Hong Kong’s government is considering marginally relaxing mortgage loan-to-value ratios for some residential property purchases, the city’s finance chief said.

The government is working with the Hong Kong Monetary Authority and will carefully deliberate between balancing financial stability and interests of first-time home owners, Financial Secretary Paul Chan said on a Commercial Radio program.

The city last year raised a cap for first-time buyers to acquire a property with a 10% down payment to HK$10 million from HK$8 million. Some homeowners called for the government to assist with purchasing bigger flats after they start a family, Chan said.

Hong Kong Developers Cut Housing Project Prices as Outlook Dims

Chan also cautioned residents against a high-interest rate environment amid market expectations that the US Federal Reserve will hike rates once or twice for the second half of this year. Hong Kong interest rates move in lockstep with the US as the local currency is pegged to the greenback.

Earlier this month, Chan told lawmakers he would consider further relaxing the loan-to-value ratio for first-time homebuyers but rejected proposals to ease property cooling measures, including adjusting stamp duties, The Standard newspaper reported.

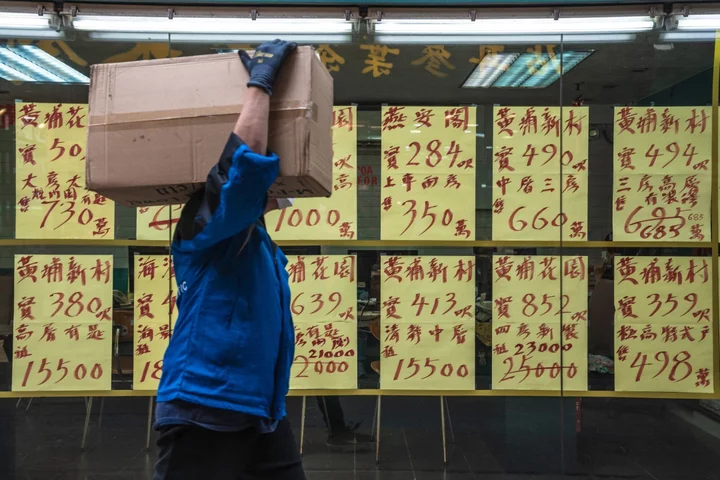

Hong Kong’s residential market is showing fresh signs of weakness after a short-lived rebound in the first quarter. Home prices may end the year unchanged from the start of 2023, suggesting a 7% drop, Citigroup Inc said last month. A gauge of second-hand property prices is down 13% from its record in 2021.