More disappointing inflation news could help to persuade Federal Reserve policymakers to raise interest rates again, giving ammunition to hawks who argue there’s more work needed to restore price stability.

The personal consumption expenditures price index, the Fed’s preferred inflation gauge, rose a faster-than-expected 0.4% in April, Commerce Department figures showed Friday.

“When I look at the data and I look at what’s happening with inflation numbers, I do think we’re going to have to tighten a bit more,” Cleveland Fed President Loretta Mester told CNBC in an interview later on Friday. “Everything is on the table in June.”

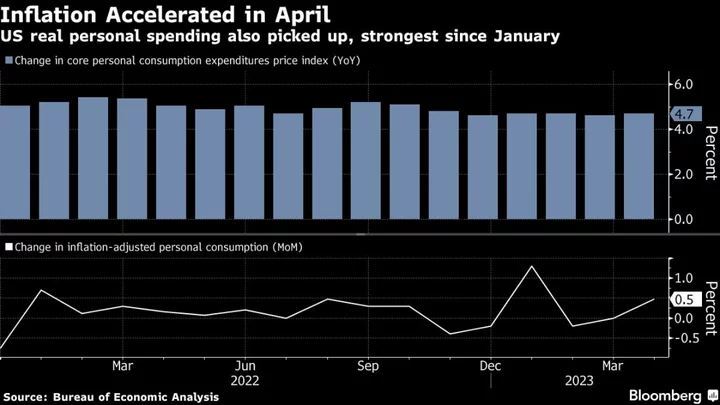

From a year ago, the measure climbed 4.4% compared with 4.2% the previous month. Excluding food and energy, the so-called core PCE index increased 0.4% from the prior month and 4.7% from April 2022.

“This is the wrong direction for the Fed,” said Diane Swonk, chief economist at KPMG LLP. “June will depend on getting outside of debt ceiling issues but a July hike is now in play.”

Officials have raised rates by 5 percentage points in the past 14 months to curb inflation running more than double their 2% target. With their benchmark rate now in a 5% to 5.25% target range following a quarter-point increase earlier this month, Fed Chair Jerome Powell said a week ago that policymakers could afford to watch the data and the evolving outlook.

Policy makers will get an additional read on employment and consumer prices prior to the Federal Open Market Committee’s next meeting June 13-14. They may also be reluctant to hike so long as there’s uncertainty over the fate of the debt ceiling negotiations in Congress.

Still, investors moved up bets on a rate hike next month to more than 50% from 18% a week ago, reflecting recent hawkish Fed speeches as well as signs of economic strength. Consumer spending, adjusted for prices, increased 0.5%, the strongest advance since the start of the year, the report Friday found. Treasury yields jumped after the report.

Read more: US Inflation Picks Up, Keeping Fed Tilted Toward Another Hike

“The combination of inflation moving upward and consumer spending remaining so strong will increase the odds of the Fed raising rates another time in mid-June,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co.

Some Fed officials, though, including Atlanta Fed’s Raphael Bostic and Philadelphia’s Patrick Harker, have stressed that the impact of banking failures on credit has yet to be felt, and that monetary policy works with a lag, so that much of pain from higher rates has yet to be seen in official data.

“It’s going to take a bit more to unlodge them from a June pause, but it does raise the chance of another hike thereafter,” said Derek Tang, an economist at LH Meyer/Monetary Policy Analytics in Washington. “The stronger the data flow, the more likely that next hike is in July rather than September.”

“Patience has limits, and it will start to wear thin if the economy keeps roaring and bank stress doesn’t worsen,” he said.

Policymakers at their May 2-3 meeting said they were uncertain about how much additional policy tightening might be needed, and weighed the slower-than-expected progress on inflation and resilient labor market against the likelihood of a credit crunch following recent banking turmoil, according to minutes from the meeting released in Washington on Wednesday.

(Updates with Mester comment in third paragraph.)