Indonesia isn’t ruling out an out-of-cycle rate increase after policymakers surprised most forecasters with a hike last week, according to a central bank spokesman.

“As a possibility, it is always there even if it is very small,” Bank Indonesia’s spokesman Erwin Haryono said on late Thursday after the Philippines delivered a 25-basis-point unscheduled rate hike. “But so far, the policy response delivered during the latest Board of Governors’ meeting is sufficient.”

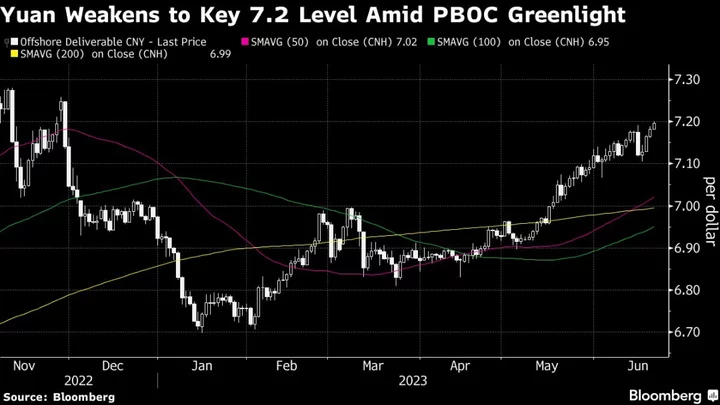

The comments underscore growing pressure on regional central banks to take bolder tightening steps to support their currencies as the dollar strengthens and US Treasury yields rise. Neighboring Bangko Sentral ng Pilipinas raised its key rate to 6.5% in an off-cycle move on Thursday.

Rupiah Intervention

PT Bahana Sekuritas, the only one out of 31 to predict that Indonesia would raise its benchmark rate to 6% last week, is now saying the central bank “could and most likely would” tighten further. That may even happen earlier than the next scheduled meeting on Nov. 23, its analysts said.

“Should the rupiah weaken again, we believe there is some probability BI might resort to the option of hiking interest rates outside its regular monthly meeting – which it did in August 2013 and May 2018,” Bahana’s Satria Sambijantoro and Drewya Cinantyan wrote in a note. Further rate increase is necessary as central bank intervention may not be sustainable, they added.

The rupiah declined 0.1% to 15,940 a dollar as of 10:24 a.m. in Jakarta. That’s near a three-year-low of 15,962 reached on Monday. The 10-year government bond yield climbed four basis points, set for the most in a week, to 7.20%.

As far as inflation threats go, however, Indonesia is in a far better position than the Philippines after having cooled price gains to within target since May, while its neighbor faces the risk of missing its price goal for a third straight year in 2024.

BSP Governor Eli Remolona said the central bank “fell a little bit behind” after deciding to hold the rate in September when inflation risks increased. Meanwhile, Indonesia’s October rate increase, which came after eight months of pause, was meant as a “preemptive, front-loading” move, said Governor Perry Warjiyo, who signaled last week that he’s ready to take action if warranted.

Another quarter-point rate hike to 6.25% would act as an insurance policy for the Indonesian economy against geopolitical risks and rising political uncertainty ahead of the 2024 election that could affect foreign inflows, Bahana analysts wrote. Other economists are also expecting further tightening as last week’s rate move have done little to halt the rupiah’s slide.

Indonesia’s Financial System Stability Committee — which includes the central bank, finance ministry, financial services authority and deposit insurance agency — is due to meet on Nov. 3 and may deliver a more comprehensive response then, BI’s Haryono added.

(Adds market movement in sixth paragraph.)