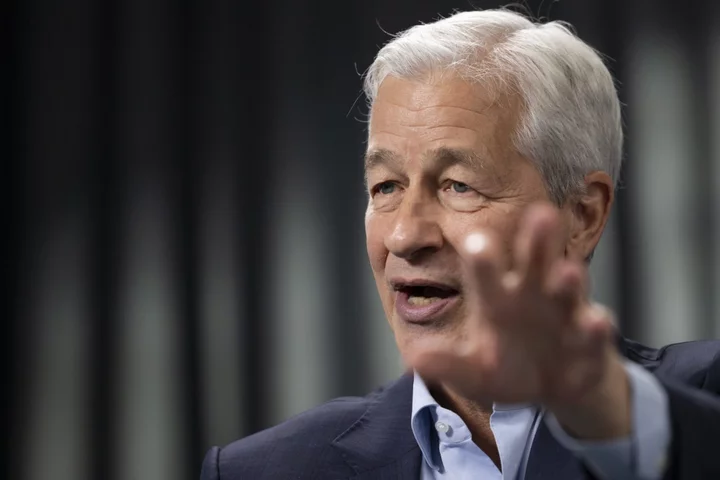

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said the fact that central banks got financial forecasting “100% dead wrong” about 18 months ago should prompt some humility about the outlook for next year.

Speaking on a panel at the Future investment Initiative summit in Riyadh, Saudi Arabia, Dimon voiced doubts that central banks and governments around the world could manage the economic fallout from rising inflation and slowing global growth.

“Fiscal spending is more than it’s ever been in peacetime and there’s this omnipotent feeling that central banks and governments can manage through all this stuff,” he said in the discussion moderated by Carlyle Group Inc. co-founder David Rubenstein. “I am cautious about what will happen next year.”

Dimon likened today’s situation to that of the global economy in the 1970s, with high spending and lots of wastage, and brushed off the impact of further rate hikes.

“I don’t think it makes a piece of difference whether rates go up 25 basis points or more,” he said. “Whether the whole curve goes up 100 basis points, be prepared for it. I don’t know if it’s going to happen.”

On the same panel, Bridgewater Associates CEO Ray Dalio struck a gloomy note, saying his outlook for the global economy in 2024 is “pessimistic,” citing several risks such as high levels of public debt, conflicts and disorder.

Dimon also slammed policymakers’ approach to tackling climate change, likening current efforts to inefficient “whack-a-mole” with little discernible strategy.

“We will make the breakthroughs we need, but its going to be later and longer than we think due to our own basic incompetence,” he said.