China’s raw materials producers are at the forefront of falling industrial profits as poor demand and price deflation tear into margins at steel mills, metals smelters, chemicals firms and coal miners.

While the pace of declines slowed in April across many sectors — in large part due to the base effect of comparing against last year when Shanghai was in lockdown — the weakening of profitability at coal mines worsened. Ferrous metals producers, which include the makers of steel for buildings and cars, were the worst performers on a monthly basis.

The profits figures are just the latest in a line of data that show China’s economic recovery stalling, particularly in industries linked to manufacturing and construction.

Coal miners in the world’s biggest producer are contending with a collapse in prices as rising domestic output is augmented by massive imports, lifting stockpiles to historically high levels. The benchmark price at Qinhuangdao port has dropped 18% this year to its lowest since the beginning of 2022. Underlining weak industrial demand for fuel, liquefied natural gas prices have fallen 40% since the start of the year.

The drop is counter to usual trends because it comes despite rising temperatures, when much of the country is forced to crank up the air-conditioning.

“The good days of high coal prices are basically coming to an end,” said research firm Fengkuang Coal Logistics, which also noted the ever-increasing contribution of renewables to China’s energy mix.

The flip side is that falling prices favor the power plants that run on fossil fuels. The coal-fired operations of independent power producers are likely to become profitable from the second quarter as the so-called dark spread — the profit margin of electricity rates over coal costs — expands further, said Tony Fei, an analyst at BOCI Research Ltd.

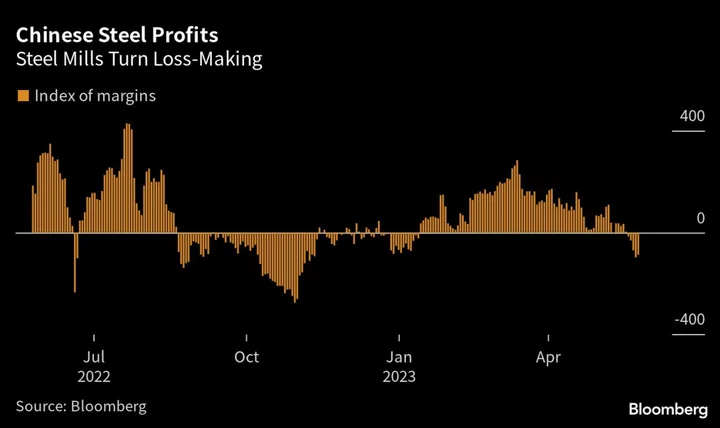

Steel mills, meanwhile, were sounding the alarm in the middle of last year over crisis conditions in the industry at the height of China’s Covid lockdowns. Another bleak summer is in prospect as seasonal demand falls. The economy’s reopening after the pandemic has hardly improved matters, and a disappointing construction season in the second quarter saw mills cut prices.

China is likely to reduce output again this year to help meet its climate goals, which should support prices and margins. But in the absence of a resurgence in demand, that’ll be cold comfort for the world’s biggest steel industry, and all eyes are now on whether Beijing is prepared to expand the levels of stimulus that have so far disappointed markets.

The Week’s Diary

(All times Beijing unless noted otherwise.)

Monday, May 29

- Nothing major scheduled

Tuesday, May 30

- SMM Indonesia Nickel and Cobalt Industry Chain Conference in Jakarta, day 1

Wednesday, May 31

- China official PMIs for May, 09:30

- CCTD’s weekly online briefing on Chinese coal, 15:00

- SMM Indonesia Nickel and Cobalt Industry Chain Conference in Jakarta, day 2

Thursday, June 1

- Caixin’s China manufacturing PMI for May, 09:45

Friday, June 2

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

On the Wire

Australia’s barley sector may be the next beneficiary of the thawing relationship with Beijing, Trade Minister Don Farrell said following another meeting with his Chinese counterpart.

--With assistance from Liz Yee Xing Ng, Dan Murtaugh, Kathy Chen and Ailing Tan.