After being burned by crude’s slump in the first half of 2023, hedge funds are rushing back into the oil market with their most bullish wagers in more than a year.

Money managers entered the year betting that restricted Russian output and resurgent Chinese demand would propel crude back toward the heights it had reached in 2022. Those hopes were quickly dashed as recession fears, US banking turmoil and resilient Russian flows pushed prices lower. Among the hardest hit was oil trader Pierre Andurand, whose main fund had its worst-ever run in the first half.

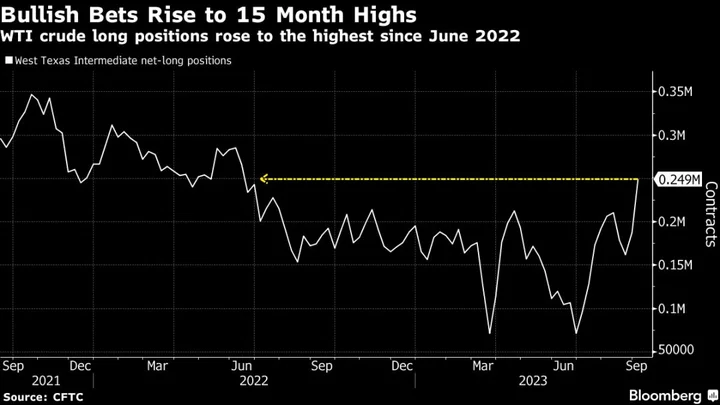

But after a retreat to some of the most bearish positions of the past decade at the end of the first half, hedge funds have ramped up net long bets as OPEC+ output reductions — and the extension of unilateral cuts by Saudi Arabia and Russia — have sent crude surging 30% since mid-June. Data released Friday show money managers are now the most bullish on US crude since June 2022 as many of the catalysts they’d expected to ignite a rally finally show signs of materializing.

“A considerable amount of dry powder had been sitting on the sidelines, meaning the recent strong tape could set off a further chase and catch-up in positioning,” Michael Tran, a global energy strategist at RBC Capital Markets, said in an email. “This oil market has evolved into as much of a momentum-based market as it is a fundamentally based one.”

Andurand’s fund notched one of its best months ever in July, and other hedge funds have returned to the market, helping boost participation.

Still, caution remains. Renewed concerns about China’s economy and US monetary policy have hindered crude’s rally. Banks including Goldman — which late last year forecasted prices shooting to $100 or higher — maintained their more tempered forecasts, even while noting that the most recent OPEC+ moves offer the potential for prices to outstrip their projections. And lingering memories of the first half’s losses may soften funds’ conviction.

For now, evidence of the market tightening — in ways it failed to in the first half — is starting to show up. Saudi Arabia and Russia prolonged their supply curbs by 1 million barrels a day and 300,000 a day, respectively, until December. The news is in sharp contrast to the supplies the market was used to earlier in the year, when Russian oil supplies had at one point risen more than 1.4 million barrels a day from the end of last year.

“The biggest gap in our projected balances this year has been Russia,” Francisco Blanch, head of commodities research at Bank of America Corp., said in July. “We came into the year thinking we were going to lose a lot of Russian supply. What we saw was an enormous amount of Russian oil, both crude and petroleum products coming into the market.”

Further on the supply side, Iran’s oil exports had been rising amid secret diplomacy with the US, but are likely to have now peaked for the year, according to people with knowledge of the country’s sales.

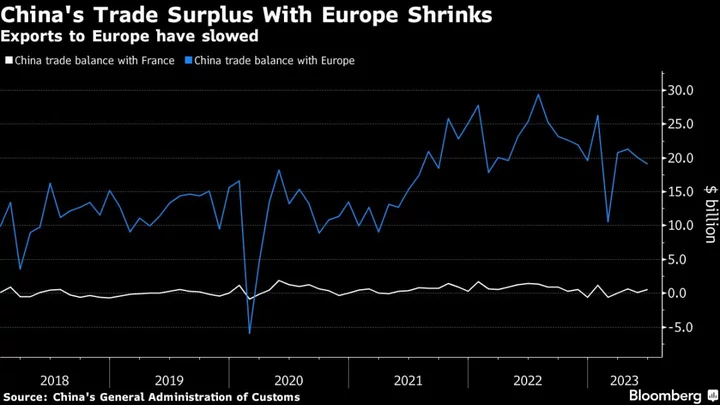

Secondly, the markets largely abandoned expectations that China’s economic rebound from its harsh Covid-19 restrictions will fuel a surge in demand in the first half of 2023. Data from the first half of the year showed flights from China in June at only 39% of pre-pandemic levels and trade exports plunging from March to July.

“The bulls got global recovery wrong,” Ed Morse, global head of commodity research at Citigroup Inc., said in July. “And they were overly optimistic on Chinese demand in particular.”

Now going into the second half, China’s demand is improving and providing bulls with a stronger case. China’s jet fuel production rebounded strongly, and domestic weekly flights surged 13% above pre-pandemic levels in late August.

And while China’s consumption isn’t as robust as anticipated, a spate of recent industry forecasts showed global oil demand rising to records.

“Much of the market’s growth pessimism has been abandoned,” Goldman Sachs Group Inc. analyst Daan Struyven said in a phone interview in July. “And consistent with a reduction in pessimism, positioning has risen pretty significantly.”

Lastly, crude’s correlation with broader risk assets has diminished. Most large drops in oil prices this year — including during the US banking crisis in March — were fueled by selloffs in equity markets.

And while the higher interest rates that have weighed on equities remain a headwind for crude — especially since they make it more expensive to store oil and encourage refiners to offload their crude into the market — Goldman at least now sees a soft landing for the economy.

Financial investors’ rising participation in the oil market should increase liquidity and provide a buffer against extreme moves both up and down, Rebecca Babin, a senior energy trader at CIBC Private Wealth, said in July. But the resilience of those investors’ conviction remains an open question.

“Unfortunately, with some of the carnage wreaked in the first half of the year, hedge funds will be running tight risk parameters,” she said. “So they could easily be shaken from the market again if things don’t play out the way they are positioned.”