Investors are yanking cash out of the market for inflation-protected bonds as price pressures moderate in the US, even as the securities rallied along with the broader market in November.

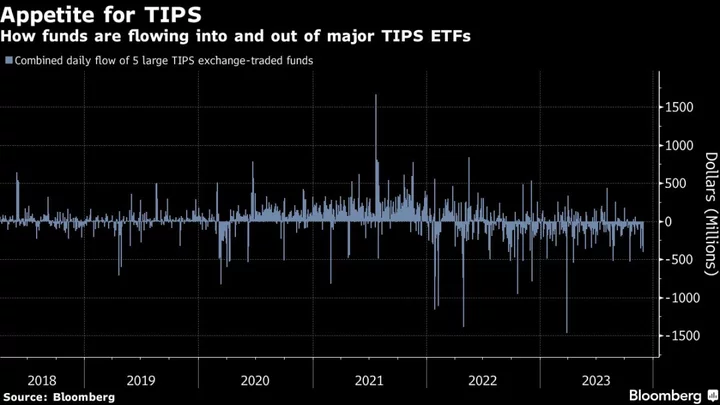

A combined $2.166 billion was pulled out of five major exchange-traded funds that target the Treasury’s inflation-protected securities in November, according to data compiled by Bloomberg. That’s the biggest monthly outflow from those funds since October 2022.

Read: Inflation-Linked Bonds Will Keep Losing Out to Treasuries

The outflows came as recent data revealed softening inflation, and an index of nominal Treasury bonds rallied the most since November 2008. The Bloomberg US Treasury index gained 3.5% last month, outpacing a 2.7% rise in the Bloomberg TIPS index, its best since March.

Personal income and spending report released this week showed the PCE deflator — the Federal Reserve’s preferred metric for assessing progress on its inflation mandate — was on course to fall below the central bank’s median forecast of 3.7% for end-2023, according to Bloomberg Economics.

Ebbing inflation and a slowing economy has compelled the bond market back to pricing in Fed easing over the next 12 months, with swaps traders leaning toward a first rate cut as early as March. Even so, Fed Chair Jerome Powell has pushed back against Wall Street’s expectations, saying the committee will move cautiously.

Read: Powell Brushes Off Rate-Cut Speculation as Fed Moves Carefully

Investors will now pay close attention to US consumer inflation figures released as the Fed begins its two-day meeting in mid-December. At that meeting, the Fed will upgrade its summary of economic projections, including core inflation and rate policy estimates.

The following is a series of indicators on how the market views US inflation:

Inflation Snapshot

Inflation News Bites

- Euro-zone inflation cooled more than expected, putting the 2% target in sight as investors step up bets that the European Central Bank will cut interest rates sooner than officials suggest.

- US consumer spending, inflation and the labor market all cooled in recent weeks, adding to evidence that the economy is slowing.

- Argentina’s president-elect Javier Milei let slip his choice of economy minister, saying that Luis Caputo will take over the job with a mission to pull Argentina from its deep economic crisis, while also warning the country faces a period of “stagflation.”

- Brazil’s annual inflation slowed roughly in line with expectations in early November, approaching the target range as central bankers forge ahead with plans for more monetary easing.

Key Upcoming US Releases

- Dec. 8: Non-farm payrolls, including hourly earnings and unemployment rate; University of Michigan survey of inflation expectations

- Dec. 12: CPI report; real average hourly and weekly earnings

- Dec. 13: PPI report; Federal Open Market Committee interest rate decision

- Dec. 14: Import price index

- Dec. 21: GDP price index

- Dec. 22: Personal income and spending report, including PCE, for November; University of Michigan survey of inflation expectations

(Corrects ETF flow data in second paragraph.)