Japan can’t yet declare it’s beaten deflation, and the central bank will therefore need to retain its ultraeasy monetary settings even after it loosened its grip on bond yields, according to a key lawmaker behind the nation’s decades-long quest to fight falling prices.

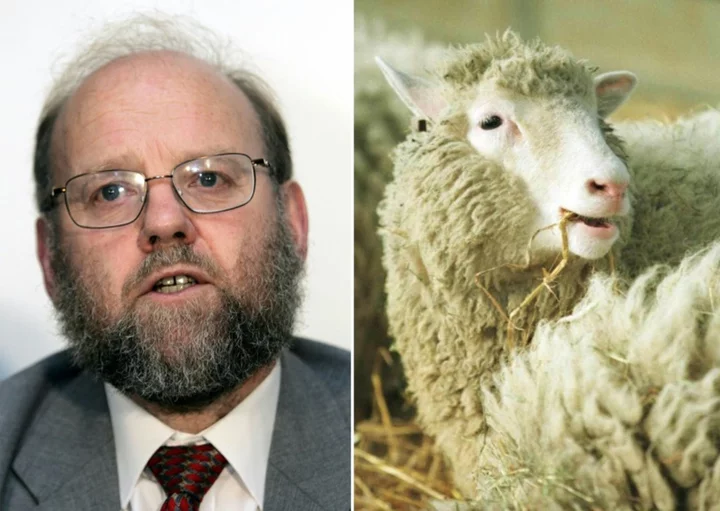

If nominal wage growth of 3% becomes a steady trend in tandem with a sustainable 2% pace of consumer inflation, the Bank of Japan can start mapping an exit from its current policy scheme, said Akira Amari, who was the economic revitalization minister when the central bank embarked on its aggressive easing campaign under former governor Haruhiko Kuroda.

Kuroda’s successor Kazuo Ueda surprised the markets on July 28 by loosening the bank’s grip on 10-year-government bond yields, although he emphasized that the move wasn’t a step toward policy normalization.

“We have pledged to beat deflation, and we can’t picture an exit strategy from easing without achieving that,” Amari said in an interview on Wednesday in Tokyo. “We must see wage gains exceeding inflation become a trend.”

While Japan’s key inflation indicator has been running above the BOJ’s target for more than a year, authorities haven’t been convinced the trend will hold. Ueda has said inflation will probably slow later this year.

Amari was influential in the 2013 formation of the government’s joint policy statement with the BOJ under former premier Shinzo Abe. The statement, which Ueda has said he will honor, forms the basis of cooperation between the government and the BOJ in their mission to achieve 2% inflation and economic growth.

Amari’s comments come in contrast to the views of some BOJ watchers who say the recent policy tweak was a de facto end of its yield control program and will likely to lead to a pickup in interest rates. Amari emphasized premature policy tightening could put the brakes on the economic recovery by discouraging companies from investing.

Japan’s situation is deeply different from the US, where the Federal Reserve has grappled with rampant inflation, Amari said.

“They are raising interest rates because they struggle with inflation, but here in Japan, we are trying to go to a stage where we can declare an exit from deflation,” Amari said. “They are cooling the situation with ice. We are warming it with a blanket.”