considered a normal aspect of human perception and memory." About two-thirds of people in good health experience déjà vu during their lifetime, according to WebMD, though it is more likely to happen to people aged 15 to 25. The website explains: "A familiar sight or sound can trigger the feeling. You may walk into a room in a building you’ve never visited yet feel like you know it intimately." Health.com adds: "People with more education, those who travel a lot and people who can recall their dreams are also more likely to experience déjà vu." How to join the indy100's free WhatsApp channel Sign up to our free indy100 weekly newsletter Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

2023-11-14 01:18

Bardstown Bourbon Company to Release Discovery #10

BARDSTOWN, Ky.--(BUSINESS WIRE)--Jun 1, 2023--

2023-06-02 02:00

H&M to grow third-party brand strategy as online rivalry intensifies

STOCKHOLM H&M plans to sell more third-party brands online and in stores, CEO Helena Helmersson said on Thursday,

2023-06-29 20:14

'American Ninja Warrior' Season 15: Tallest Mega Wall and thrilling new obstacles raise the stakes like never before

'American Ninja Warrior' Season 15 will also introduce exciting changes to the show's format

2023-06-06 07:31

Things to know about the latest court and policy action on transgender issues in the US

After the latest wave of legal rulings on restrictions for transgender people, a Texas ban on gender-affirming care for minors is in effect

2023-09-02 05:53

Warner Bros Discovery plans to offer live sports for free on Max - Bloomberg News

(Reuters) -Warner Bros Discovery plans to offer live sports at no additional price on its Max streaming service for a

2023-09-07 00:14

Greg Gutfeld net worth: Fox News host earns a staggering salary from hosting two shows on network

Greg Gutfeld is currently a co-host on the panel of 'The Five' and has his own late-night talk show 'Gutfeld!'

2023-09-03 17:42

You Might Like...

Apex Legends Legends Tier List June 2022

How tall is Natalie Portman? Internet once called MCU star ‘kid in cosplay’ for her role in ‘Thor’

South Korea’s Exports Pick Up Momentum as Chips Bounce Back

MANSCAPED® Introduces The Handyman™ Compact Electric Face Shaver

NBA MVP Joel Embiid gets sixth career triple-double to help 76ers rout Lakers 138-94

Brawling fans in stands delay start of Argentina-Brazil World Cup qualifying match for 27 minutes

Google Joins Microsoft in Shielding Users From AI Copyright Lawsuits

How did Ray Lewis III die? College football star was the son of Hall of Fame linebacker Ray Lewis