Swedish lender Svenska Handelsbanken AB has taken a major step toward exiting Finland after it struck agreements to sell parts of its commercial, investment and life insurance businesses in the Nordic country.

Sweden’s third biggest bank by market value has been seeking buyers for its Finnish operations since the fall of 2021, when it announced it would focus on the core markets of Sweden, the UK and Norway. As part of the same strategy, the bank sold its Danish unit, with assets of almost $10 billion, to Jyske Bank A/S last June in what was the biggest bank deal in Denmark in two decades.

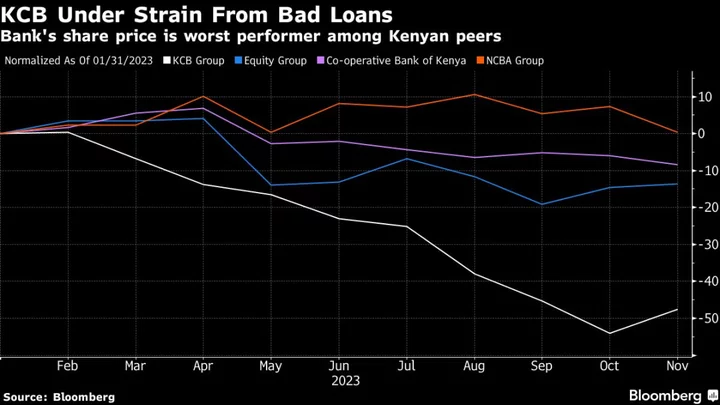

Shares in Handelsbanken were little changed when trading started in the Swedish capital on Wednesday. The stock is down about 16% so far this year, making it by far the worst performer among the big three lenders in Sweden, with weaker-than-expected capital levels in the first quarter weighing on the shares in recent weeks.

The Stockholm-based bank gave no details about what it intends to do with the proceeds from the Finnish deal, which is expected to close in the second half of next year. The lender will receive cash equal to the actual net asset value, which was about €1.3 billion ($1.4 billion) at the end of March, as well as a maximum premium payment of €8.5 million.

“The most important thing with this is what the bank does with the capital since it is already over capitalized and this will make it even more so,” said Andreas Hakansson, an analyst at Danske Bank. “Handelsbanken won’t initiate any new buyback program related to this sale until 2025 at the earliest.”

The Finnish deal will see Oma Savings Bank Plc buying Handelsbanken’s small and medium-sized enterprise unit in Finland, while the asset management and investment services division will be sold to S-Bank Plc. The life insurance unit will be acquired by Fennia Life Insurance Company Ltd, according to a statement. All three buyers are based in Finland.

The agreement comprises a loan book totaling €4.1 billion and deposit volumes of about €2.8 billion, representing 50% of risk-weighted exposure of the bank’s operations in Finland.

“The divestment of the bank’s remaining operations in Finland continues as part of a separate process,” it said.

--With assistance from Love Liman.

(Adds share price, analyst comment.)